Este artículo también está disponible en español.

As Bitcoin (BTC) inches nearer to $70,000, its dominance within the wider crypto market has risen to a cycle excessive of 58.9%.

Bitcoin Dominance Rises, Are Altcoins In Bother?

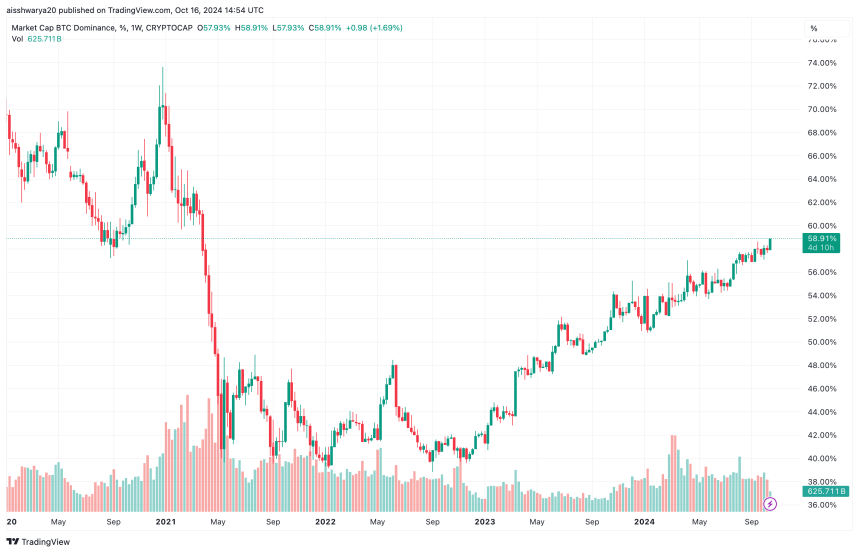

Bitcoin dominance (BTC.D), a metric that measures the proportion of the whole cryptocurrency market cap commanded by the main digital asset, has hit a brand new cycle excessive of 58.9%. The final time the crypto market witnessed this degree of BTC.D was in April 2021.

After a slight pullback following Iran’s assault on Israel earlier this month, Bitcoin has risen by virtually 10% previously week, buying and selling at $67,769 on the time of writing.

Associated Studying

Concurrently, the whole crypto market cap has surged from $2.26 trillion on October 8, to $2.41 trillion on October 16, in keeping with information from CoinGecko. Nonetheless, the rise within the complete crypto market cap is basically buoyed by the upward motion in BTC worth.

At first of October, BTC.D hovered round 57.1%. Since then, it has risen by roughly 1.8%, showcasing Bitcoin’s sturdy efficiency relative to altcoins equivalent to Ethereum (ETH), Solana (SOL), Binance Coin (BNB), and others.

The present degree of BTC.D has forged doubt on the prospects for the much-anticipated “altseason,” usually characterised by parabolic worth will increase in altcoins and a decline in BTC.D. Notably, BTC.D peaked at 70% throughout the post-COVID bull market in 2020-21 earlier than dropping to 40% by mid-2021.

In late 2022, BTC.D bottomed out at round 39% amid the collapse of FTX, which halted operations as a consequence of fraud costs towards its management. Since then, BTC.D has been on a gradual rise, as proven within the chart under.

ETH/BTC Ratio Should Rebound For A Potential Altseason

As BTC.D continues to rise, you will need to think about the ETH/BTC buying and selling pair. For the uninitiated, the ETH/BTC buying and selling pair – colloquially referred to as the ETH/BTC ratio – tracks Ethereum’s (ETH) efficiency towards BTC.

Associated Studying

At press time, ETH/BTC buying and selling pair stands at 0.0385, a degree final seen in April 2021. The chart under reveals that Ethereum has failed to determine the next excessive towards Bitcoin since at the very least November 2022, reflecting weak ETH worth motion over the previous two years.

A robust ETH efficiency towards BTC typically precedes an altseason, however there aren’t any clear indicators of a significant pattern reversal.

Additional, the whole worth locked (TVL) in decentralized finance (DeFi) protocols throughout all blockchains has slid from virtually $110 billion in June 2024 to $88 billion, indicating weak demand for altcoins amongst crypto traders.

Nonetheless, some crypto analysts and technical indicators nonetheless counsel a possible altseason could also be on the horizon.

For instance, earlier this month, the altcoin market cap surpassed its 200-day exponential shifting common (EMA), a key resistance degree that indicators sturdy altcoin efficiency in current days.

Equally, Steno Analysis just lately remarked that ETH is ready for a comeback following the US Federal Reserve (Fed) rate of interest cuts. BTC trades at $67,769 at press time, up 2.5% previously 24 hours.

Featured picture from Unsplash, Charts from Tradingview.com