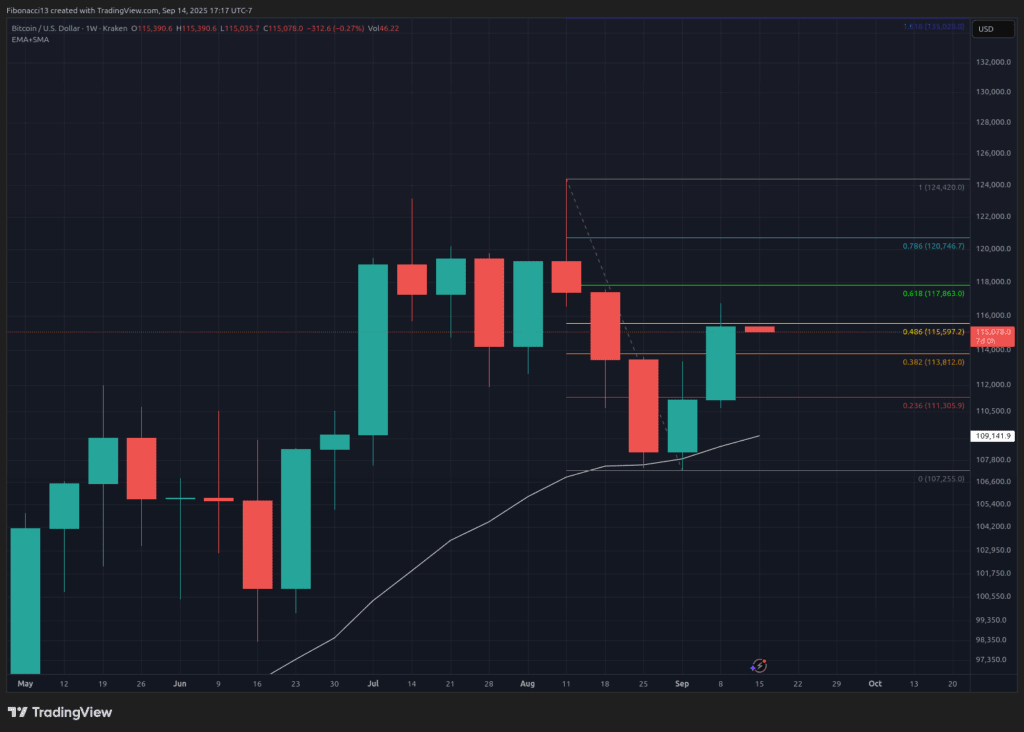

Bitcoin Value closed final week at $115,390, briefly breaching the $115,500 resistance degree because it pushed into the weekend, solely to dip again down and shut the week out just under it. Final week produced a robust inexperienced candle for the bulls, sustaining upward momentum into this week. The U.S. Producer Value Index got here in properly under expectations on Wednesday morning final week, giving market bulls hope for the upcoming charge lower resolution by the Federal Reserve. U.S. inflation information the next morning was lukewarm, nevertheless, because it registered at 2.9%, as anticipated, however increased than the earlier month’s studying of two.7%. The Federal Reserve may have its work lower out for it this week at Wednesday’s FOMC Assembly, the place it should weigh the advantages and disadvantages of slicing or not. The market is absolutely anticipating a 0.25% rate of interest lower (as seen in Polymarket), so any hesitation now by the Fed will probably result in a market correction.

Key Assist and Resistance Ranges Now

Coming into this week, the $115,500 degree is the subsequent resistance degree bitcoin can be seeking to shut above. $118,000 can be standing in the best way above right here, nevertheless. If bitcoin places in one other sturdy week, it’s potential the value pushes above the $118,000 degree intraweek solely to shut again under it on Sunday. We should always count on sellers to step in strongly there and strain bulls to present again some floor.

If bitcoin sees any weak spot this week, or a rejection from the $118,000 degree, we should always look all the way down to the $113,800 degree for short-term assist. Under there, we now have weekly assist sitting at $111,000. Closing under there would probably problem the $107,000 low.

Outlook For This Week

Zooming into the every day chart, bias is simply barely bearish as of Sunday’s shut, after rejecting from $116,700 final Friday. This might shortly return to a bullish bias, although, if Monday’s US inventory market worth motion resumes its bullish development as properly. The MACD is at present attempting to carry above the zero line and re-establish it as assist for bullish momentum to renew. In the meantime, the RSI is dipping however stays in a bullish posture. It should look to the 13 SMA for assist if promoting intensifies into Tuesday.

All eyes can be on Chairman Powell and the Federal Reserve on Wednesday as he speaks at 2:30 PM Jap. With something aside from a 0.25% charge lower announcement at 2:00 PM more likely to trigger important market volatility that will absolutely spill over into bitcoin.

Market temper: Bullish, after two inexperienced weekly candles in a row — anticipating the $118,000 degree to be examined this week.

The following few weeks

Sustaining momentum above $118,000 can be key within the coming weeks if bitcoin can leap over this impending hurdle within the close to future. I’d count on bitcoin to proceed into the $130,000s if it will probably set up $118,000 as assist as soon as once more.

Assuming the Fed lowers charges this week, the market will then sit up for October for a further rate of interest lower. Due to this fact, supportive market information and continued cuts can be essential to bitcoin’s worth path going ahead, fueling a bullish continuation to new highs.

On the flip aspect, any important bearish occasions, or the Fed stunning everybody with a call to not lower on Wednesday, will certainly ship the bitcoin worth again down to check assist ranges.

Terminology Information:

Bulls/Bullish: Consumers or buyers anticipating the value to go increased.

Bears/Bearish: Sellers or buyers anticipating the value to go decrease.

Assist or assist degree: A degree at which the value ought to maintain for the asset, not less than initially. The extra touches on assist, the weaker it will get and the extra probably it’s to fail to carry the value.

Resistance or resistance degree: Reverse of assist. The extent that’s more likely to reject the value, not less than initially. The extra touches at resistance, the weaker it will get and the extra probably it’s to fail to carry again the value.

SMA: Easy Shifting Common. Common worth based mostly on closing costs over the required interval. Within the case of RSI, it’s the common power index worth over the required interval.

Oscillators: Technical indicators that fluctuate over time, however usually stay inside a band between set ranges. Thus, they oscillate between a low degree (usually representing oversold circumstances) and a excessive degree (usually representing overbought circumstances). E.G., Relative Power Index (RSI) and Shifting Common Convergence-Divergence (MACD).

MACD Oscillator: Shifting Common Convergence-Divergence is a momentum oscillator that subtracts the distinction between 2 shifting averages to point development in addition to momentum.

RSI Oscillator: The Relative Power Index is a momentum oscillator that strikes between 0 and 100. It measures the pace of the value and adjustments within the pace of the value actions. When RSI is over 70, it’s thought-about to be overbought. When RSI is under 30, it’s thought-about to be oversold.