Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Knowledge reveals the Bitcoin market sentiment has damaged into the acute greed territory following the cryptocurrency’s new excessive above $111,000.

Bitcoin Worry & Greed Index Has Shot Up Just lately

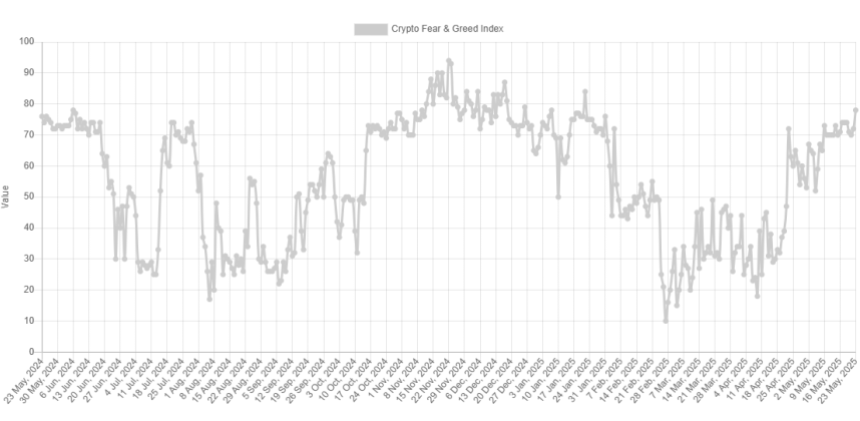

The “Worry & Greed Index” refers to an indicator created by Various that tells us in regards to the sentiment held by the common dealer within the Bitcoin and wider cryptocurrency markets. The metric makes use of a numerical scale working from 0-100 with a view to symbolize the sentiment. All values above 53 symbolize greed among the many buyers, whereas these beneath 47 point out concern. The index mendacity between these two cutoffs implies a web impartial mentality.

Associated Studying

Moreover these three essential zones, there are additionally two ‘excessive’ areas referred to as the acute greed (above 75) and excessive concern (beneath 25). At current, the market sentiment is inside the previous of the 2, in accordance with the most recent worth of the Worry & Greed Index.

Traditionally, the acute sentiments have held a lot significance for Bitcoin and different digital belongings, as they’ve been the place main tops and bottoms have tended to type. The connection has been an inverse one, nonetheless, which means that a very bullish ambiance makes tops doubtless and an extra of despair bottoms.

Some merchants exploit this reality with a view to time their purchase and promote strikes. This buying and selling approach is popularly often called contrarian investing. Warren Buffet’s well-known quote sums up the core concept: “be fearful when others are grasping, and grasping when others are fearful.”

With the Bitcoin sentiment now making a return into the acute greed area, it’s potential that followers of this philosophy could also be beginning to look towards the exit.

That stated, the Worry & Greed Index has a worth of ‘simply’ 78 for the time being. For comparability, the December high occurred at round 87 and the January one at 84. Earlier within the rally, the metric even hit a a lot greater peak of 94 in November.

As such, it’s potential that the present market is probably not fairly that overheated when it comes to sentiment simply but, assuming demand from the buyers doesn’t let off. It solely stays to be seen, although, how Bitcoin and different cryptocurrencies would evolve underneath this excessive greed.

Talking of demand, whales have simply made a big quantity of withdrawals from the Binance platform, as CryptoQuant neighborhood analyst Maartunn has identified in an X publish.

The indicator displayed within the chart is the “Trade Netflow,” which tells us in regards to the web quantity of Bitcoin that’s shifting into or out of the wallets related to a centralized change, which, on this case, is Binance.

Clearly, the Binance Trade Netflow has noticed a big damaging worth, implying that the buyers have shifted a notable quantity of cash out of the change. Extra particularly, web outflows for the platform have stood at 2,190 BTC or about $237 million.

Associated Studying

This might doubtlessly point out demand from the big-money buyers for HODLing the cryptocurrency in self-custodial wallets.

BTC Worth

On the time of writing, Bitcoin is floating round $108,400, up over 4% within the final seven days.

Featured picture from Dall-E, CryptoQuant.com, Various.me, chart from TradingView.com