Ark Make investments’s newest submitting reveals a chunky $32.7M acquisition of Robinhood (HOOD) shares.

On the floor, it’s an fairness play, however dig deeper, and it seems to be like a by-product guess on the resurgence of crypto market participation. Traditionally, Robinhood’s quantity spikes act as a canary within the coal mine for retail capital, sometimes previous main on-chain exercise by 3-5 weeks.

The timing feels deliberate. Because the Federal Reserve indicators potential price pauses, risk-on belongings are re-pricing. However shopping for HOOD is simply the floor commerce. The inevitable second-order impact of a retail inflow? Large Bitcoin community congestion. When hundreds of thousands of recent customers attempt to transfer $BTC, charges don’t simply rise; they skyrocket, making the bottom layer virtually unusable for anybody shifting lower than six figures.

That bottleneck is strictly why institutional eyes are drifting towards infrastructure that may deal with the approaching liquidity shock. Whereas Wall Road buys alternate shares, on-chain capital is positioning into scalability protocols.

Particularly, good cash seems to be front-running the congestion narrative by accumulating Bitcoin Hyper ($HYPER), the primary protocol to weld the Solana Digital Machine (SVM) instantly onto a Bitcoin Layer 2.

Purchase $HYPER right here.

Fixing the Velocity Drawback: Bitcoin Meets SVM Velocity

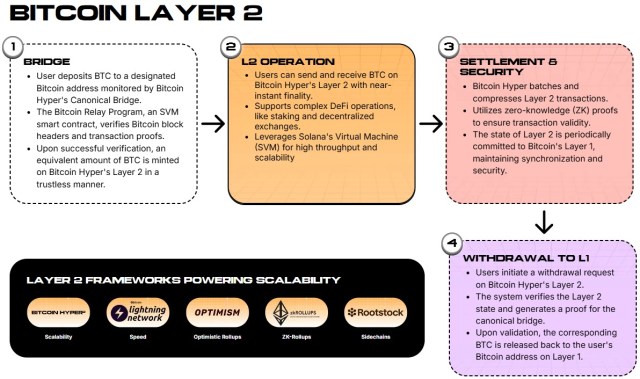

The thesis right here is easy mechanics. Bitcoin is safe however gradual; Solana is quick however has confronted centralization complications. By fusing these architectures, Bitcoin Hyper ($HYPER) makes an attempt a ‘better of each worlds’ surroundings to unravel the trilemma plaguing present Layer 2s.

Most current Bitcoin L2s nonetheless really feel sluggish in comparison with trendy DeFi requirements. Bitcoin Hyper bypasses the lag through the use of the Solana Digital Machine (SVM) for execution. The consequence? Sub-second transaction finality and prices which might be fractions of a cent, all whereas anchoring state to the Bitcoin L1.

That issues as a result of it lastly unlocks high-frequency use circumstances for $BTC, suppose gaming, real-time funds, and complicated DeFi swaps, that had been beforehand unattainable (or simply too costly) on the bottom layer.

Builders are eyeing the Rust-based surroundings too. The protocol affords a Developer SDK and API in Rust, which means the huge pool of Solana devs can port their dApps to the Bitcoin ecosystem with out rewriting their codebase. This isn’t nearly constructing a series; it’s about importing a whole developer financial system.

You should purchase $HYPER right here.

Presale Information Alerts Institutional Accumulation

The market’s urge for food for high-performance infrastructure reveals up within the laborious numbers. In keeping with the official presale web page, Bitcoin Hyper ($HYPER) has raised over $32M, a determine that frankly outpaces most comparable infrastructure rounds this cycle. The token sits at $0.013675, a valuation that appears modest relative to the utility proposition.

The incentives appear structured to maintain that liquidity sticky. Staking opens instantly after the Token Era Occasion (TGE), with a 7-day vesting interval for presale members. That lock-up mechanism helps forestall speedy sell-offs, aiming to create a steady ground at launch.

For traders watching Ark Make investments purchase the ‘shovels’ (Robinhood), Bitcoin Hyper represents the ‘floor’ the place the precise digging occurs.

Go to the official $HYPER presale right here.

The content material offered on this article is for informational functions solely and doesn’t represent monetary recommendation. Cryptocurrency investments, together with presales and shares like Robinhood, carry excessive dangers. At all times conduct your individual due diligence earlier than investing.

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.