In response to knowledge from Coinglass, the crypto market noticed liquidations price greater than $1.6 billion over the previous 24 hours, with the vast majority of them being lengthy positions. Elevated trade inflows threaten to crash Bitcoin (BTC) additional under the necessary assist degree at $112,000.

Bitcoin Tumbles, Will It Lose $112,000?

Bitcoin fell from round $116,000 to as little as $111,800 earlier immediately, because the broader cryptocurrency market skilled volatility amid issues in regards to the US authorities shutdown. Prediction markets on Kalshi are presently giving a 70% probability of a shutdown in 2025.

Associated Studying

Commenting on immediately’s BTC worth motion, CryptoQuant contributor PelinayPA remarked that on the finish of August and early September, virtually 65,000 BTC have been withdrawn from exchanges, which coincided with a worth restoration within the digital asset.

The analyst shared the next chart, which exhibits BTC withdrawals from exchanges. Usually, giant outflows from buying and selling platforms point out that traders are shifting their holdings to private wallets – decreasing fast promoting strain and signaling a bullish development.

That mentioned, latest developments recommend that such outflows have weakened. Particularly, since September 20, trade knowledge exhibits that extra traders are selecting to maintain their cash on exchanges.

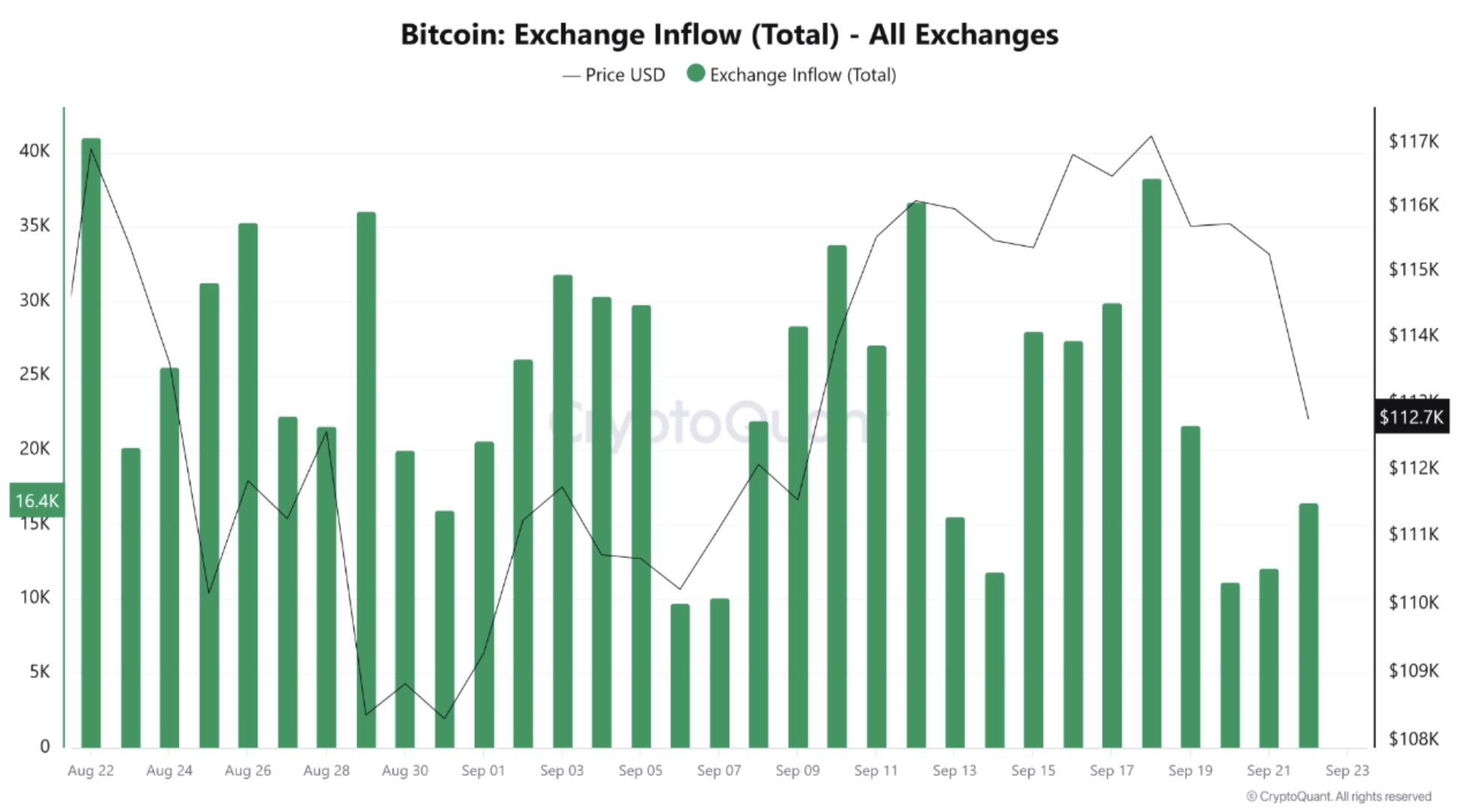

PelinayPA shared one other chart which exhibits BTC deposits to exchanges. Notably, between September 17 and 19, Bitcoin inflows to exchanges surged to almost 40,000, whereas the value tumbled to $117,000.

For the uninitiated, excessive BTC inflows to exchanges normally indicate that traders are shifting their cash from personal wallets to platforms the place they are often bought, signaling elevated promoting intent. This creates short-term bearish strain on worth, as increased provide on exchanges can outweigh demand.

The CryptoQuant analyst added that in the course of the rally between September 7 and 15, BTC outflows from exchanges exceeded inflows, supporting bullish momentum. Nonetheless, inflows surpassed outflows after September 17, triggering robust promoting strain and pushing BTC right down to $112,700. She concluded:

Inflows stay excessive whereas outflows are comparatively weak, indicating short-term draw back strain. If outflows improve once more, signaling accumulation, BTC might rebound strongly from the $112K zone. In any other case, additional draw back danger stays.

Ought to BTC Holders Be Frightened?

Bitcoin’s fall to $112,000 shouldn’t come as a shock. Latest on-chain knowledge had already hinted that BTC may very well be in hassle on account of a scarcity of whale participation within the latest rally.

Associated Studying

It’s price highlighting that BTC’s newest fall in worth got here shortly after the US Federal Reserve (Fed) minimize rates of interest by 25 foundation factors. Though the flagship cryptocurrency fell, consultants imagine that it’s nonetheless removed from an actual capitulation.

CryptoQuant CEO Ki Younger Ju just lately predicted that BTC might high out at $208,000 in the course of the ongoing market cycle. At press time, BTC trades at $113,175, down 2.1% up to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com