A modest declare. A daring quantity. Each are on the desk for Bitcoin this week as a debate over methods to learn short-term streaks in worth positive aspects grows louder.

Associated Studying

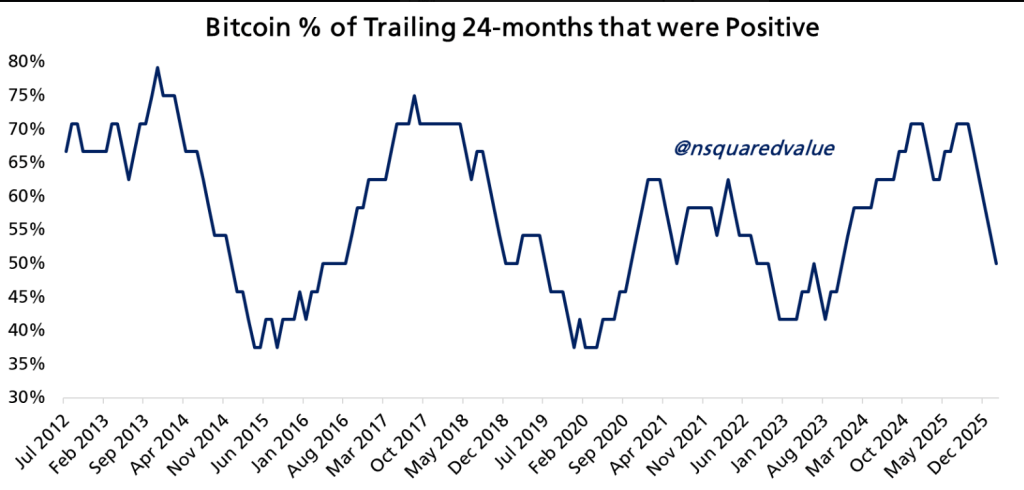

Crypto analyst Timothy Peterson has identified that half of the final 24 months confirmed optimistic returns. Based mostly on stories, he then gave an almost 90% likelihood that Bitcoin could be greater in 10 months.

That leap from a easy rely to a agency chance is the headline grabber. It ought to be met with cautious questions on how the chances had been calculated and what assumptions had been constructed into the mannequin.

Counting Constructive Months

Peterson primarily based his view on a evaluate of month-to-month efficiency knowledge. Figures compiled by CoinGlass present that Bitcoin closed six months of 2025 in optimistic territory, whereas the remaining six completed decrease.

In keeping with the information, 50% of the previous 24 months ended with positive aspects. Peterson mentioned he tracks this rolling two-year window to identify potential turning factors in worth traits.

50% of the previous 24 months have been optimistic.

This suggests a 88% likelihood that Bitcoin will probably be greater 10 months from now.

The common return is exp(60%)-1 = 82% => $122,000.

Knowledge goes again to 2011. https://t.co/k4IjTisuTH pic.twitter.com/ZxfTyequjt— Timothy Peterson (@nsquaredvalue) February 21, 2026

Market Odds And Betting

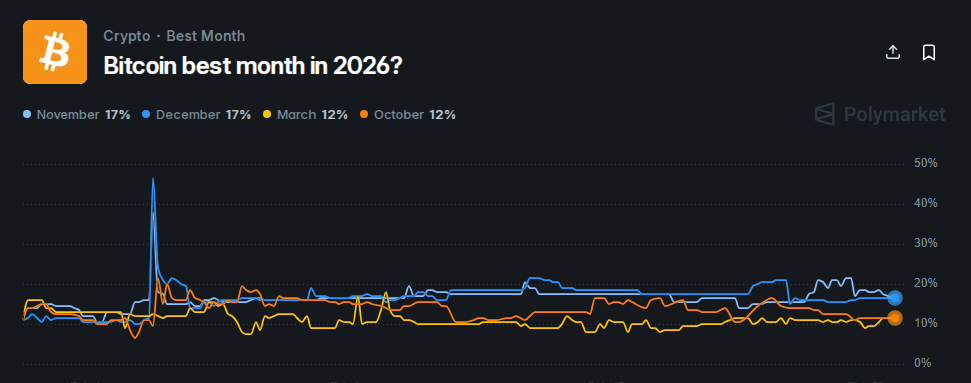

An alternate of bets exhibits a really completely different view. Polymarket at present costs December as solely a 17% shot at being one of the best month of 2026, with November a hair greater.

These numbers reply a unique query from Peterson’s: they mirror market bets on which month will outperform others, not whether or not the value will merely be greater at a future date.

Betting markets may be blunt instruments, however they do pack the collective view of many merchants right into a single quantity.

Bitcoin Value Motion

Value has not been calm. Bitcoin traded in a roughly $67,000–$68,000 band this week as geopolitical rigidity within the Center East tightened.

Protected-haven property like gold and oil jumped on information flows, and Bitcoin felt the squeeze as some patrons stepped again. On the identical time, dwell tickers confirmed the token about 20% under its stage firstly of the 12 months, a reminder that headline percentages cover broad intraday swings.

Analysts Are Break up

Voices from the buying and selling desk are divided. Michael van de Poppe advised near-term inexperienced candles might be coming, urging merchants to look at for a carry. Then again, Peter Brandt has argued a deeper low could not arrive till late 2026.

Each views relaxation on completely different units of alerts — one on momentum and chart construction, the opposite on longer cycle patterns and danger of macro shocks.

Sentiment Nonetheless Down

In the meantime, move knowledge from spot ETF purchases, derivatives positioning, and on-chain liquidity figures would add weight to any forecast.

Associated Studying

Peterson’s forecast comes as crypto market sentiment continues to say no, with stories noting that dialogue and exercise round Bitcoin predictions have slowed. Merchants seem cautious, weighing previous traits towards present uncertainty available in the market.

Featured picture from Vecteezy, chart from TradingView