Crypto markets are leaning towards their quietest temper in years, and a few analysts say that might be the sign sellers have run out of steam. In accordance with Matrixport, a hunch in investor temper has pushed its measures to ranges which have up to now lined up with market turning factors.

Associated Studying

Crypto Sentiment At Multi-Yr Lows

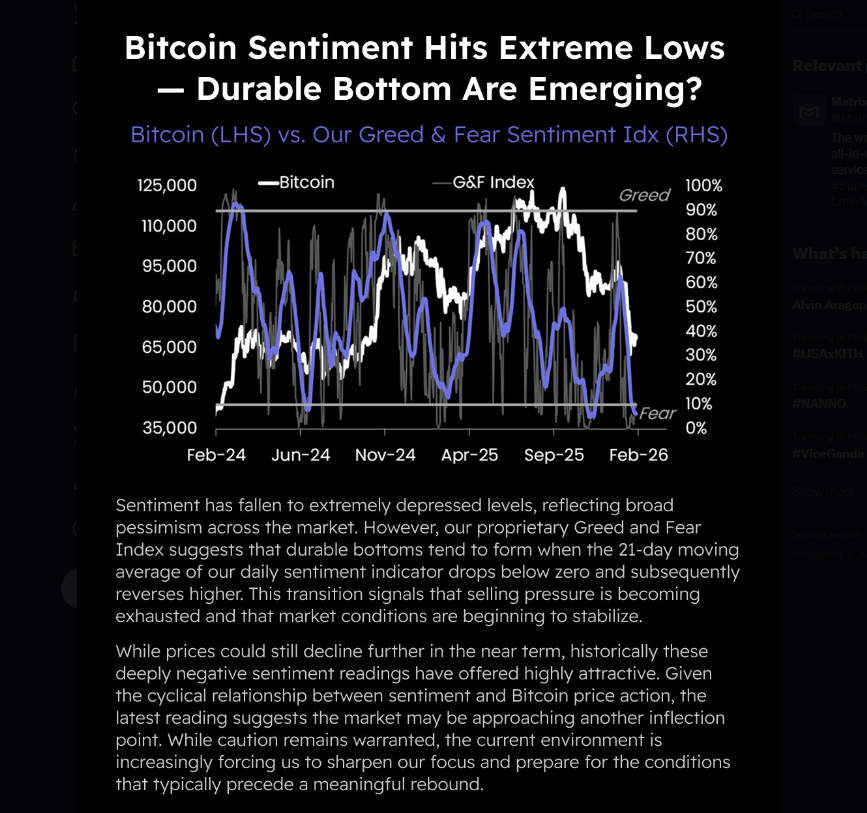

In accordance with Matrixport, its Bitcoin fear-and-greed gauge has the 21-day shifting common under zero and beginning to flip up, which is the form of shift that in prior episodes marked the tip of broad promoting.

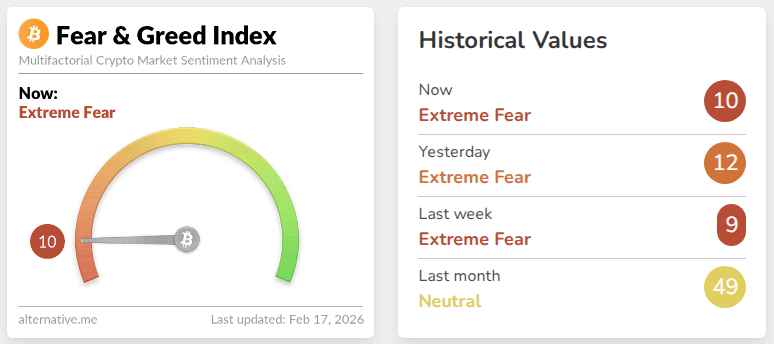

Reviews observe Various.me’s Concern and Greed Index sits close to 10 out of 100, a studying that traces up with what merchants name “excessive worry.” These are blunt, unpleasant numbers. In addition they are inclined to make just a few traders begin searching for bargains.

Comparable Readings From The Previous

Previous moments with comparable readings got here after steep drops. June 2024 and November 2025 had been named by Matrixport as earlier instances when market temper hit comparable depths, and every was adopted by at the least a brief change in value motion.

That sample doesn’t promise a rebound each time, nevertheless it does present how deeply destructive views can ultimately be absorbed by consumers who step again in at decrease costs.

Right now’s #Matrixport Each day Chart – February 17, 2026

Bitcoin Sentiment Hits Excessive Lows ⁰— Sturdy Backside Are Rising?

#Matrixport #Bitcoin #BTC #CryptoMarkets #MarketSentiment #FearAndGreed #RiskManagement #Volatility #CryptoResearch pic.twitter.com/WxJg3xrHSf

— Matrixport Official (@Matrixport_EN) February 17, 2026

Technical Indicators Flash Oversold Alerts

Frank Holmes of Hive says Bitcoin is about two customary deviations under its 20-day buying and selling norm — a uncommon studying seen only some instances in 5 years. Reviews observe that these extremes have traditionally produced short-term bounces over the next 20 buying and selling days.

Bitcoin itself has been shifting sharply: it briefly climbed above $70,000 over the weekend, solely to fall again about 2.5%, buying and selling close to $68,750 on the time of writing.

Different trackers report it dipped near $60,000, marking one of many deepest drops in a number of years. Merchants are preserving an in depth eye on US GDP and revenue information, which might affect threat urge for food and the subsequent strikes for crypto markets.

Promoting Stress Might Be Close to Exhaustion

Reviews say Matrixport nonetheless warns that costs might transfer decrease earlier than any significant backside is cemented. The agency factors to a cyclical hyperlink between temper and value — deep pessimism usually precedes an inflection, however cycles might be messy and prolong.

Promoting strain might be exhausted and but new headlines or information can push costs down additional earlier than consumers really feel assured sufficient to remain.

Associated Studying

What Merchants May Do Subsequent

Some traders see current readings as a horny entry level, whereas others favor to attend for clearer affirmation from value and quantity.

Lengthy-term holders usually level to the underlying community metrics and institutional curiosity as causes to stay optimistic, and their positions are being watched intently.

Quick-term gamers, in contrast, are taking a cautious stance, utilizing stops, scaling entries, or sitting out till alerts agency up.

Featured picture from Unsplash, chart from TradingView