Fast Take

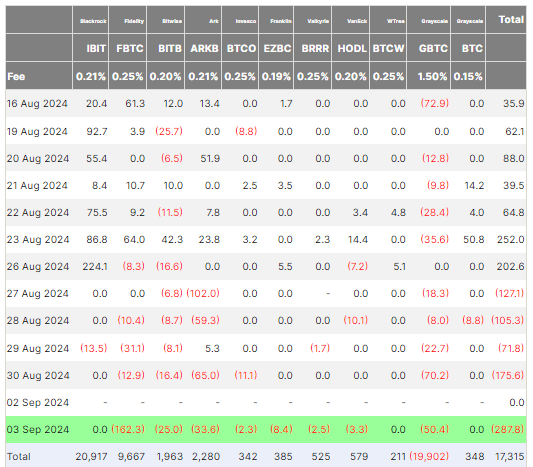

Farside knowledge reveals that Bitcoin ETFs skilled a big outflow of $287.8 million on Sept. 3, marking the most important outflow since Might 1, when $563.7 million exited the market.

Eight ETF issuers recorded outflows, highlighting a broad retreat from Bitcoin ETF investments. Among the many hardest hit was Constancy’s FBTC, which noticed a $162.3 million outflow, and Grayscale’s GBTC, with $50.4 million leaving the fund. Bitwise’s BITB ETF misplaced $25.0 million, whereas ARK’s ARKB ETF skilled a $33.6 million outflow.

Notably, BlackRock’s IBIT ETF noticed neither inflows nor outflows. Over the past 5 buying and selling days, Bitcoin ETFs have skilled a cumulative outflow of $767.6 million, equal to round 4% of complete internet flows, now at $17.3 billion.

Ethereum ETFs additionally confronted outflows, amounting to $47.4 million. Grayscale’s ETHE fund noticed an outflow of $52.3 million, although this was barely offset by Constancy’s FETH ETF, which recorded a $4.9 million influx. General, complete outflows for Ethereum ETFs have now reached $524.8 million, in response to Farside knowledge.

Bitcoin is down 4% up to now 5 days, buying and selling round $56,500.