Bitcoin and the broader crypto market are heading right into a tightly packed US macro calendar simply as Washington’s crypto rulebook lurches towards a key committee vote.

The week’s tone was set late Sunday when Federal Reserve Chair Jerome Powell disclosed that the Justice Division had served the Fed with grand jury subpoenas and threatened a prison indictment tied to his prior testimony on a Federal Reserve constructing renovation.

Powell framed it as political strain aimed toward financial coverage and dismissed the probe’s acknowledged rationale in unusually blunt phrases: “The specter of prison fees is a consequence of the Fed setting charges based mostly on our greatest evaluation of what’s going to serve the general public, relatively than following the preferences of the President.”

The speedy market response was measured however clear: greenback softness and weaker US fairness futures, in the meantime Bitcoin rallied again above $92,000 whereas main altcoins additionally registered modest positive aspects. Nonetheless, it must be seen how these positive aspects will be sustained when the US market opens.

#1 Bitcoin And Crypto Face Essential Macro Week

The primary main scheduled macro waypoint is US CPI for December 2025, due Tuesday, Jan. 13 at 8:30 a.m. ET. With crypto nonetheless buying and selling as a high-beta expression of worldwide liquidity and real-rate expectations, CPI stays the week’s most direct enter into the entrance finish of the curve and, by extension, the greenback’s near-term route.

For the US inflation prints, the market is strolling into Tuesday with a reasonably tight consensus: December CPI is anticipated at +0.3% month-over-month, with headline inflation seen holding at 2.7% year-over-year. On the core aspect, estimates cluster round +0.31% m/m and a pair of.7% y/y.

The final CPI learn (November 2025) was 2.7% y/y on headline and a pair of.6% y/y for “all objects much less meals and power” (core). As a result of the October CPI remark was not printed because of the 2025 lapse in appropriations, BLS reported the month-to-month change as a two-month transfer: CPI-U rose 0.2% from September to November on a seasonally adjusted foundation.

On Wednesday, consideration shifts to the delayed producer-price launch. BLS is scheduled to publish the November 2025 PPI on Jan. 14, and it has mentioned October knowledge can be printed alongside that November launch (there can be no standalone October PPI report).

As for the numbers merchants will key off, calendar consensus going into the Jan. 14 launch factors to headline PPI at +0.3% m/m and a pair of.7% y/y, with core PPI seen at +0.1% m/m and a pair of.6% y/y. The final obtainable PPI print earlier than that batch launch was September 2025, which confirmed +0.3% m/m and +2.7% y/y for remaining demand.

Later the identical day, markets can also have to cost a authorized headline with macro attain: The US Supreme Court docket is anticipated to difficulty rulings on Jan. 14, with President Donald Trump’s sweeping tariffs among the many main circumstances nonetheless pending. The Court docket doesn’t pre-announce which circumstances can be determined, however a tariff determination might have a heavy worth impression on all monetary markets, with Bitcoin and crypto prone to observe the transfer from US equities.

#2 Senate Committee Markup Set For Jan. 15

On the crypto-native aspect, US market construction laws is shifting towards a decisive committee step. Senate Banking Committee Chairman Tim Scott introduced the committee will maintain a markup on “complete digital asset market construction laws” on Thursday, Jan. 15.

That markup issues much less as a remaining end result than as a sign on whether or not negotiators have the votes and the coalition to advance a coherent framework towards a ground course of.

#3 BNB Chain’s Fermi Improve

BNB Chain has scheduled its Fermi onerous fork for Jan. 14 at 02:30 UTC, delivered by way of the BSC v1.6.4 consumer launch. The chain’s personal weblog positions the improve as a speed-and-reliability push: “Fermi focuses on making BSC quicker […] predictable and dependable as community utilization grows. The improve shortens block instances, strengthens finality […] and ensures the chain continues to carry out constantly.”

The headline technical modifications are a discount in block time from 0.75 seconds to 0.45 seconds and tightened fast-finality guidelines—parameters that matter most for latency-sensitive purposes and high-throughput intervals.

#4 Polygon’s Open Cash Stack

Polygon is teeing up a Jan. 13 X Areas occasion (12 p.m. ET) billed as an “inside scoop” on its “Open Cash Stack” imaginative and prescient from Sandeep Nailwal and Polygon Labs CEO Marc Boiron. The printed imaginative and prescient frames the initiative as a modular stack spanning rails, wallets, on/off-ramps, stablecoin interoperability, compliance, and onchain id—aimed toward making stablecoin and tokenized-money motion really feel extra like default web plumbing than a bespoke crypto workflow.

Polygon’s personal write-up makes the ambition express: “However our north star is obvious: transfer all cash onchain […] As a result of onchain cash is extra versatile, cash will transfer and stay onchain.”

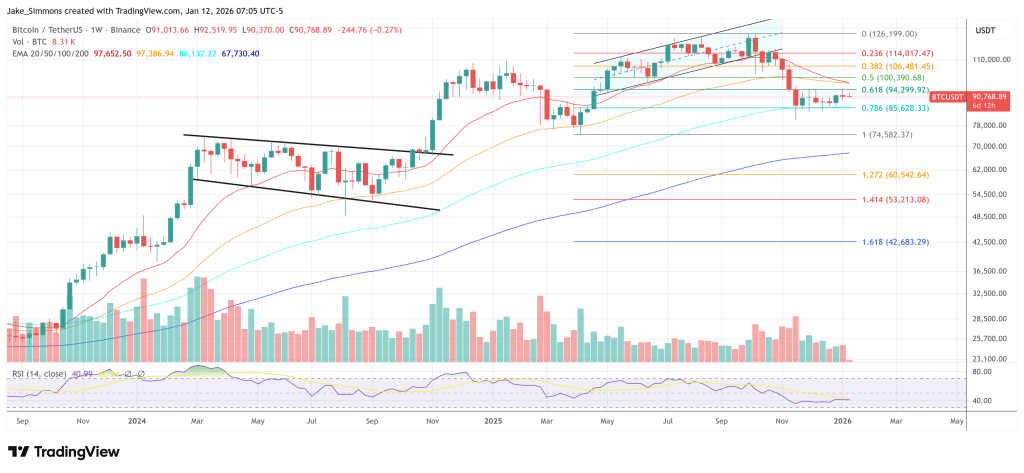

At press time, Bitcoin traded at $90,768.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.