Bitcoin is as soon as once more on the heart of market turbulence, buying and selling simply above the $110,000 degree, which many analysts view as a vital zone of demand. Whereas BTC is holding this help for now, volatility has surged as bears enhance stress and investor sentiment grows cautious. The market is intently watching whether or not Bitcoin can preserve its footing or if a deeper correction will unfold.

Associated Studying

One of many largest elements fueling this uncertainty is the current capital rotation from Bitcoin to Ethereum, a shift that has rattled Bitcoin loyalists. Ethereum’s resilience and whale accumulation have put BTC below extra scrutiny, elevating fears that Bitcoin’s dominance available in the market may weaken if the pattern continues.

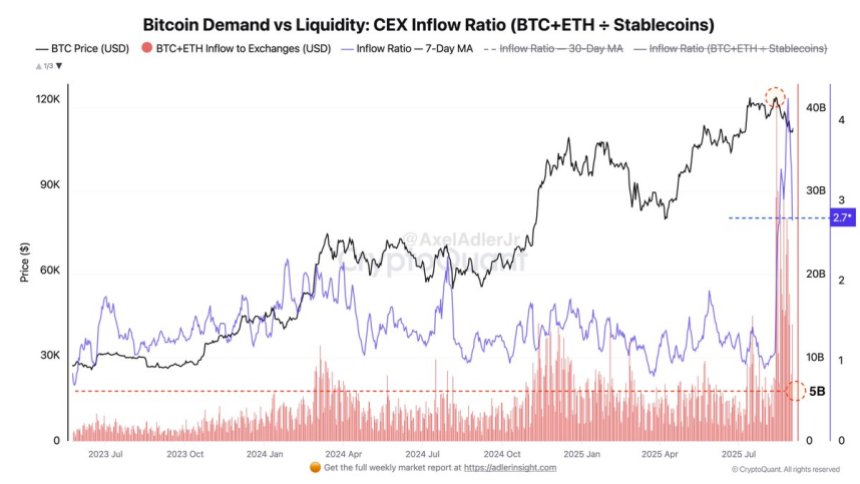

Including to the warning, prime analyst Axel Adler highlighted contemporary information displaying a surge in BTC+ETH inflows to exchanges following Bitcoin’s all-time excessive of $124,000. On the identical time, stablecoin inflows lagged considerably, signaling that the current enhance in provide on exchanges was not met with contemporary liquidity. This imbalance usually factors to profit-taking and extra promoting stress.

Bitcoin Influx Ratio Alerts Bearish Setup

In line with Adler, the current weak point in Bitcoin is strongly linked to alternate circulate dynamics. He factors to the Influx Ratio (BTC+ETH ÷ Stablecoins), a key indicator that measures the stability between main crypto inflows and stablecoin liquidity. Lately, this ratio spiked to 4.0×, coinciding with a wave of promoting stress and a noticeable worth pullback. Adler explains this as a traditional case of extra provide overwhelming contemporary liquidity, a dynamic that has traditionally positioned downward stress on Bitcoin.

Since then, the ratio has eased to round 2.7× on a 7-day transferring common, and influx volumes of majors have cooled to roughly $5 billion per day. Whereas this marks an enchancment from the extremes, it nonetheless alerts that inflows of BTC and ETH are comparatively excessive in comparison with the stablecoin capital accessible to soak up them. Merely put, there may be not sufficient new demand flowing in to help sustained upward motion at present ranges.

Adler’s evaluation means that Bitcoin stays in a bearish setup, with restricted shopping for liquidity maintaining rallies capped. Nonetheless, he additionally cautions that crypto markets are extremely dynamic, and developments can shift shortly. A sudden resurgence in stablecoin inflows or renewed institutional demand may reverse the present imbalance, sparking one other bullish leg. For now, although, the information leans bearish, highlighting the significance of monitoring alternate flows as BTC navigates this vital section.

Associated Studying

BTC Testing Pivotal Resistance Stage

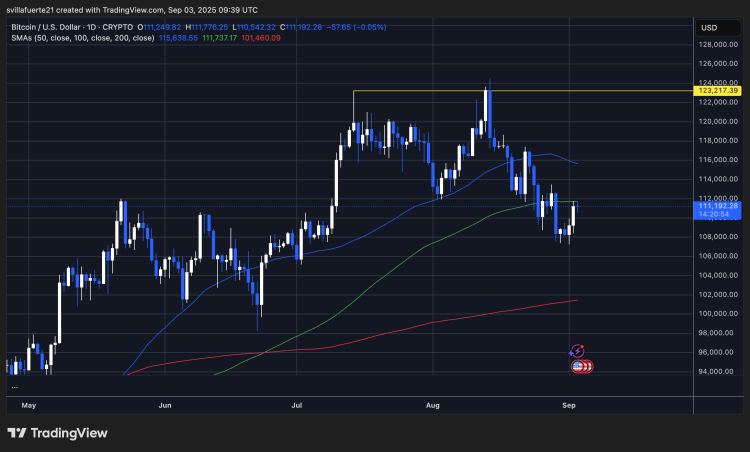

Bitcoin is presently buying and selling close to $111,192, displaying a modest restoration after final week’s volatility that pushed the value beneath $108,000. The chart highlights Bitcoin’s try and reclaim momentum, with the value hovering simply above the 100-day SMA (inexperienced line at ~$111,737). This transferring common now acts as quick resistance, and BTC wants a transparent breakout above it to sign energy.

On the upside, the 50-day SMA (~$115,638) represents the following main barrier. If bulls handle to push above this degree, it will open the trail to retesting the native peak round $123,217, marked as a key resistance line. Nonetheless, Bitcoin’s incapability to maintain positive factors above the 100-day SMA in current classes means that sellers stay lively.

Associated Studying

Help lies round $108,000, with stronger demand possible on the 200-day SMA (~$101,460). A breakdown beneath $108,000 may expose BTC to deeper losses, probably dragging the value towards the psychological $100,000 degree.

Bitcoin stays in a consolidation zone, caught between main transferring averages. A decisive transfer above $115,000 would tilt momentum bullish once more, whereas a failure to carry present ranges dangers renewed promoting stress. Bulls should defend $108,000 to stop additional draw back.

Featured picture from Dall-E, chart from TradingView