Este artículo también está disponible en español.

Avalanche has confronted relentless promoting stress since mid-December, wiping out over 60% of its worth and erasing all of the features from the spectacular November 2024 rally. The prolonged downtrend has left traders unsure about its near-term prospects as your entire market struggles to regain footing amid ongoing volatility. Nonetheless, current value motion is providing a glimmer of hope, as AVAX seems to be stabilizing and discovering robust demand at essential ranges.

Associated Studying

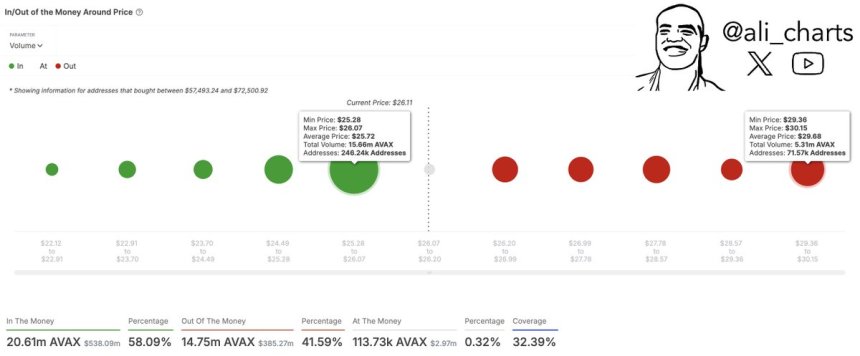

Prime analyst Ali Martinez has shared key insights, highlighting a possible restoration situation for Avalanche. Based on Martinez, AVAX is holding above a crucial demand zone between $25.30 and $26.10. This degree is performing as a powerful help, providing the muse wanted to shift market sentiment. If the worth continues to carry above this zone, Avalanche may achieve the momentum mandatory for a restoration rally, with a goal of $30 in sight.

The approaching days might be pivotal for AVAX as traders watch intently for indicators of power or a possible breakdown. Whereas the bearish sentiment from December lingers, this demand zone might be the launchpad for a turnaround, sparking renewed optimism amongst merchants and long-term holders alike. Will Avalanche lastly bounce again? Time will inform.

Avalanche Poised For A Restoration

Avalanche has been buying and selling in a state of indecision, with bulls unable to push the worth above the $27 mark and bears failing to drive it additional down. This tug-of-war has stored the market in a decent vary, leaving merchants and traders unsure concerning the subsequent main transfer. Whereas some analysts are optimistic a couple of potential restoration, others are warning of a continuation of the bearish development that has plagued AVAX since mid-December.

Martinez shared crucial insights on X, highlighting that Avalanche is holding above a key demand zone between $25.30 and $26.10. This degree has acted as robust help over the previous few days, stopping additional draw back and giving bulls a possibility to stage a comeback.

Based on Martinez, this demand zone may present the momentum wanted for a rally towards the $30 mark. Nonetheless, the worth should first clear the $27 degree, which has confirmed to be a big resistance level. If AVAX manages to interrupt via this degree, a rally may comply with rapidly.

The subsequent few days might be essential for Avalanche’s value motion. Bulls must reclaim the $27 mark to shift sentiment and appeal to extra consumers. On the flip aspect, shedding the important thing help zone may end in a continuation of the bearish development, doubtlessly taking AVAX into decrease demand ranges.

Associated Studying

Because the market watches intently, all eyes are on whether or not Avalanche can muster the power for a restoration rally or succumb to additional promoting stress. This indecision units the stage for a doubtlessly explosive transfer, and merchants ought to stay cautious because the market finds its route.

AVAX Worth Testing Essential Provide

Avalanche (AVAX) is buying and selling at $26.7 following a 7% surge yesterday, signaling renewed efforts by bulls to regain management of value motion. The $27 mark has emerged as a crucial provide degree, performing as a barrier to additional upward motion. Bulls are at the moment centered on reclaiming this degree, which has held the worth down for a number of days. If AVAX can efficiently push above the $27 mark and clear the $28 resistance, a restoration rally may achieve momentum, doubtlessly driving the worth towards the $30 mark.

Nonetheless, the present rally faces challenges as promoting stress stays robust at these key ranges. Shedding the $25 help zone would possible halt the restoration try and result in additional consolidation beneath the important thing provide vary that AVAX is at the moment testing. A breakdown beneath $25 may convey Avalanche again into the $23-$24 demand zone, prolonging the uncertainty surrounding its short-term route.

Associated Studying

The approaching days might be essential in figuring out whether or not AVAX can maintain its current features and reverse its bearish development. For now, bulls should construct on yesterday’s momentum by reclaiming and holding the $27 mark as help. This might set the stage for a breakout above $28, shifting market sentiment in favor of a broader restoration rally.

Featured picture from Dall-E, chart from TradingView