In accordance with CoinDesk Analysis’s technical evaluation information mannequin, ether superior on heavier-than-usual buying and selling, then slipped late after an upper-band rejection, leaving a tighter vary and a transparent set of checkpoints above and beneath.

Analyst remark

- Crypto analyst Michaël van de Poppe stated on X that Ethereum is the very best ecosystem to spend money on and that ether is close to a push to a brand new all-time excessive above $5,000.

- In plain English: he’s arguing that developer exercise, merchandise and community results make the ethereum ecosystem enticing, and that worth motion is getting near the type of power seen earlier than document highs.

- How that matches the chart as we speak: the mannequin exhibits consumers energetic on the way in which up, however sellers nonetheless guarding the $3,860–$3,880 band. For a run at document territory, the primary process could be a clear reclaim of $3,880 and follow-through above the $3,887.35 session excessive—steps that will present management shifting again to consumers close to the highest of the present vary.

Technical evaluation highlights

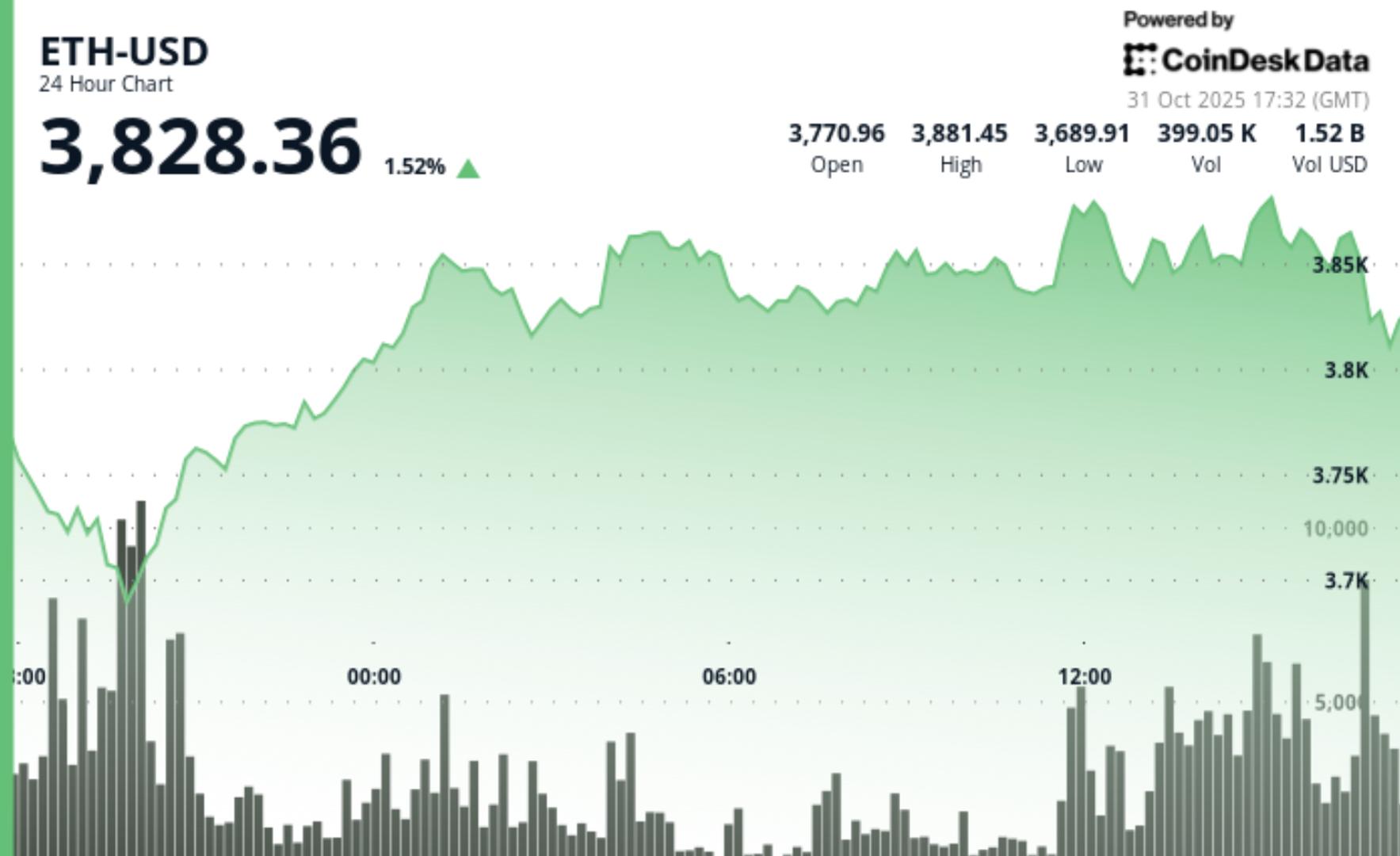

- Efficiency and participation: ETH +1.50% to $3,822.60 with quantity +19.01% vs the seven-day common; deviation from CD5 –0.06%.

- Intraday path: From $3,771.27 to $3,822.78 inside a $193.66 vary, printing increased lows by the session.

- Momentum peak: 2 p.m. UTC, 446.7K quantity on the push by $3,860, tapping a $3,887.35 excessive.

- Late rejection: Last hour –1.30% from $3,869 → $3,820 on 21.8K quantity (about 6× that part’s session common), making a decrease excessive close to $3,865.

Assist and resistance map

- Assist: $3,680–$3,720 zone that caught early-session weak point.

- Resistance: $3,860–$3,880 band, with $3,880 as a psychological degree.

- Close to-term band: Commerce clustered $3,730–$3,880 after the take a look at of the higher band.

- Session reference: A reclaim of $3,880 reopens the $3,887.35 excessive.

Quantity image

- Total: +19.01% vs the seven-day common alerts significant participation.

- On the advance: 446.7K at 2 p.m. UTC marked the strongest bullish print.

- Into the shut: 21.8K on the drop from $3,869 → $3,820 exhibits provide crowding the ceiling late.

What the patterns counsel

- Uptrend with a warning flag: Greater lows constructed an advance, however the decrease excessive into the shut warns sellers are nonetheless energetic close to the top quality.

- Vary conduct: With demand exhibiting up on dips and provide at $3,860–$3,880, $3,730–$3,880 frames the near-term map.

- Subsequent proof level: Bulls would need a agency break and maintain above $3,880; bears will search for a lack of $3,720 to show $3,680.

Targets and danger framing

- If consumers press: Reclaim $3,880 → examine $3,887.35; sustained power retains give attention to the higher band.

- If sellers regain management: Beneath $3,720 → $3,680 turns into the subsequent demand space.

- Tactical lens: With participation elevated however resistance revered, many merchants anticipate a transparent escape of $3,730–$3,880 earlier than leaning tougher.

CoinDesk 5 Index (CD5) context

- Vary and switch: CD5 rose from $1,878.33 → $1,901.52, reaching $1,924.98 earlier than reversing to $1,901.52, in step with profit-taking into resistance throughout majors.

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.