Bitcoin is going through a important check after a pointy however modest correction from its all-time highs, falling from $126,000 to round $120,000. Whereas bulls stay answerable for the broader pattern, market sentiment is beginning to present indicators of uncertainty, with some analysts suggesting that Bitcoin could possibly be nearing a cycle prime. Others, nonetheless, preserve a extra optimistic view, arguing that the market continues to be in worth discovery mode and making ready for one more leg larger.

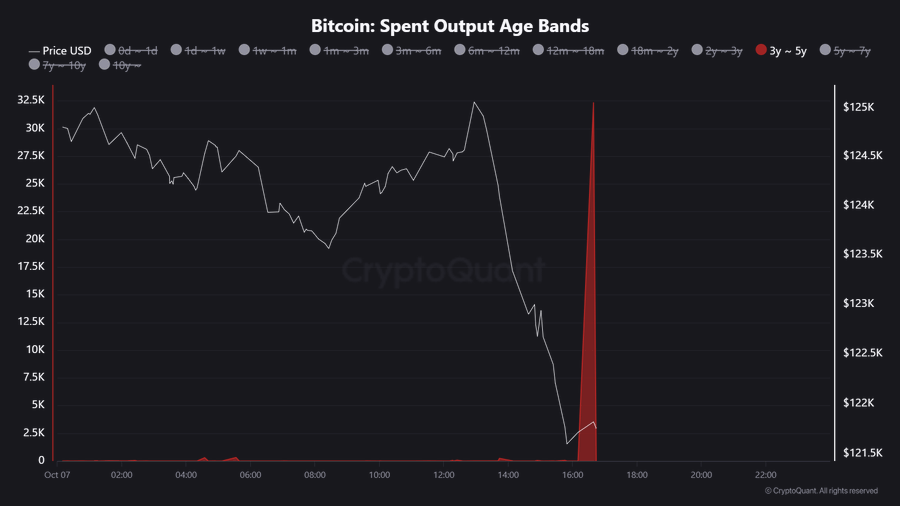

Amid this debate, prime analyst Darkfost has cautioned traders a couple of current wave of deceptive onchain interpretations. Experiences circulating throughout social media claimed that over 32,000 BTC, value almost $4 billion, moved onchain from wallets dormant for 3–5 years. Nonetheless, Darkfost clarified that this info is wrong and stems from a misunderstanding of Bitcoin’s UTXO (Unspent Transaction Output) mechanism.

He explains that whereas it seems as if tens of 1000’s of BTC had been moved, the precise quantity transferred was far smaller, attributable to how Bitcoin’s transaction construction data exercise. Darkfost’s clarification serves as a reminder to strategy sensational onchain information with warning — particularly throughout risky market phases when concern and euphoria can distort evaluation.

Analyst Clarifies Deceptive Whale Motion Knowledge

Darkfost make clear the confusion surrounding the reported motion of 32,000 BTC from wallets that had been dormant for years. He explains that the whale concerned — recognized as the identical dealer who just lately bought BTC on Hyperliquid to purchase ETH — solely moved 3,000 BTC, not 32,000.

The confusion arises as a result of the whale’s unique UTXO contained 32,321 BTC, which had been inactive for over three years. Since Bitcoin’s UTXO system doesn’t enable partial spending, your entire output needed to be spent to maneuver simply the three,000 BTC. After the transaction, the pockets nonetheless holds 29,321 BTC, which means that solely about 10% of the overall stability truly modified palms.

Darkfost confirmed that this explicit handle hadn’t proven any outflows in years, including to the intrigue. Whereas giant dormant wallets turning into energetic can typically sign promoting strain, he emphasised that the onchain knowledge should be interpreted fastidiously to keep away from exaggerating market exercise.

On this case, the supposed “large transfer” was merely a technical artifact of Bitcoin’s transaction construction, not a sign of large-scale promoting. Nonetheless, analysts and merchants are protecting a detailed eye on related actions, as reactivated whale addresses can typically precede market volatility. Darkfost’s clarification serves as a precious reminder that context and technical understanding are important when analyzing on-chain knowledge — particularly in instances when misinformation can simply gasoline panic or hypothesis throughout the crypto market.

Bitcoin Holds Key Assist After Sharp Pullback

Bitcoin is presently buying and selling round $122,700, exhibiting resilience after a pointy correction from its all-time excessive close to $126,200. The 4-hour chart reveals that BTC efficiently held above the $120,000 help zone, suggesting that consumers proceed to defend key ranges regardless of short-term volatility. The yellow line at $117,500 stays an important degree — beforehand a resistance — now appearing as the primary structural help in case of additional draw back.

The short-term shifting averages (blue and crimson strains) present that the worth stays above each the 50-period and 200-period shifting averages, confirming a bullish construction. The current bounce from $121,000 aligns with robust demand absorption, which regularly precedes one other upward try. If Bitcoin breaks above $124,500, it may sign renewed momentum towards retesting the $126,000 ATH, probably main to cost discovery.

Nonetheless, a rejection close to present ranges may result in a deeper retest towards the $120,000–$118,000 vary, the place the subsequent consolidation part could kind. General, the chart signifies that Bitcoin’s uptrend stays intact, however bulls want a decisive shut above $125,000 to verify continuation. The market seems to be in a wholesome pause after a steep rally, making ready for its subsequent decisive transfer.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.