Este artículo también está disponible en español.

A brand new narrative is rising amongst seasoned crypto analysts who at the moment are forecasting the arrival of the trade’s first ever secular bear market. This prediction suggests a sweeping transformation might be imminent, characterised by a protracted downturn lasting doubtlessly for years, diverging from the comparatively short-term cycles sometimes related to the crypto market.

Crypto’s First Ever Secular Bear Market

The dialog round this shift was sparked by a question to CrediBULL Crypto (@CredibleCrypto), a famend crypto analyst with 417,000 followers on X, who was requested concerning the impression of celebrities and sports activities stars coming into the crypto house with their very own coin choices. Responding to issues that this development may dilute the purity and utility of cryptocurrencies, @CredibleCrypto provided a decisive view on the long run trajectory of the market.

“Most of these items will get worn out within the subsequent bear market imo. Our first secular bear market on this house since inception. The .com bust of crypto – the place 99% of the junk might be erased, by no means to return, whereas the FAANG of crypto will emerge on the opposite finish and thrive for the subsequent couple a long time (.com increase of crypto),” @CredibleCrypto remarked.

This analogy to the dot-com bubble posits that very like the burst that cleared out weaker web shares whereas establishing tech giants, the secular crypto bear market might equally purge lesser, speculative tasks and pave the best way for stronger tasks to dominate.

Associated Studying

Including to the discourse, @astronomer_zero, one other crypto analyst, highlighted the everyday market psychology that precedes such downturns. He remarked, “Yeah, the occasion is quickly over. After we transfer into euphoria first as soon as extra, as a result of markets virtually by no means crash on concern. And for a giant crash, huge euphoria is required. ‘A bubble can not pop if it doesn’t exist’. Simply so we will have a barely greater style of celeb/principal adoption bubble greed, pulling in additional liquidity to gasoline the drop. Secular bear market begins in 2026/27.”

Remarkably, the S&P 500 is already transferring in direction of a “blow off prime” situation. As famous by one other analyst, the S&P 500 is already displaying a steeper angle than in 2007 previous to the Nice Monetary Disaster (GFC). Astronomer clarified: “That’s true and this transfer is a part of the ultimate levels. However that’s SPX. I talked about how SPX will not be correlated to BTC and the way BTC is evolving to an asset of security sooner than most of the people’s expectations.”

Requires a US recession and a blow-off prime for the worldwide monetary markets are getting more and more louder on X.

One of the vital vocal proponents of this idea is Henrik Zeberg, head macroeconomist at Swissblock. He means that preemptive measures by the US Federal Reserve, geared toward staving off a recession by means of substantial liquidity injections, might drive main indices to new heights.

Associated Studying

Particularly, Zeberg forecasted the S&P 500 reaching between 6,100 and 6,300, the Nasdaq climbing to between 24,000 and 25,000, the Dow Jones to about 45,000, and Bitcoin peaking between $115,000 and $120,000 earlier than a recession units in round December 2024.

The idea of a secular bear market, whereas new to the crypto market, has historic precedents in conventional monetary markets. Such durations are marked by a downward development in asset costs over prolonged durations, usually spanning a number of financial cycles. Not like cyclical bear markets which might be comparatively short-lived and adopted by fast recoveries, secular bear markets exhibit extended stagnation or decline, interrupted sometimes by partial recoveries that don’t revert to earlier highs.

Probably the most-widely identified examples for secular bear markets are The Nice Despair (1929-1942) and the Dot-com Bubble Burst (2000-2013). Following the burst of the dot-com bubble in 2000, the US inventory markets, notably technology-heavy indices just like the NASDAQ, skilled a big downturn. The NASDAQ didn’t regain its peak 2000 ranges till 2015, marking a protracted interval of restoration.

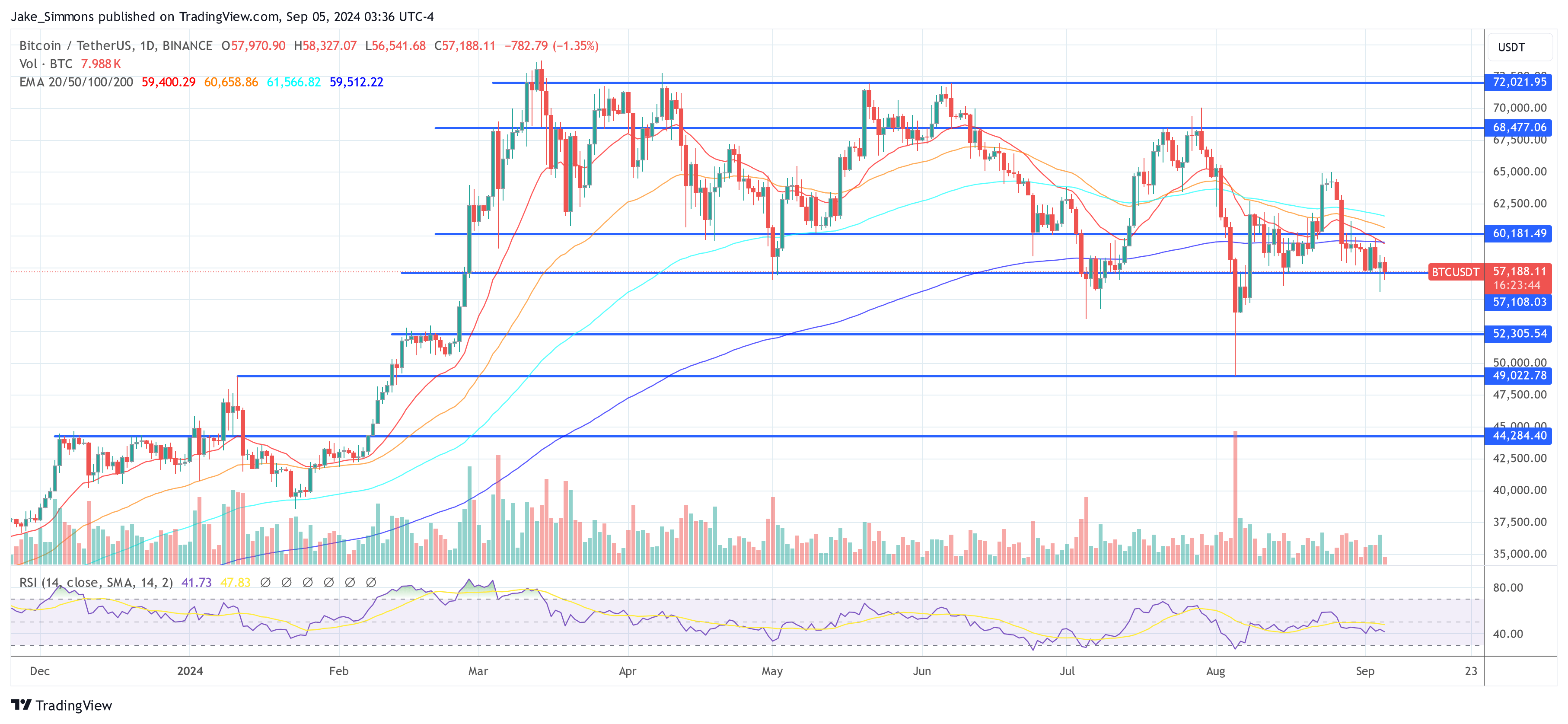

At press time, Bitcoin traded at $57,188.

Featured picture created with DALL.E, chart from TradingView.com