Customers of Arbitrum orbit chains, layer-3 options for Ethereum constructed on high of the platform’s expertise stacks, can now pay gasoline charges utilizing USDC. The transfer comes at the same time as ARB, the native token of the Ethereum layer-2, continues to publish decrease lows, pushing losses to almost 80% since January 2024 highs.

Arbitrum Orbit Chains Help USDC For Paying Gasoline Charges

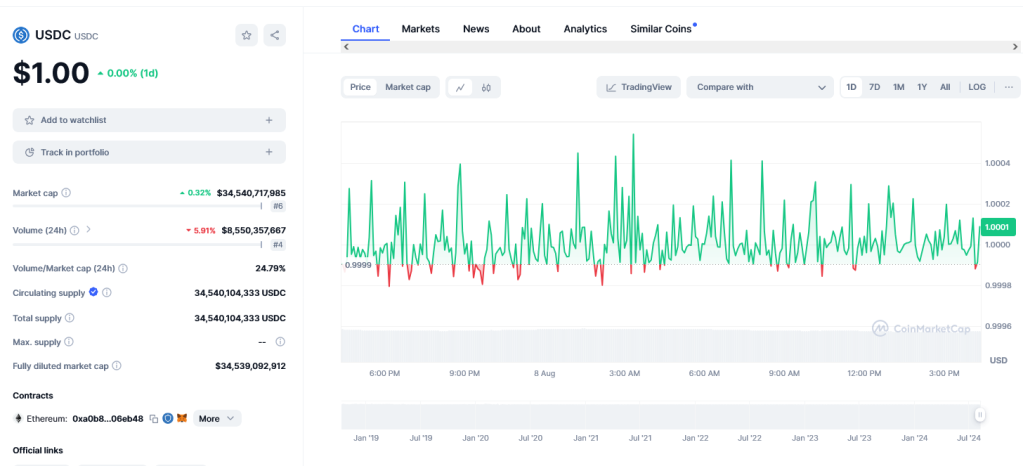

In a press launch, the choice to combine bridged USDC goals to cut back gasoline charges and appeal to extra builders. As of August 8, USDC is likely one of the high stablecoins by market cap. CoinMarketCap knowledge reveals that Circle, the stablecoin issuer, has minted over $34.5 billion of the token, primarily on Ethereum and its layer-2s.

It ought to be famous that USDC can also be supported in different ecosystems, together with Solana and the BNB Chain. Presently, over $1.6 billion USDC has been bridged to Arbitrum.

By permitting customers to pay gasoline charges utilizing USDC, Arbitrum stated they might be saved from the ache of putting up with volatility typical in ETH. Relying on demand, gasoline charges are inclined to fluctuate, rising by a number of folds when there may be congestion within the mainnet.

This volatility tends to influence consumer expertise considerably. As such, some customers go for various platforms like Solana or Avalanche, the place gasoline charges are comparatively low.

Since USDC is pegged to the dollar, it’s steady. Accordingly, whatever the decentralized app they use on Arbitrum’s orbit chains, customers can predict gasoline charges, making it simpler to funds and, extra importantly, handle funds.

Pushing Adoption, ARB Down 80% In 8 Months

Within the press launch, Arbitrum added that this integration will free orbit chain customers from holding a number of tokens, additional enhancing consumer expertise.

Circle additionally introduced a grant program for tasks seeking to be constructed on Arbitrum. This will likely spur the adoption of USDC on the orbit chain.

Regardless of the combination, ARB, the native token of Arbitrum, stays underneath intense promoting strain. As of August 8, the downtrend stays, and ARB is down almost 80% from January 2024 highs.

Though costs have been consolidating, as evident within the every day chart, bulls must push increased, clearing $0.60. Nonetheless, a clear break above 40.80, or July highs, may spark demand. This surge might revive demand within the medium to long run.