Onchain Highlights

DEFINITION:The proportion of distinctive addresses whose funds have a median purchase worth that’s decrease than the present worth. “Purchase worth” is right here outlined as the value on the time cash had been transferred into an tackle.

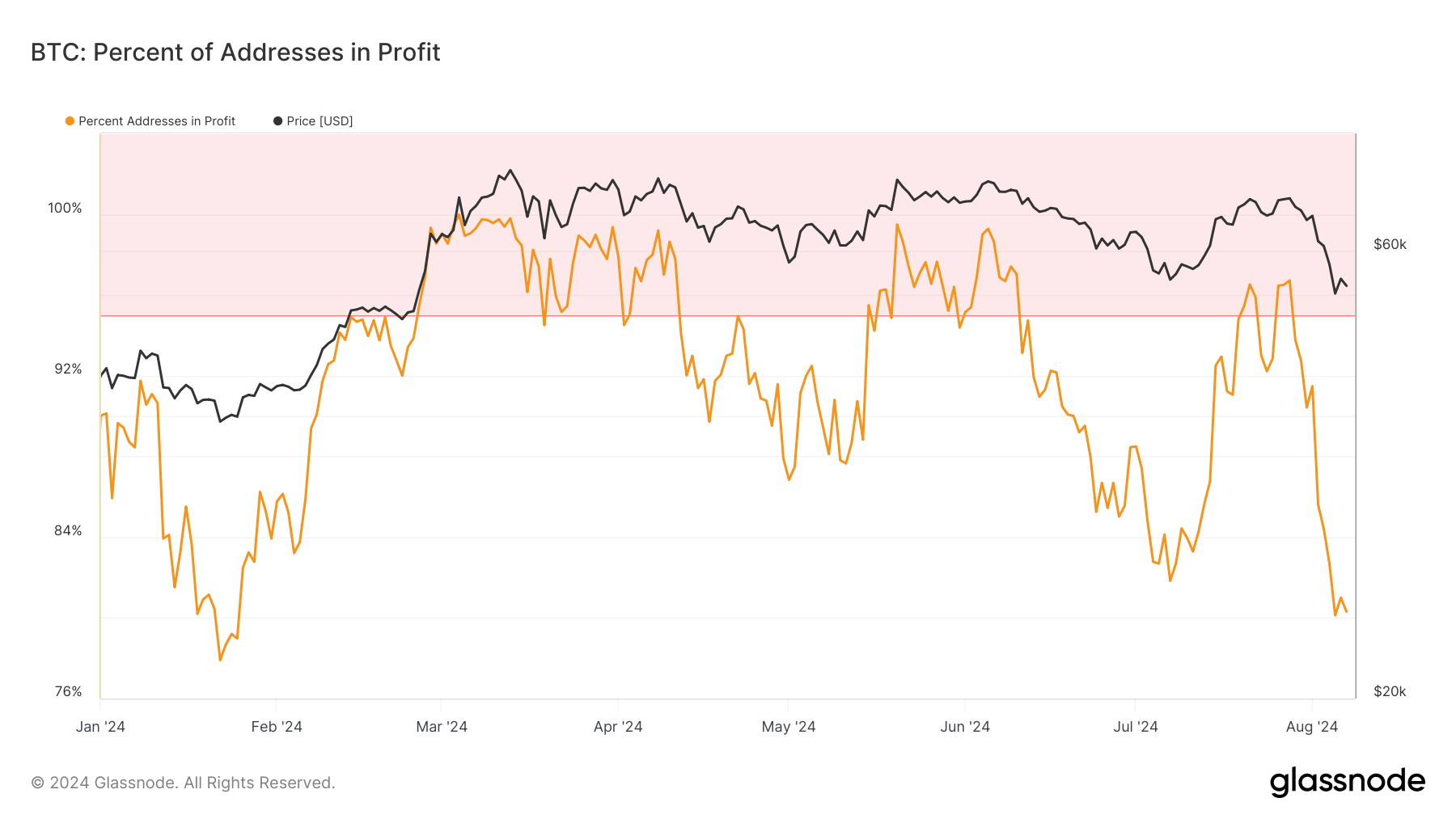

Bitcoin’s % of addresses in revenue skilled notable fluctuations all through 2024. Early within the yr, the metric hovered round 92%, coinciding with Bitcoin’s worth close to $50,000.

Within the lead-up to the April 2024 halving, each the value and revenue percentages noticed elevated volatility. The metric peaked at 100% in March when Bitcoin costs surged previous $70,000, marking a major excessive level for the yr.

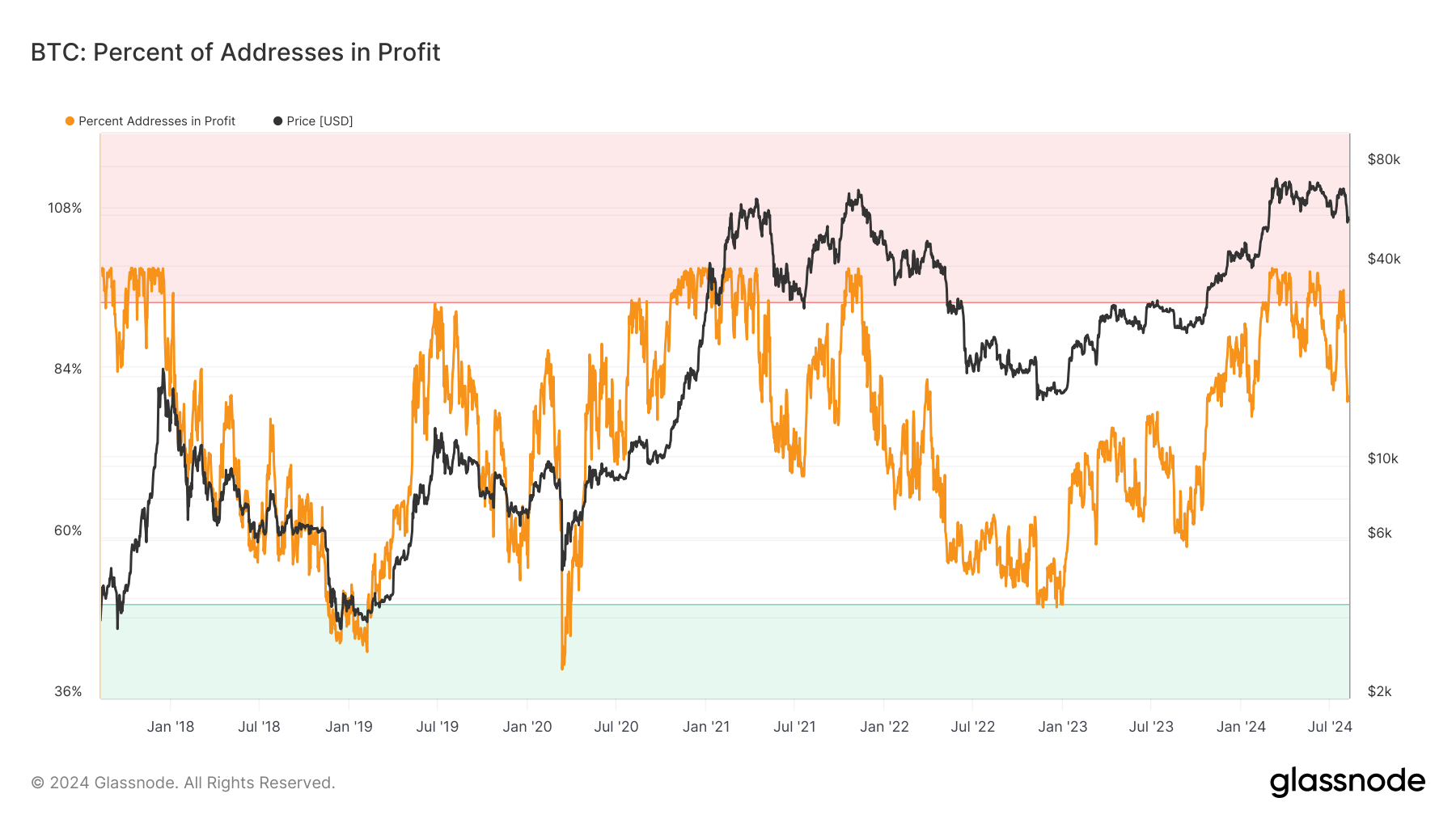

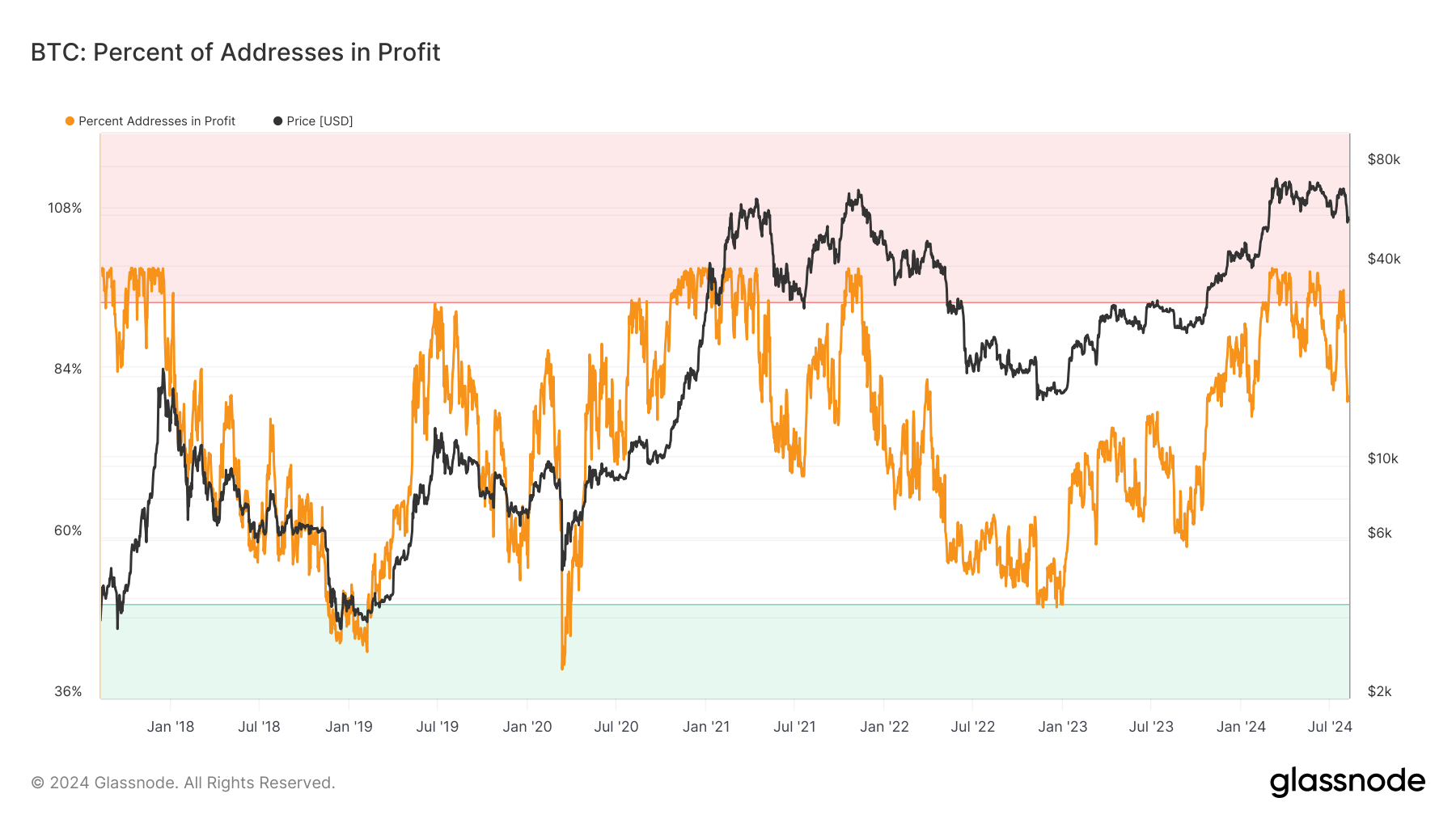

Nevertheless, the next months launched downward stress, with the proportion of addresses in revenue dropping to round 80% by August as Bitcoin’s worth retraced beneath the $55,000 degree. This development mirrors earlier cycles, reminiscent of the numerous fluctuations noticed between 2018 and 2023, when related patterns of sharp climbs adopted by steep declines had been evident.

These shifts spotlight the cyclical nature of Bitcoin’s market conduct, influenced by main occasions like halvings and market sentiment shifts, resulting in appreciable impacts on the profitability of Bitcoin holders over time.