An analyst has defined how a shifting common (MA) that has traditionally served because the boundary for bear markets is located at this stage.

Bitcoin 50-Week MA Is At the moment At $75,195

In a brand new publish on X, analyst James Van Straten has shared a few vital MAs associated to Bitcoin. An “MA” is a technical evaluation (TA) software that calculates the common worth of any given amount and as its identify implies, it strikes in time together with the amount and updates its worth accordingly.

MAs could be taken over any window of time, whether or not that be simply 10 minutes or 10 years. The principle use of this indicator is for finding out long-term developments, because it helps filter out any short-term deviations within the chart.

Right here is the chart shared by the analyst, that reveals the development within the 50-week and 200-day MAs of the Bitcoin worth over the previous yr:

As is seen within the above graph, the Bitcoin worth has dropped beneath the 200-day MA after the current market downturn, which means that the asset’s worth now’s decrease than the common for the final 200 days.

In TA, the 200-day MA is commonly checked out as a boundary line between bearish and bullish developments, with a breakdown of the extent being thought-about a foul signal. Thus, it could seem that BTC has misplaced this vital stage with its newest plunge.

One other stage which will divide macro developments, nevertheless, is the 50-week MA, which the cryptocurrency nonetheless stays above. “Under 50WMA is a bear market,” notes Van Straten. At current, the extent is located round $75,195.

If BTC’s present bearish trajectory continues, it’s potential that this line may be put to check. The analyst has identified, although, that the coin has dropped below the 200-day MA just a few occasions earlier than and managed to get better earlier than breaking beneath the 50-week MA. It now stays to be seen whether or not an analogous sample would play out this time as properly or not.

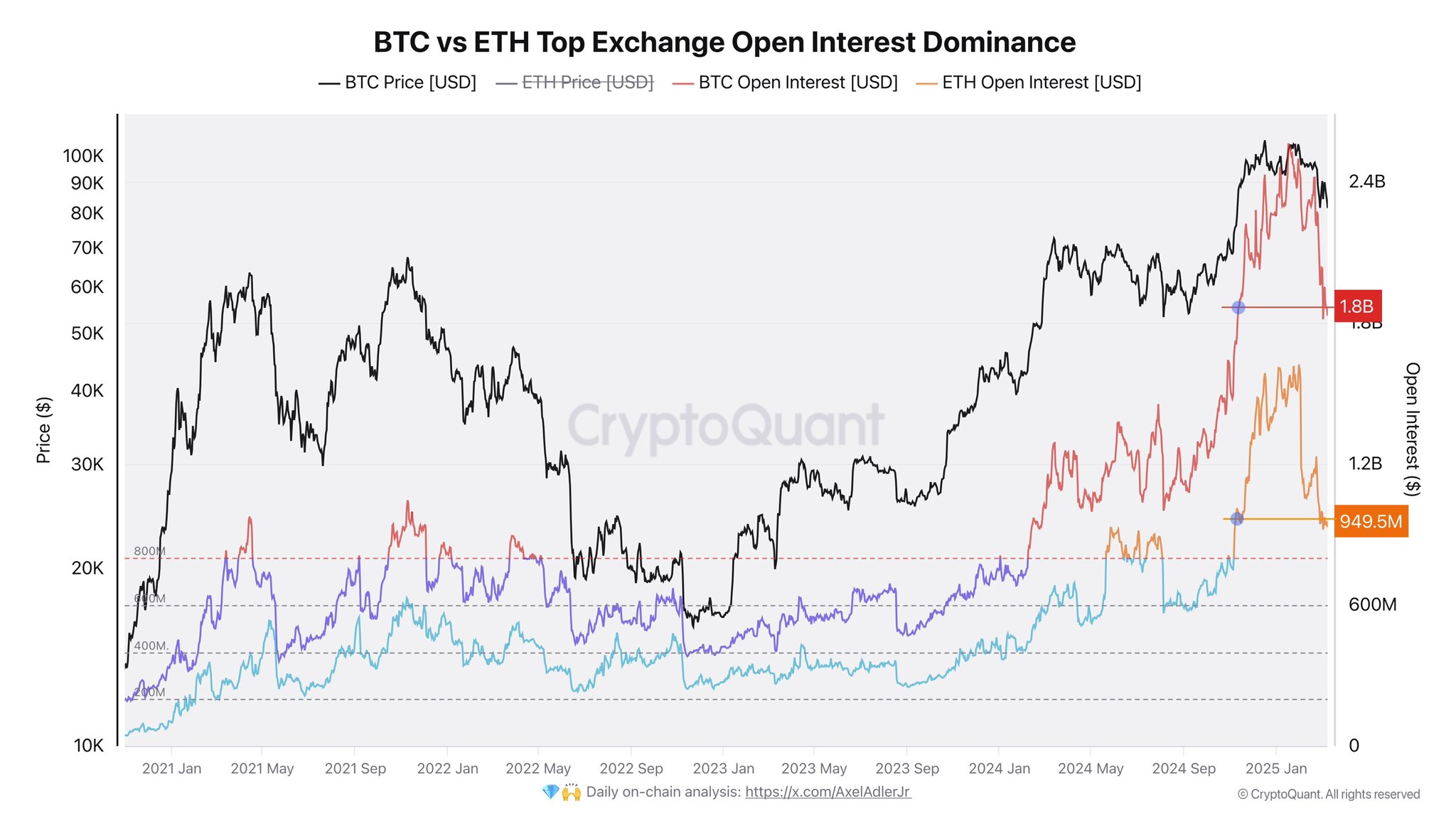

In another information, the downwards trajectory of the market has meant {that a} leverage flush has occurred over on the derivatives facet of the sector, as CryptoQuant writer Axel Adler Jr has shared in an X publish.

Within the chart, the analyst has hooked up the info for the “Open Curiosity,” an indicator that measures the entire quantity of derivatives positions associated to a given asset which can be presently open on all centralized exchanges.

It might seem that the metric has plunged by $668 million for Bitcoin and $700 million for Ethereum.

BTC Worth

Bitcoin has made some restoration over the last 24 hours as its worth has jumped 7%, reaching the $83,000 stage.