The worth efficiency of Bitcoin over the previous two weeks has been a significant supply of concern, because the coin’s worth continues to float away (about 15% down now) from its all-time excessive. Because the flagship cryptocurrency slows down, the most recent on-chain knowledge suggests {that a} group of traders is exiting the market en masse.

Extra Quick-Time period Holders Are Giving Up Their Holdings

In an October 18 put up on the X platform, on-chain analyst Darkfost revealed {that a} vital variety of Bitcoin’s short-term traders have began to shut their positions and notice their losses.

Associated Studying

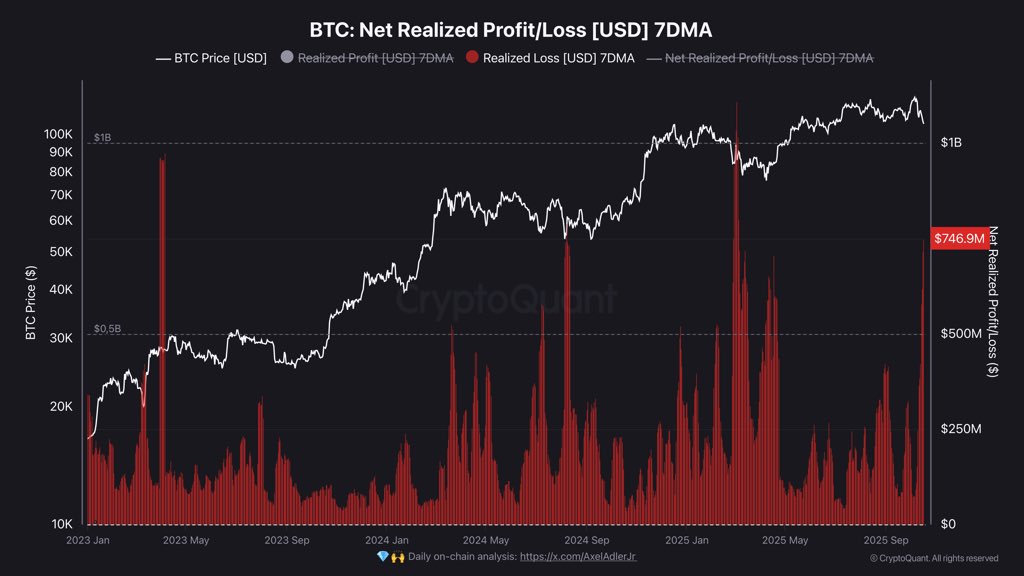

Darkfost’s evaluation was hinged on the Internet Realized Revenue/Loss metric, which tracks the online quantity (in USD) of income or losses which can be realized on-chain. This metric measures the online revenue or loss every day, averaged, on this case, over seven days. It supplies perception into whether or not extra traders are promoting at losses or with their heads nonetheless above water..

In accordance with the crypto pundit, the realized losses of BTC traders have surged to an approximate stage as excessive as $750 million per day, one of many highest ranges this present cycle has seen. Apparently, Darkfost defined that the magnitude of those capitulation occasions stands simply akin to these seen through the 2024 summer time correction.

What’s price noting about this capitulation section is what might possible observe. In accordance with the analyst, occasions like this normally precede native bottoms. What this implies is that after short-term holders (often known as the “weak fingers”) have surrendered their holdings to the more-confident long-term holders (the “diamond fingers”), the cryptocurrency stands an opportunity of seeing a worth rebound — an expectation in congruence with historic traits.

Nonetheless, on the extra cautious aspect, Darkfost supplied a delicate warning that the dreary reverse is also the case in a state of affairs the place the market stands at an early bearish section.

Bitcoin Whales May Be Accumulating Once more

Supporting the optimistic redistribution principle, a Quicktake put up on the CryptoQuant platform by Abramchart presents a glimmer of hope for Bitcoin market individuals. Referencing the Inflows To Accumulation Addresses (Dynamic Cohort) metric, the analyst highlighted a major influx of greater than 26,500 BTC into whale accumulation wallets.

When massive quantities of Bitcoin — resembling this magnitude — are moved, it normally alerts an underlying institutional or whale accumulation, as cash are sometimes transferred from exchanges to those wallets for long-term holding.

Associated Studying

Following historic patterns, it is rather possible that this accumulation occasion will precede a continued bullish growth of the flagship cryptocurrency. As Abramchart defined, this pattern all serves as a touch that sensible cash is “quietly shopping for the dip.”

As of this writing, Bitcoin holds a valuation of about $106,870, with no vital motion seen over the previous 24 hours.

Featured picture from iStock, chart from TradingView