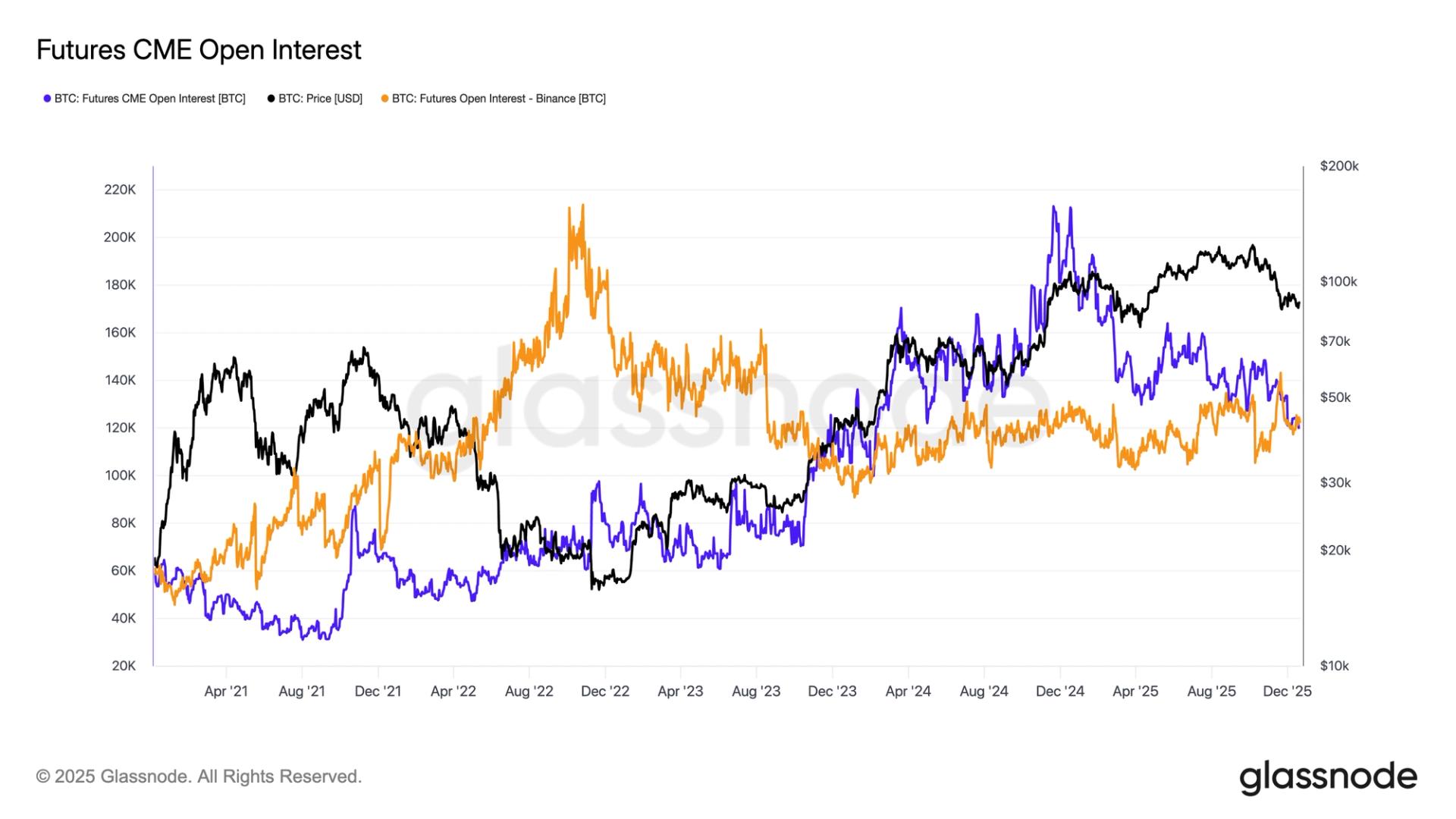

The CME has misplaced its place because the primary change for bitcoin futures open curiosity (OI). Binance has now overtaken CME as the biggest venue by OI in line with CoinGlass information, with Binance holding roughly 125,000 BTC ($11.2 billion in notional worth) in opposition to the CME’s of 123,000 BTC ($11 billion).

CME OI began the yr at 175,000 BTC, however that stage has steadily fallen because the profitability of the premise commerce — during which merchants purchase spot bitcoin whereas concurrently promoting futures to seize the worth premium between the 2 markets — has declined.

Open curiosity on Binance, nonetheless, has remained regular all year long as it is the change extra more likely to be favored by retail punters betting on directional value actions.

Simply greater than a yr in the past, CME OI reached a file 200,000 BTC as costs rallied towards $100,000 following President Trump’s election victory. At the moment, the annualized foundation price surged to round 15%.

Right now, the CME that foundation price has compressed to roughly 5%, in line with Velo information, reflecting diminishing returns for institutional foundation merchants.

As spot and futures costs converge and market effectivity improves, arbitrage alternatives proceed to shrink. CME had been the biggest change for bitcoin futures OI since November 2023, pushed by institutional positioning forward of the launch of spot bitcoin ETFs in January 2024. That benefit, for the second, seems to have light.