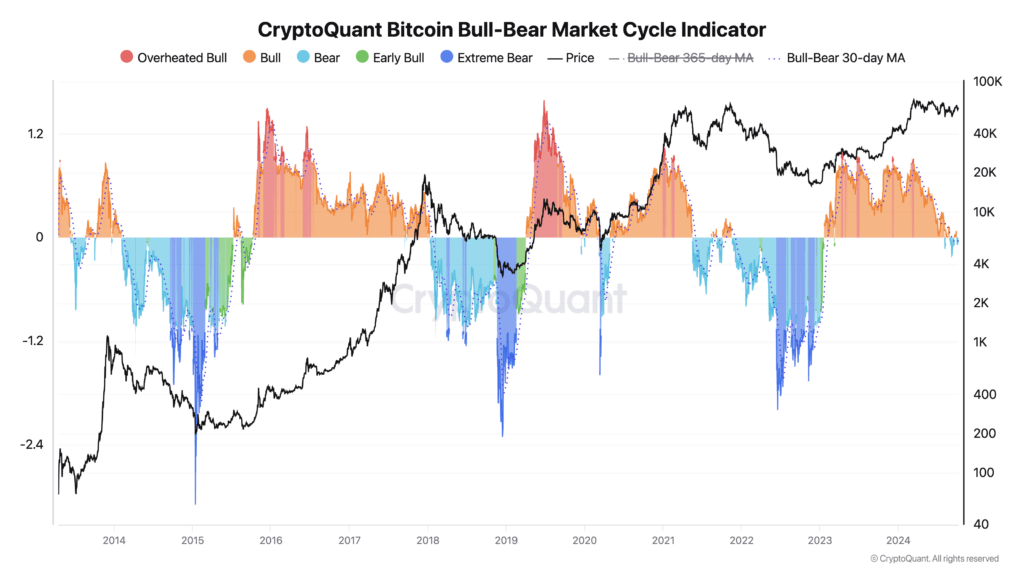

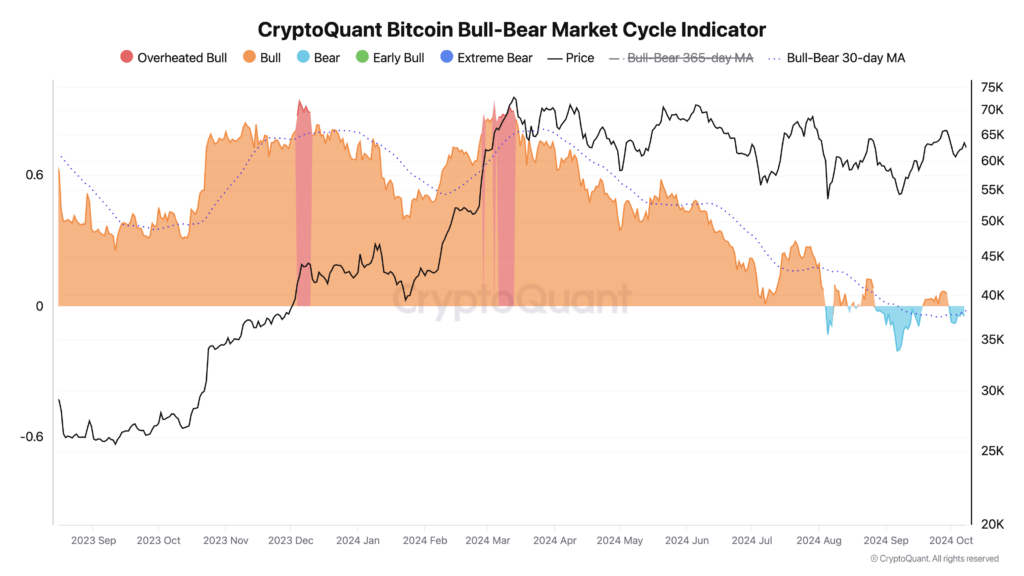

Bitcoin’s current market traits immediate questions on whether or not the early 2024 bull run has ended or if there may be nonetheless potential for additional progress into 2025, aligning with historic post-halving peaks. In accordance with CryptoQuant’s Bitcoin Bull-Bear Market Cycle Indicator, Bitcoin has transitioned right into a bear part after an overheated bull interval earlier this 12 months.

In March 2024, Bitcoin surged to an all-time excessive of $73,750.07, reflecting a major peak in market optimism. This surge corresponded with an overheated bull part, the place costs considerably exceeded historic averages. Traditionally, Bitcoin’s bull markets attain their peaks round 500 days after a halving occasion, suggesting that the present cycle could not have absolutely matured.

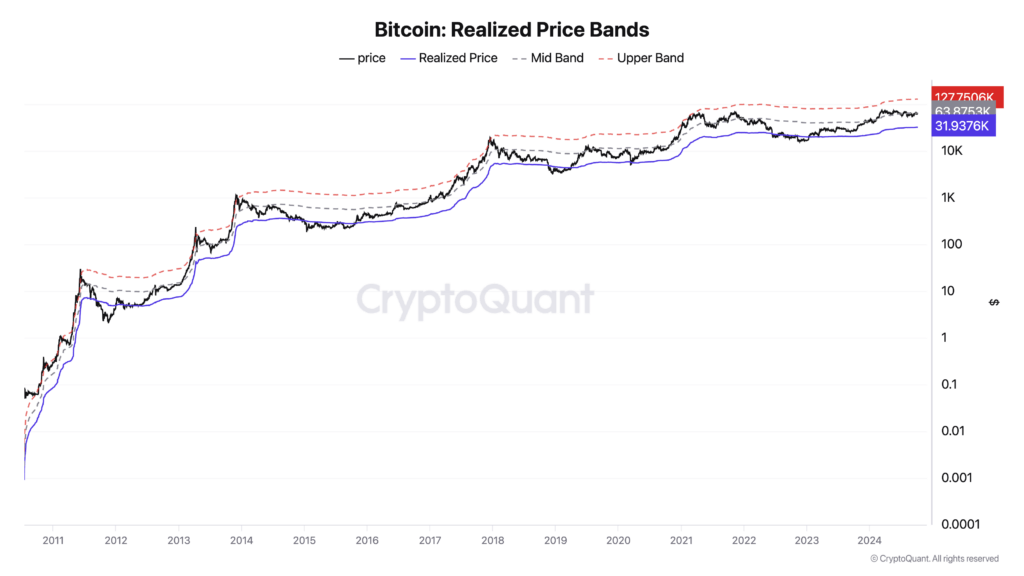

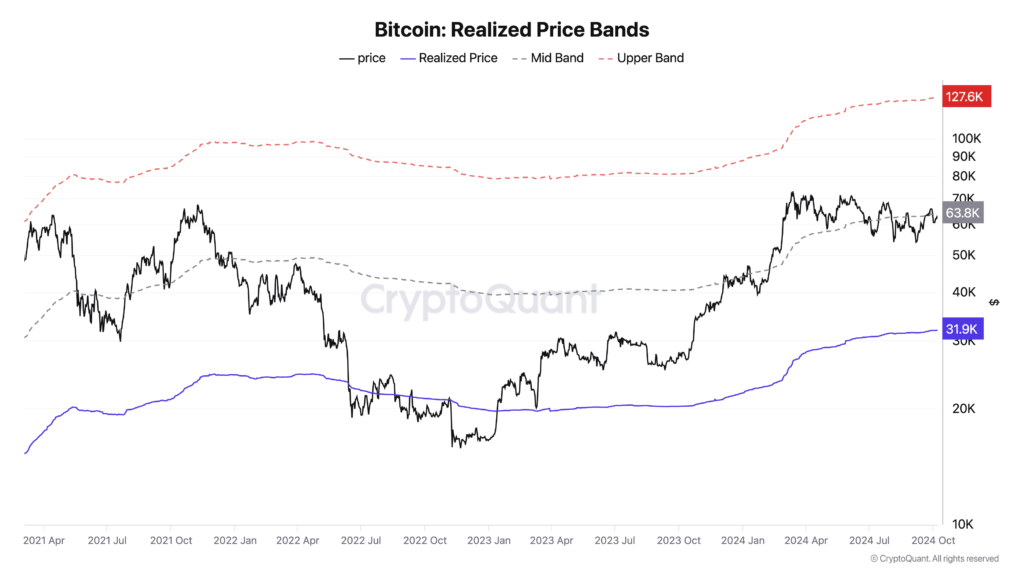

Nonetheless, the realized worth chart, which calculates the typical worth of all Bitcoins based mostly on their final motion, signifies that Bitcoin continues to be across the midpoint of its cycle. In earlier cycles, the realized worth has risen to new highs earlier than the market transitions into a protracted bear part. The present knowledge implies that Bitcoin has but to hit the height usually noticed in previous bull markets.

Regardless of coming into a bear part, Bitcoin’s worth stays sturdy in comparison with the start of the 12 months. On Oct. 9, Bitcoin was buying and selling at $62,151, virtually doubling its worth since January, when it was round $42,000. This sustained efficiency suggests sturdy market help, even amid fluctuations and cooling market sentiment.

Bitcoin market cycles are characterised by intervals of speedy progress adopted by corrections. The current shift right into a bear part may sign a short lived consolidation reasonably than the top of the bull market. Earlier cycles have exhibited related patterns, with interim bear phases occurring earlier than the market resumes its upward trajectory towards new peaks.

Analysts are debating whether or not the early 2024 peak represents the cycle’s climax or if Bitcoin will proceed to rise into 2025, becoming the historic sample of bull market tops showing over a 12 months after the final halving. The realized worth chart helps the potential for additional progress, as the height usually happens after surpassing the midpoint, with the higher band at present at $127,000.

Elements comparable to regulatory developments, the 2024 US Election, institutional adoption, and different macroeconomic circumstances may affect Bitcoin’s trajectory within the coming months. The interaction between the bear/bull market indicator and the realized worth means that whereas market sentiment has cooled, underlying fundamentals should help continued progress. Additional, with Bitcoin holding sturdy above $60,000, it’s laborious to be bearish on the asset.

The important thing query stays whether or not Bitcoin will adhere to its historic cycles, with a major peak but to return, or if the early 2024 surge was the head for this era, bolstering fears of considerably diminishing returns.

The put up Bitcoin dips into bear market zone although realized worth reveals room for progress to $127,000 appeared first on CryptoSlate.