The crypto market confronted in current months, as each Bitcoin and Ethereum broke under vital assist ranges. Bitcoin broke under $110,000, whereas Ethereum additionally slipped underneath $4,000. This downturn triggered billions in liquidations and pushed the Concern and Greed Index into worry territory.

Nevertheless, information from on-chain analytics platform Sentora (previously IntoTheBlock) reveals that accumulation is quietly underway. Regardless of the value declines, alternate outflows for each property have remained strongly unfavourable.

Associated Studying

Key Weekly Metrics

An prolonged decline carried over from the earlier week noticed the Bitcoin value falling under $110,000 with growing promoting stress and liquidations of leveraged positions. Nevertheless, regardless of this sharp transfer to the draw back, on-chain information illustrates an attention-grabbing totally different pattern occurring beneath the floor of the volatility. In accordance to figures offered by the on-chain analytics platform Sentora, greater than $5.75 billion price of BTC flowed out of centralized exchanges over the course of the week.

This outflow, though small in comparison with intervals of robust bullish motion, reveals a lingering investor conviction, particularly amongst some traders that may be taking benefit and shopping for the dip.

Ethereum’s value motion over the identical interval was much more pronounced than that of Bitcoin. The value crash noticed the main altcoin break down beneath the psychologically important $4,000 assist degree and proceed to briefly take a look at decrease zones round $3,850. Nonetheless, regardless of the depth of this decline, the alternate circulation information makes it clear that the bearish value motion didn’t handle to discourage accumulation exercise throughout the community.

Over $3.08 billion price of ETH exited exchanges in the course of the week, which serves as proof of a continued willingness amongst traders to steadily accumulate Ethereum, even within the face of short-term losses and market stress.

Regardless of unfavourable value efficiency, alternate outflows remained robust for each ETH and BTC, indicating accumulation throughout the market pic.twitter.com/eAqZTk6Vof

— Sentora (beforehand IntoTheBlock) (@SentoraHQ) September 26, 2025

Outflows Drive Change Balances To Multi-Yr Lows

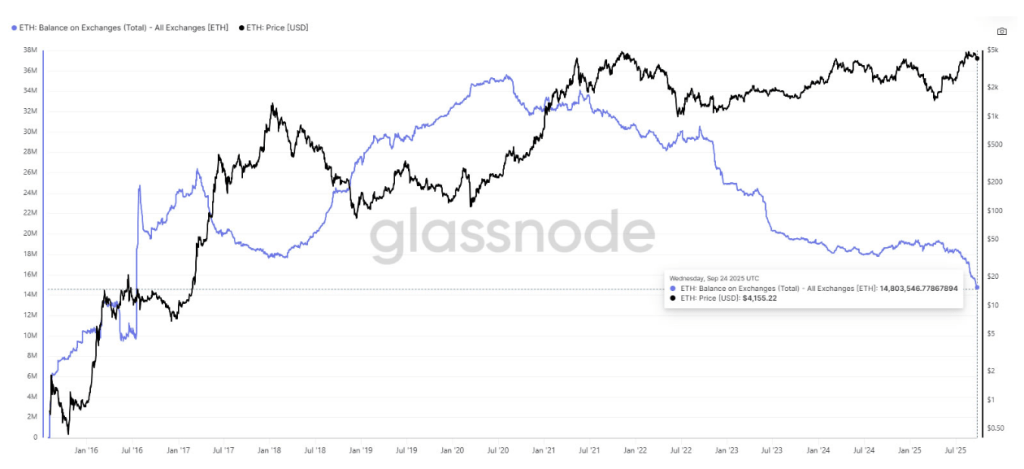

Curiously, Ethereum final week’s outflows ties right into a notable pattern that has been growing in current months. Knowledge reveals that Ethereum’s whole provide on exchanges has dropped to only 14.8 million ETH, its lowest degree since 2016. A lot of this provide has been redirected into staking, long-term chilly storage, and DeFi protocols, which have all led to a drastic decline within the ETH on buying and selling platforms.

ETH steadiness on exchanges. Supply: Glassnode

Knowledge from a CryptoQuant Quicktake publish by contributor CryptoOnchain provides additional weight to this pattern of heavy outflows. Between August and September 2025, Ethereum’s 50-day Easy Transferring Common (SMA) netflow dropped under -40,000 ETH per day, the bottom degree seen since February 2023. This persistent unfavourable netflow reveals that traders have been steadily shifting their ETH away from exchanges and inserting it into staking, chilly storage, or different long-term holding choices. “Decrease alternate balances equals diminished short-term provide,” the analyst stated.

Ethereum Change Netflow

Associated Studying

On the time of writing, Bitcoin was buying and selling at $109,585, whereas Ethereum traded at $4,011.

Featured picture from Unsplash, chart from TradingView