Bitcoin has reached a brand new all-time excessive as soon as once more, surging to $123,200 earlier in the present day, a transfer that has reignited bullish sentiment throughout the cryptocurrency market. After weeks of regular consolidation and powerful institutional inflows, the highest cryptocurrency continues its upward momentum, breaking previous key psychological ranges and getting into uncharted territory.

Associated Studying

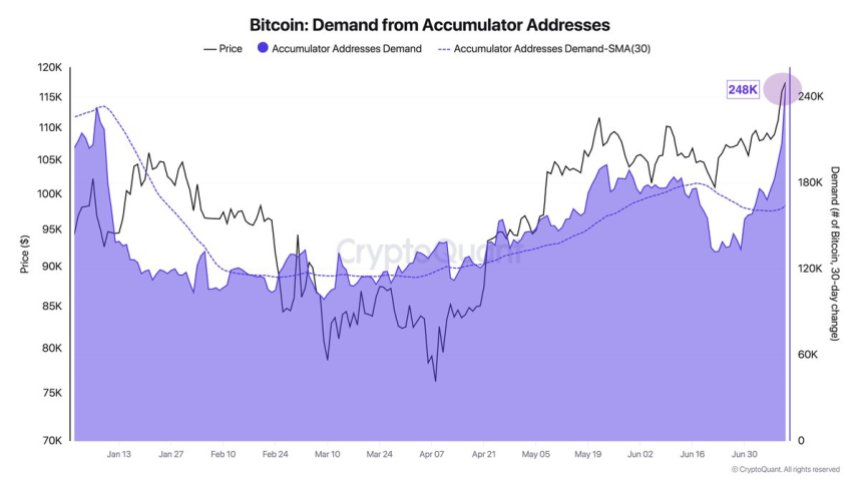

One of the vital notable developments fueling this surge is the rise in demand from so-called “accumulator” addresses. In response to high analyst Darkfost, these wallets—categorised by their constant habits of solely accumulating BTC with none historical past of promoting—have hit a brand new file excessive in 2025. This group of addresses is usually related to high-conviction holders, together with long-term retail traders, institutional contributors, and funds with strategic positioning.

The spike in accumulator exercise reveals a deeper layer of confidence in Bitcoin’s long-term trajectory. Even with BTC above $120,000, these addresses proceed to stack sats aggressively, suggesting that sensible cash shouldn’t be ready for decrease costs. As a substitute, they look like getting ready for a possible continuation of the bull cycle.

Accumulators Add BTC, However Will They Maintain By way of Volatility?

As of in the present day, Bitcoin accumulator addresses have collectively added roughly 248,000 BTC, properly above the month-to-month common of 164,000 BTC. This important uptick highlights a pointy improve in demand over a brief interval, indicating that long-term gamers are actively positioning themselves regardless of Bitcoin persevering with to publish new all-time highs.

These addresses, typically related to entities which have by no means bought BTC, are sometimes considered as extremely refined traders with long-term horizons. The current surge in accumulation suggests these gamers see continued upside potential, even after Bitcoin reached $123,200. Their habits displays robust market confidence and a perception that the present rally could also be removed from over.

Nonetheless, there’s a caveat. If Bitcoin enters a part of correction or extended consolidation, a few of these addresses could start to exit their positions. Doing so would strip them of their accumulator standing and introduce substantial promoting stress into the market. With the 248,000 BTC added now value round $30 billion, any important liquidation from this cohort might affect short-term worth stability.

This week might be notably essential. The extremely anticipated “Crypto Week” in Washington begins, with the US Home of Representatives scheduled to debate and vote on key crypto regulatory payments. The outcomes might drive volatility and affect whether or not these accumulators proceed to carry or start to fold.

Associated Studying

Bitcoin Breaks Out With Sturdy Momentum Above $120K

The 8-hour chart exhibits Bitcoin has decisively damaged out above the important thing resistance at $109,300, accelerating sharply to succeed in new all-time highs at $123,200. This breakout follows weeks of consolidation between the $103,600 and $109,300 ranges, throughout which Bitcoin established a stable base of help. The transfer was accompanied by a notable surge in quantity, confirming robust purchaser conviction behind the rally.

Technically, BTC is now buying and selling properly above its 50, 100, and 200-period easy shifting averages (SMAs), which at present sit at $110,795, $108,079, and $106,980, respectively. The bullish alignment of those shifting averages helps the continued uptrend and signifies that consumers have regained full management of the market construction.

Associated Studying

The explosive breakout above $110K suggests the market has entered a worth discovery part, the place historic resistance ranges provide little steering. If Bitcoin manages to carry above $120K within the coming classes, this degree could flip into new help.

Featured picture from Dall-E, chart from TradingView