Regardless of Bitcoin (BTC) and Ethereum (ETH) nonetheless struggling to reclaim their all-time highs, there seems to be a definite reality amongst each property now, as proven within the newest data.

Notably, in response to Matrixport’s latest report, Ethereum is now displaying larger worth fluctuations in comparison with Bitcoin previously weeks.

Ethereum’s Unstable Outpacing Bitcoin’s

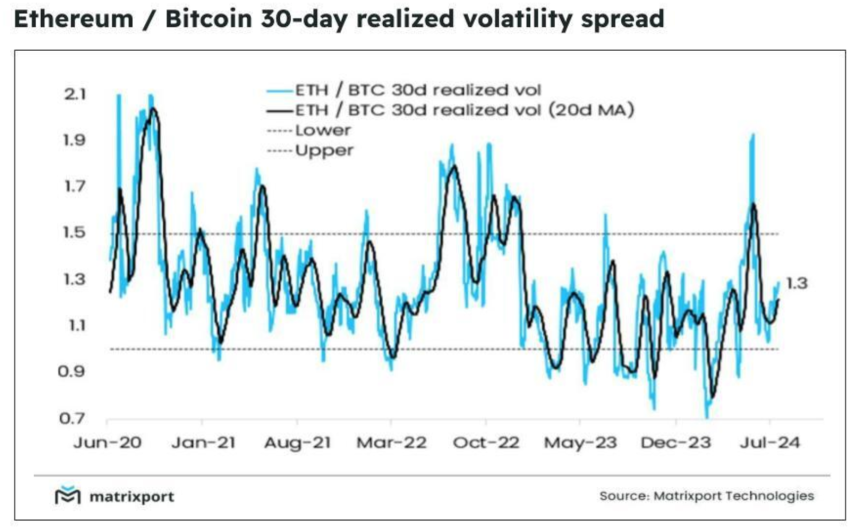

Volatility measures the value variations of an asset over time, with increased volatility indicating extra important worth adjustments. In line with knowledge from Matrixport, the 30-day realized volatility unfold between ETH and Bitcoin usually ranges from 1.0 to 1.5.

#Matrixport Immediately-Aug 13: #Ethereum’s Volatility Surpasses #Bitcoin’s#Cryptoassets #cryptomarket #BTC #ETH pic.twitter.com/QoKsuLUrAH

— Matrixport Official English (the one official X) (@Matrixport_EN) August 13, 2024

Because of this Ethereum’s worth actions have been as much as 50% extra erratic than that of Bitcoin, suggesting that Ethereum could supply a riskier marketplace for traders.

This elevated volatility is clear in the way in which Ethereum reacts to market stimuli. Over latest weeks, Ethereum has proven volatility ranges increased than Bitcoin.

This distinction has change into notably notable for the reason that onset of the newest bull market, with Ethereum’s worth experiencing extra drastic shifts.

These speedy adjustments can considerably impression funding methods, as Ethereum’s bigger peaks and troughs current completely different danger and reward eventualities in comparison with the comparatively extra secure Bitcoin. Matrixport famous within the report:

Attributable to Ethereum’s underperformance for the reason that begin of this bull market, this increased volatility has made it a much less interesting asset. Nonetheless, so long as the volatility ratio stays inside this vary, shopping for Ethereum volatility on the decrease finish might current a sexy alternative.

Bitcoin And Ethereum Efficiency

In the meantime, over the week, each property seem like nearly mirroring one another in worth efficiency, with BTC rising by 7.5% and ETH by 7.9%.

Nonetheless, there was a noticeable distinction within the efficiency of the previous 24 hours. Over this era, Bitcoin has surged by 2.8% to reclaim its $61,000 worth mark. However, Ethereum has elevated by only one.2%, reclaiming its worth mark above $2,700.

The technical outlook on Bitcoin shows that the asset has now validated the setup of a possible rebound to increased ranges.

Bitcoin has efficiently retested the Channel Backside as assist (inexperienced circle) to verify a reclaim of the Channel general$BTC #Crypto #Bitcoin https://t.co/CKXDAAOA9v pic.twitter.com/ZCTQtKw580

— Rekt Capital (@rektcapital) August 13, 2024

In the meantime, the technical outlook means that ETH would possibly nonetheless be caught. Crypto evaluation platform generally known as Extra Crypto On-line on X famous:

Clearly, Bitcoin is main immediately. Ethereum continues to be caught within the vary however would possibly strive an upside breakout from right here.

Featured picture created with DALL-E, Chart from TradingView