After the large crash on October 10 – which noticed Bitcoin (BTC) contact $102,000 earlier than recovering some losses – some analysts now predict that the highest cryptocurrency could also be on the verge of one other bullish rally because it enters the ‘disbelief part.’

Bitcoin In Disbelief Section – Bother For Bears?

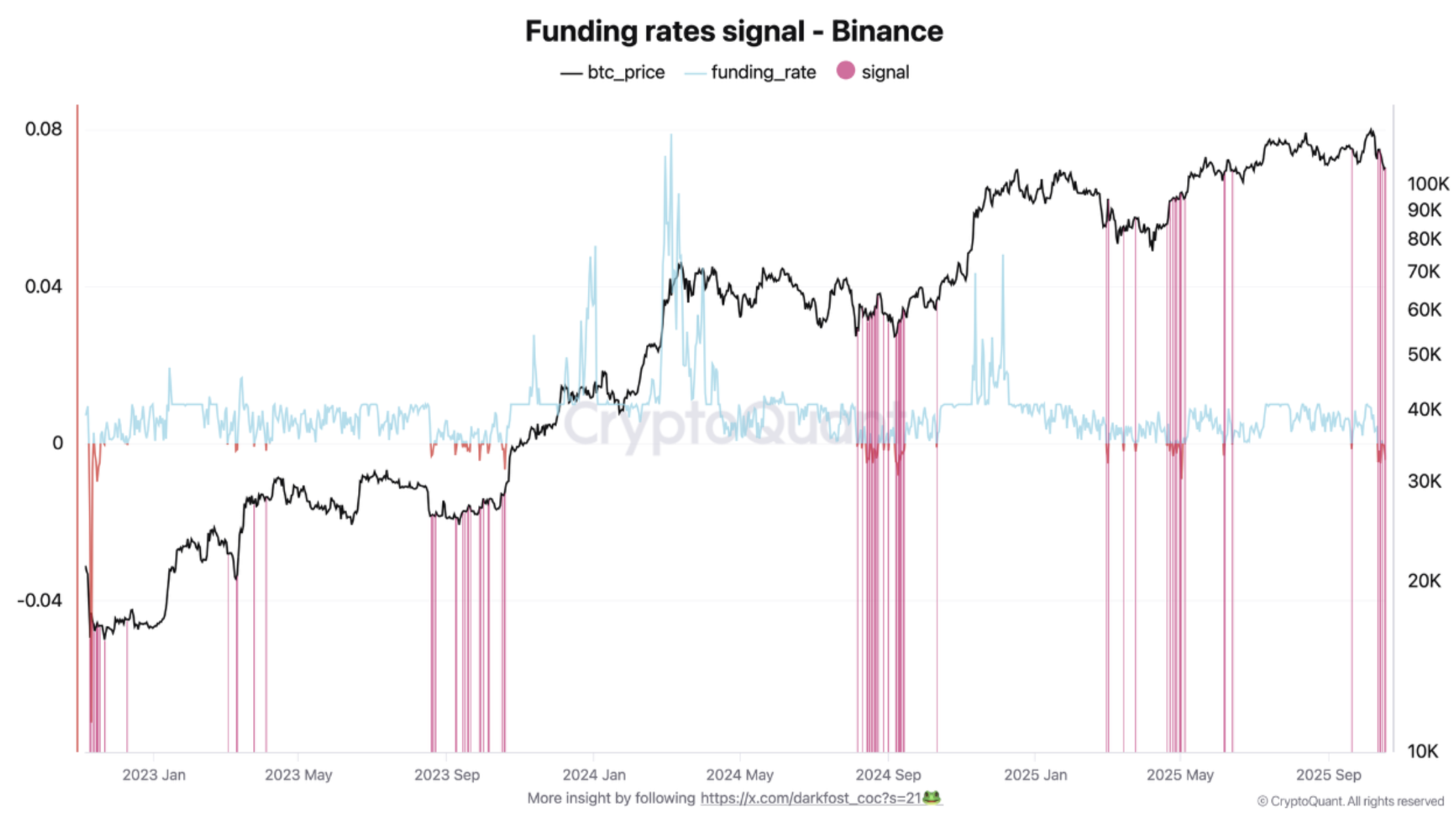

In keeping with a CryptoQuant Quicktake publish by contributor Darkfost, Bitcoin seems to be coming into the disbelief part, which will increase the potential for a rebound to the upside. The contributor emphasised the marginally adverse funding charge to assist their evaluation.

Associated Studying

For the uninitiated, the Bitcoin disbelief part happens when a brand new uptrend begins, however most buyers stay skeptical after a latest correction, doubting that the restoration is actual. Throughout this part, lingering bearish sentiment and quick positions typically act as gas for a stronger rally as soon as confidence returns.

Darkfost said that buyers’ skepticism towards BTC returning to bullish mode might be gauged by way of BTC funding charges within the derivatives market. Funding charges remained adverse at -0.004% on the trade for six out of seven days over the previous week, indicating merchants are nonetheless barely bearish.

The doubtless purpose behind merchants’ quick bias is the October 10 crypto market crash that led to a liquidation value $19 billion. Since then, merchants have constantly chosen to quick the market as a substitute of getting trapped in one other value pullback.

Nevertheless, the longer BTC stays within the disbelief part, the stronger the potential for an explosive upside transfer turns into. Darkfost added:

If the present uptrend continues to ascertain itself, the rising pile of quick positions in opposition to it may turn into a strong gas for the following leg increased. As these shorts get liquidated, it might drive costs upward, triggering a brief squeeze.

If a brief squeeze occurs, then BTC may rapidly rally to main liquidity zones round $113,000 degree, and whilst excessive as $126,000 area, the place vital quick orders liquidations are clustered.

The analyst shared two earlier occasion the place such a sample performed out. In September 2024, BTC fell to $54,000 earlier than surging to a brand new all-time excessive past $100,000.

Equally, in April 2025, the flagship digital asset rallied from $85,000 to $111,000, earlier than climbing even increased to $123,000. To conclude, the Bitcoin market could also be on the verge of one other quick squeeze, fueled by buyers’ skepticism.

BTC Traders Want To Be Cautious

Though BTC is giving hints of a looming quick squeeze, buyers ought to nonetheless train some warning earlier than coming into the market in hopes of an instantaneous turnaround in sentiment. For instance, Bitcoin exercise not too long ago slumped under its 365-day common, elevating fears of a lack of momentum.

Associated Studying

That stated, some crypto analysts forecast that BTC is probably going completed with the worth correction and is ready to surge within the coming days. At press time, BTC trades at $110,814, up 2.8% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com