Following Bitcoin’s gradual rebound seen final week, the worldwide crypto funding merchandise additionally seem to have witnessed a notable inflow of funds, with a considerable $1.44 billion pouring in over the identical interval.

In line with CoinShares, a number one crypto asset administration agency, this surge has pushed the year-to-date complete to prime roughly $17.8 billion, highlighting a rising confidence amongst buyers regardless of current market downturns.

Associated Studying

Surge In Crypto Fund Inflows

In line with the perception shared by CoinShares in its newest report, final week’s exercise marked one of many largest web inflows recorded, considerably outpacing the $10.6 billion accrued throughout the complete bull run of 2021.

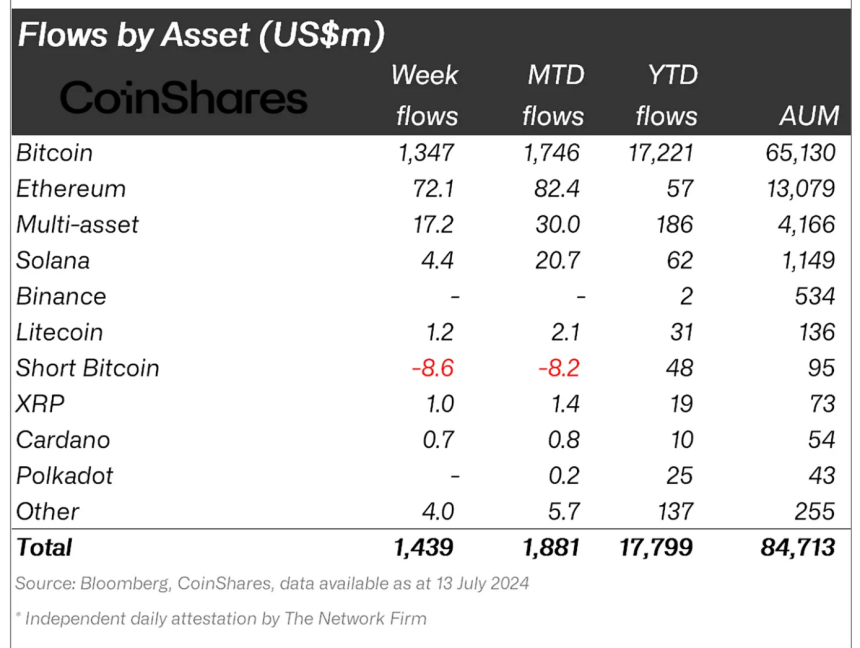

This important improve could be largely attributed to buyers benefiting from current dips within the costs of many alternative cryptocurrencies. Bitcoin-centric funds dominated this motion, bringing in about $1.35 billion of that complete quantity.

This means buyers’ sturdy urge for food for the main cryptocurrency, which continues to dominate the market regardless of periodic volatility.

Conversely, merchandise betting towards Bitcoin (short-BTC Merchandise) noticed a reversal in fortune, registering web outflows of $8.6 million—probably the most important outflow since April.

The shift in holdings signifies a change of coronary heart, which might be on account of extra favorable market circumstances, or it could merely contain strategic portfolio modifications for big holders. James Butterfill, head of analysis at CoinShares, notably famous:

We consider worth weak spot because of the German Authorities bitcoin gross sales and a turnaround in sentiment on account of decrease than count on CPI within the US prompted investor so as to add to positions.

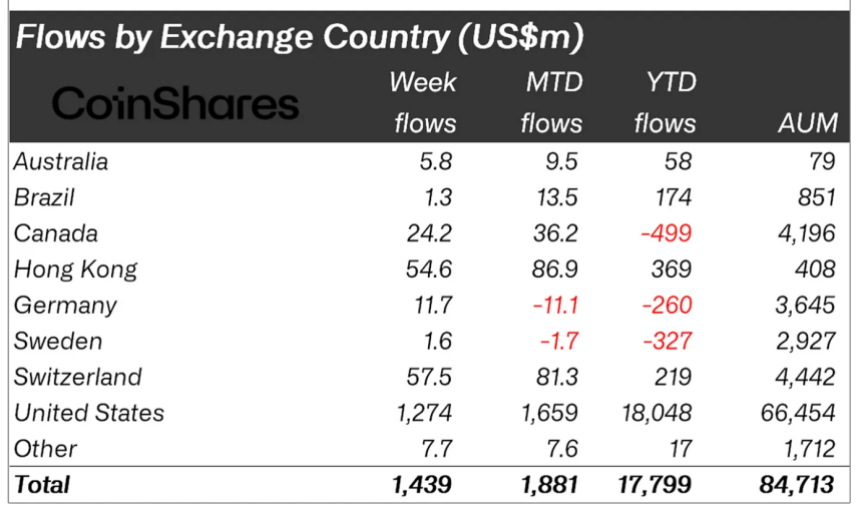

Whereas the influx rise was international, US-based funds had been by far the biggest receiver at $1.3 billion. Nevertheless, there have been additionally appreciable inflows in different components of the world.

As an illustration, Switzerland noticed $36 million, and Hong Kong and Canada collectively added greater than $137 million, indicating a common curiosity in cryptocurrency funding.

Apparently, Ethereum-based funding merchandise additionally loved a major increase, with a $72 million improve in inflows. Butterfill disclosed that this spike is probably going “in anticipation of the upcoming approval of the spot-based exchange-traded fund (ETF) within the US.”

Gradual Restoration: Bitcoin And Ethereum Market Efficiency

To this point, the inflows seen within the crypto market final week look like now mirrored in Bitcoin and Ethereum’s worth, with each belongings now seeing noticeable rebounds following their current correction, which made BTC fall as little as $53,000 ranges and Ethereum dropping under $2,900.

Associated Studying

Over the previous 24 hours alone, Bitcoin has seen fairly the surge, rising by 6.1% in worth to reclaim the $63,000 mark. On the time of writing, the asset at present trades at $63,764, nonetheless down roughly 13.9% from its March peak above $73,000.

Ethereum additionally seems to be mirroring BTC’s worth efficiency. The second largest crypto by market cap can also be up 6.4% previously 24 hours to face at a present buying and selling worth of $3,396.

Featured picture created with DALL-E, Chart from TradingView