XRP Group Day has put Ripple’s token again in focus as merchants search for catalysts amid a fragile market construction.

Abstract

- XRP Group Day has refocused consideration on the XRP Ledger’s ecosystem, highlighting developer exercise and neighborhood engagement fairly than delivering a single market-moving announcement.

- XRP is consolidating close to the $1.37–$1.38 assist zone, with narrowing Bollinger Bands and a recovering CMF suggesting promoting stress is easing, although upside stays capped under $1.45–$1.50.

- Declining XRP change reserves on Binance level to decreased fast sell-side provide, providing a supportive backdrop if renewed community-driven curiosity interprets into demand.

The community-led occasion highlights ecosystem updates, developer exercise, and ongoing engagement across the XRP (XRP) Ledger. This might assist refocus consideration on fundamentals after weeks of worth weak spot.

Whereas XRP Group Day is just not tied to a single market-moving announcement, it usually serves as a sentiment booster, significantly throughout consolidation phases.

Elevated visibility, renewed social engagement, and dialogue round XRPL use circumstances can act as short-term momentum drivers if broader market circumstances cooperate.

XRP worth motion steadies close to key assist

XRP is buying and selling close to the $1.37–$1.38 zone at press time, making an attempt to stabilize after a gentle pullback from highs above $1.60 earlier this month.

The worth is holding close to the middle-to-lower portion of the Bollinger Bands on the day by day chart. The bands have began to slender, signaling decreased volatility following the current sell-off.

Whereas XRP is not hugging the decrease Bollinger Band, indicating that draw back momentum has eased, worth has struggled to reclaim the mid-band (20-day shifting common). So long as XRP stays under this degree, upside makes an attempt are more likely to face resistance.

A sustained transfer above the mid-band would open the door towards the higher band close to the $1.45–$1.50 zone.

The Chaikin Cash Circulation (CMF) stays barely under the zero line however has turned greater from current lows, suggesting promoting stress is fading. A transfer again into constructive territory would sign bettering capital inflows.

A failure to take action may depart XRP susceptible to a retest of assist round $1.35, adopted by $1.28 on a deeper pullback.

Change reserve knowledge hints at provide dynamics

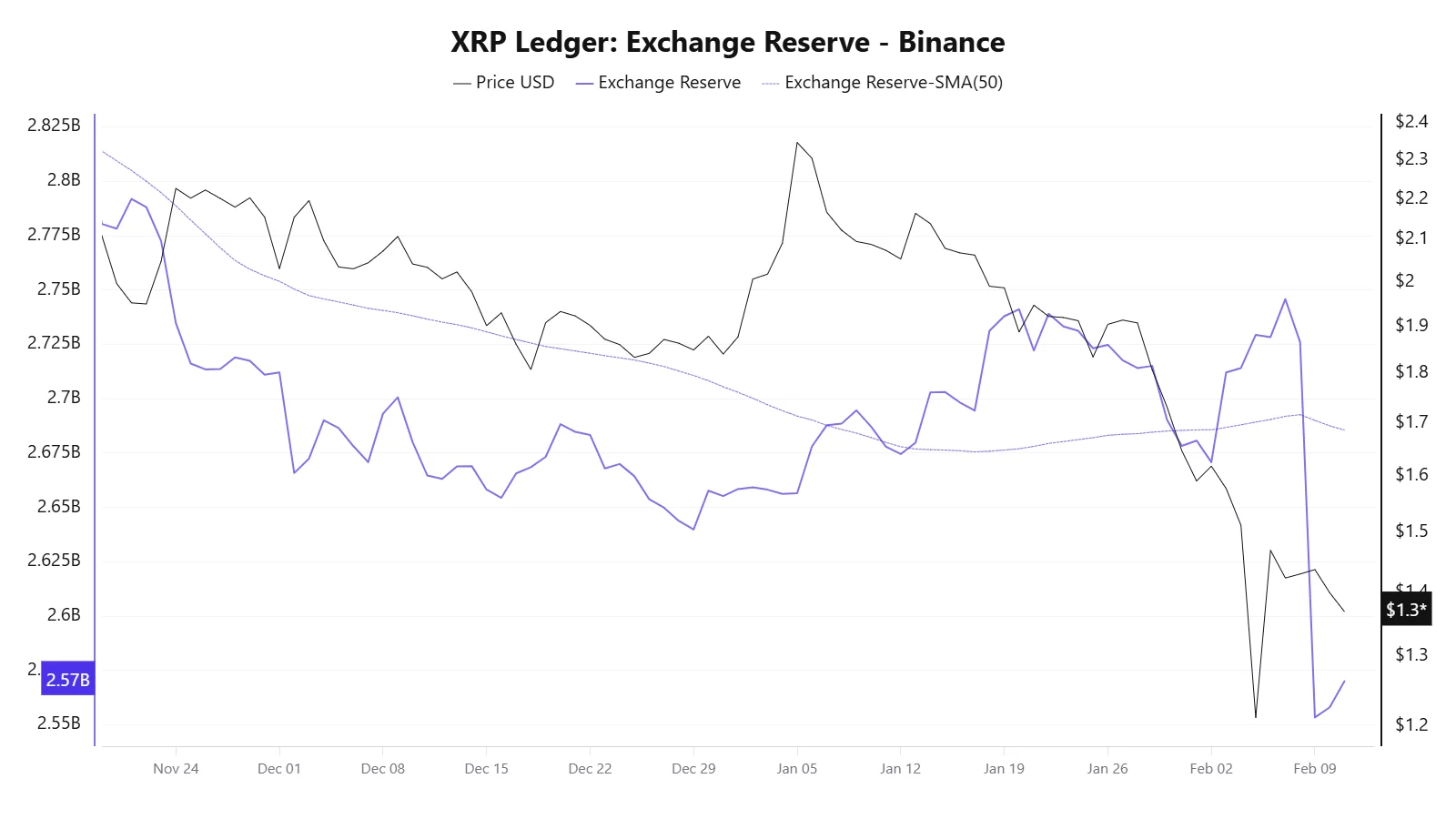

Furthermore, CryptoQuant knowledge reveals XRP change reserves on Binance have declined just lately, suggesting fewer tokens are being held on exchanges.

This pattern usually factors to decreased fast sell-side stress, as extra XRP strikes into personal wallets fairly than remaining accessible for spot promoting.

Whereas falling change reserves alone don’t assure a rally, they’ll present a supportive backdrop if demand picks up. Mixed with community-driven consideration from XRP Group Day, the supply-side dynamics may assist restrict draw back danger within the close to time period.

General, XRP stays in a consolidation section, with Group Day appearing as a sentiment catalyst fairly than a assured breakout set off. Merchants might be watching whether or not XRP can defend the $1.35 assist zone and reclaim resistance close to $1.45 to sign a shift towards restoration.