Este artículo también está disponible en español.

Bitcoin is on the verge of a historic transfer because it pushes towards its all-time highs, surging above the $71,000 mark simply yesterday. This breakout has ignited optimism amongst analysts, who count on additional upside within the coming weeks because the US election attracts close to—a interval traditionally marked by heightened volatility and market shifts.

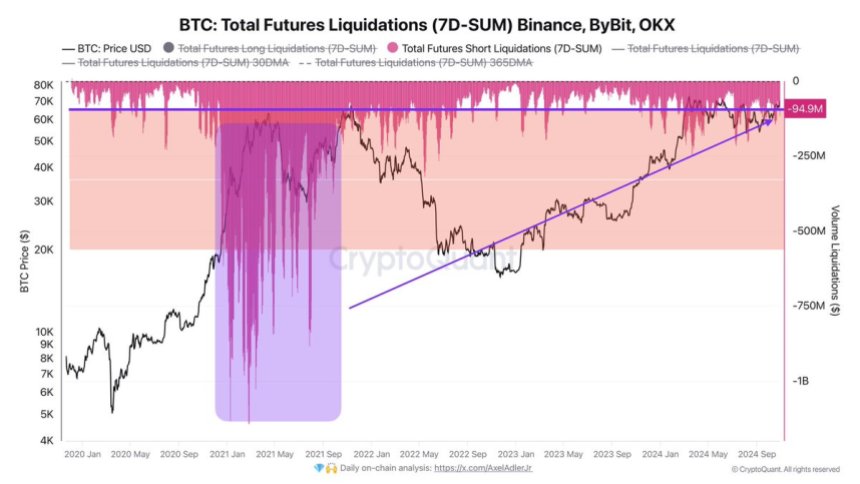

Important knowledge from CryptoQuant signifies that Open Curiosity has reached $22.6 billion, with half of those positions held by bears. If Bitcoin continues to climb, this setup creates a excessive threat of brief liquidations, doubtlessly accelerating shopping for strain as costs push above $71,000.

Associated Studying

As momentum builds, the following few days will decide whether or not BTC can maintain its uptrend or if a consolidation section under the all-time excessive will proceed. Buyers are carefully watching these worth ranges, as a confirmed breakout might sign new highs for Bitcoin. On the similar time, a stall may recommend a necessity for extra consolidation earlier than a bigger transfer.

Bitcoin Bears In Critical Hassle

Bitcoin bears are actually at excessive threat of pressured liquidations as a big degree of brief place liquidity hovers above the $71,000 threshold. In accordance with high analyst and macro investor Axel Adler, this situation might ignite a robust rally if brief positions begin liquidating en masse. Creating momentum that propels BTC past its all-time highs. Adler shared a CryptoQuant chart on X, noting that Bitcoin Open Curiosity has surged to $22.6 billion, with half of those positions held by bears.

In his evaluation, Adler emphasizes that the present market construction is poised for a significant squeeze. “There’s no must hesitate in liquidating brief positions to drive the value up,” Adler states, suggesting {that a} cascade of liquidations above $71,000 might act as a launchpad for Bitcoin, taking it into uncharted worth discovery ranges. This course of, referred to as a “brief squeeze,” happens when overleveraged brief holders are pressured to shut their positions, leading to massive purchase orders that ship costs even increased.

Associated Studying

If this situation unfolds, Bitcoin wouldn’t be the one one benefiting. As BTC leads the market, a rally previous earlier highs might sign a contemporary cycle for your complete crypto area. Altcoins usually observe Bitcoin’s lead, and the spillover impact might gas a complete bull run, with new highs throughout a number of belongings.

Buyers are watching carefully, as such a transfer might renew curiosity and funding within the crypto market, drawing in retail and institutional capital. With BTC on the sting of worth discovery, the following few days might show pivotal in shaping the market’s route.

BTC Testing Cruial Provide

Bitcoin is testing a provide zone at $71,200, brushing up in opposition to the final resistance degree earlier than reaching its all-time excessive. Bulls seem firmly in management, with worth motion signaling a possible breakout above this degree within the coming days. Breaking and holding above the $70,000 mark stays crucial. This psychologically vital degree reinforces bullish sentiment, encouraging extra consumers to enter the market.

Nonetheless, a short lived retracement to assemble liquidity at decrease demand ranges would profit Bitcoin’s uptrend. A dip towards the $69,000 degree, and even all the way down to $66,500, would nonetheless align with a bullish outlook. It might appeal to additional curiosity and create a more healthy base for the following rally. These areas would permit Bitcoin to assemble liquidity earlier than making a stronger push towards new highs.

Associated Studying

Merchants are watching, realizing {that a} sustained transfer above $71,200 might pave the way in which for worth discovery past all-time highs. A profitable breakout might set off renewed momentum throughout the market, sparking a broader bull run as Bitcoin leads the cost.

Featured picture from Dall-E, chart from TradingView