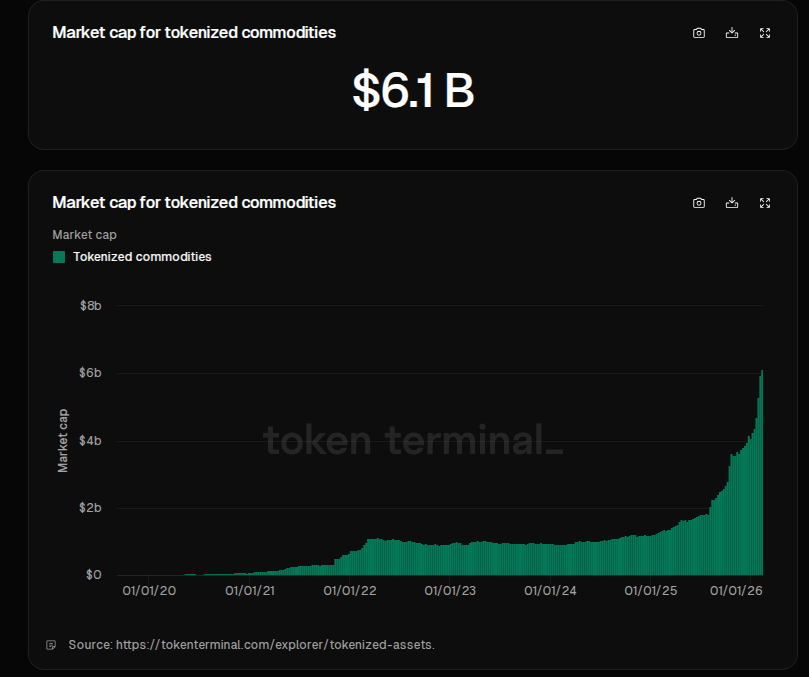

Markets have put extra gold on blockchains, And the shift has been fast. Reviews say the tokenized commodities sector grew about 53% in below six weeks, pushing its dimension to simply over $6 billion. That bounce has been led by a small group of gold tokens, and the transfer has merchants and a few huge banks watching carefully.

Gold Tokens Drive The Rally

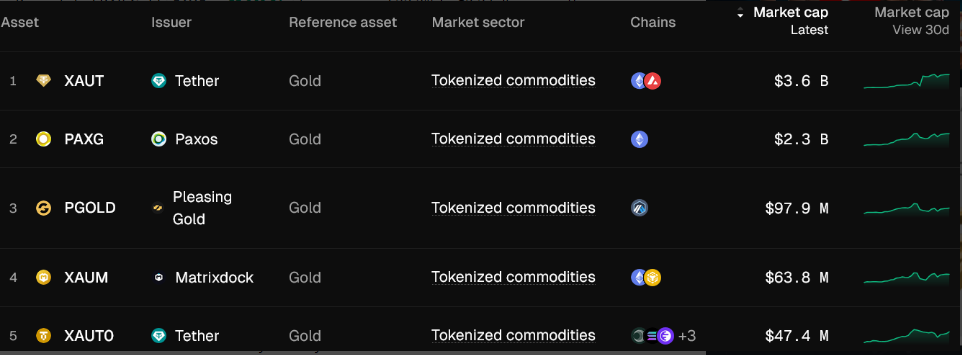

In keeping with on-chain knowledge, a lot of the contemporary worth is sitting in Tether’s XAU₮ and Paxos’s PAXG. Collectively they maintain near $6 billion of the sector’s market value.

Traders are treating these tokens as a fast solution to personal a declare on bullion with no need to maneuver bars or take care of vault paperwork. Some consumers desire a secure haven that strikes simply throughout borders. Others wish to commerce fractions of an oz in on-line markets.

Tether Strikes Towards Bodily Integration

Reviews say Tether has not stopped at issuing a token. The agency took a $150 million stake in Gold.com with plans to fold XAU₮ into that platform and to let clients pay for precise gold with stablecoins.

This can be a step towards tying token balances extra on to bodily holdings and gross sales channels. If it really works, retail consumers may use acquainted crypto instruments to purchase and acquire actual metallic, which might change how atypical individuals entry bullion.

Analysts See Large Upside

Based mostly on reviews, Geoffrey Kendrick of Normal Chartered has sketched an enormous development path: from roughly $35 billion in tokenized real-world property at this time to as a lot as $2 trillion by 2028.

Alvin Foo, a crypto analyst, has argued that tokenized commodities — gold on public chains specifically — may scale to trillion-dollar values sometime, as markets undertake fractional possession and new buying and selling rails.

These projections require many items to fall into place: clear guidelines, dependable custody proofs, and large demand from non-crypto traders. Bold targets are being set, however they relaxation on a series of technical and authorized fixes which might be nonetheless in progress.

How The System Works And Why It Issues

Stablecoin liquidity and decentralized finance plumbing are being pointed to because the plumbing that may assist bigger markets. Reviews notice that having fast settlement, low minimums, and simple custody opens bullion to smaller traders and merchants who had been locked out earlier than.

Fractional possession is already doable, which suggests somebody can personal a slice of a bar with out ever visiting a vault. But belief should be earned. Custodial audits, insured storage, and clear minting and redemption guidelines will form whether or not token holders really feel safe.

Featured picture from Personal Banker Worldwide, chart from TradingView