Este artículo también está disponible en español.

Solana is testing a vital stage after weeks of unstable worth motion and market uncertainty. Following the Federal Reserve’s rate of interest reduce announcement, Solana surged 26% however rapidly retraced 17%, reflecting the continuing turbulence within the broader crypto market. This rollercoaster worth motion has left many buyers on edge as they watch for the following clear sign.

Associated Studying

Amidst this uncertainty, high analysts are intently monitoring Solana’s subsequent transfer, with one particularly pointing to the $160 mark because the decisive stage that might decide its course. A breakout above this stage may reignite bullish momentum, whereas failure to take action might result in additional draw back stress.

The approaching days might be vital for Solana as buyers assess the market’s trajectory and brace for potential volatility. With SOL standing at a pivotal level, each bulls and bears are watching intently to see whether or not the value can break by means of key resistance or succumb to additional correction.

Solana Testing Liquidity Under $160

Solana has skilled important ups and downs over the previous couple of weeks, leaving buyers unsure after the newest dip. Many have been anticipating additional positive factors earlier than the retrace, which has now sparked warning out there. With Solana buying and selling on this unstable surroundings, the main target has shifted to key technical ranges that might decide the following huge transfer.

High crypto analyst Daan has shared his insights on X, noting that Solana has fashioned three almost equal highs across the $160 stage. He additionally highlights that SOL is constantly making increased lows, an indication of potential bullish momentum build up.

In response to Daan, this gradual upward drift means that Solana may finally break by means of the $160 resistance stage, which might be a pivotal second for the cryptocurrency.

Associated Studying

The response at $160 might be essential. If Solana manages to interrupt above this stage, it may sign a push to new highs and reignite bullish sentiment out there. Nonetheless, if the value fails to keep up momentum, Solana may stay range-bound between $120 and $160, persevering with its sideways motion. Traders are intently watching these ranges as Solana’s subsequent course may outline its efficiency for the remainder of the 12 months.

Worth Motion: Provide Ranges To Break

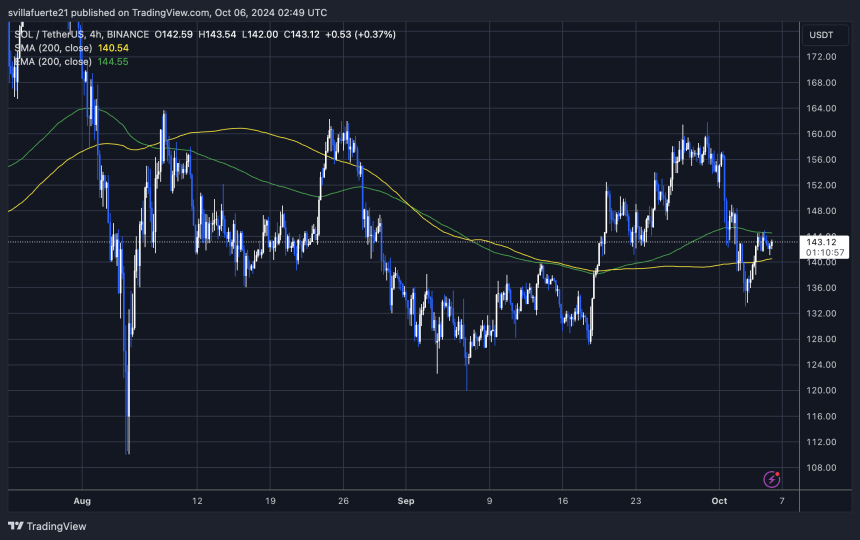

Solana (SOL) is at present buying and selling at $143 after experiencing a couple of days of uneven worth motion. The market has been unstable, and SOL is now testing the vital 4-hour 200 exponential shifting common (EMA) at $144.55. This stage serves as a key resistance level, and a breakout above it may sign a bullish continuation for Solana.

If SOL manages to interrupt and maintain above the 4-hour 200 EMA, the following goal for bulls would seemingly be the $160 stage. A transfer above $160 may reignite constructive sentiment, doubtlessly setting the stage for additional positive factors. Nonetheless, if SOL fails to interrupt above the $144.55 resistance, a retrace to decrease demand zones is anticipated.

Associated Studying

Within the occasion of rejection on the 4-hour 200 EMA, Solana may dip to the $127 assist stage, the place merchants and buyers will intently monitor for indicators of energy or additional draw back danger. The worth motion over the following few days might be essential in figuring out whether or not SOL can resume its bullish trajectory or if a deeper retracement is on the horizon.

Featured picture from Dall-E, chart from TradingView