Current on-chain knowledge exhibits that the Bitcoin value is presently at an essential section, elevating suspicions as as to whether the market is nearing a cyclical backside.

Mayer A number of Falls To 0.6 — What This Means

In a current Quicktake publish on the CryptoQuant platform, on-chain analyst Ruga Analysis identified that the Bitcoin value now has a 40% adverse deviation from its 200-day shifting common. This on-chain remark revolves across the Bitcoin Mayer A number of.

Associated Studying

For context, the Mayer A number of metric tracks how far a coin’s present value is buying and selling above or under its long-term pattern. This indicator is ready to obtain this by dividing the value by its 200-day shifting common.

When the metric exhibits a studying of 1, it sometimes implies that the Bitcoin value is buying and selling roughly on the 200-day MA. In the meantime, readings above 1 mirror that the Bitcoin value is at a premium relative to its long-term pattern, whereas readings under 1 counsel that the value is buying and selling at a reduction.

Traditionally, the metric has a number of thresholds in tandem with market circumstances. For instance, when the metric reaches ranges above 2.4, it usually indicators that the Bitcoin value is at an overbought zone (often known as the bubble territory).

As defined earlier, 1 – 1.5 represents the traditional bull-market vary, whereas 0.8 – 1.0 is usually the low cost zone (the place accumulation usually happens). Notably, when the value falls to areas under 0.8, it indicators that the Bitcoin value has been oversold, because of capitulation occasions.

Ruga Analysis revealed that the metric is presently at 0.6, reflecting an approximate 40% deviation under Bitcoin’s long-term pattern. Therefore, it’s obvious that the Bitcoin value stands at a statistical excessive.

Historic knowledge the place the Mayer A number of fell to comparable ranges additionally provides credibility to this stage’s relevance. In December 2018, the metric dropped to the 0.5 – 0.6 vary (close to Bitcoin’s market backside round $3,200) earlier than the value witnessed a greater than 540% development.

Equally, the metric fell to 0.5 owing to the COVID crash, adopted by a restoration and growth of the Bitcoin value by 1,100% in one other 12-month interval. This situation additionally repeated in November 2022, with the Mayer A number of falling to the identical area, after which the BTC value soared by over 170%.

Nevertheless, Ruga Analysis talked about, as a caveat, that the metric doesn’t exactly spot the place and when a backside will type, however merely reveals what to anticipate within the long-term. It is usually attainable that the metric might document additional draw back strikes or see some consolidation earlier than going to the upside.

Bitcoin Value At A Look

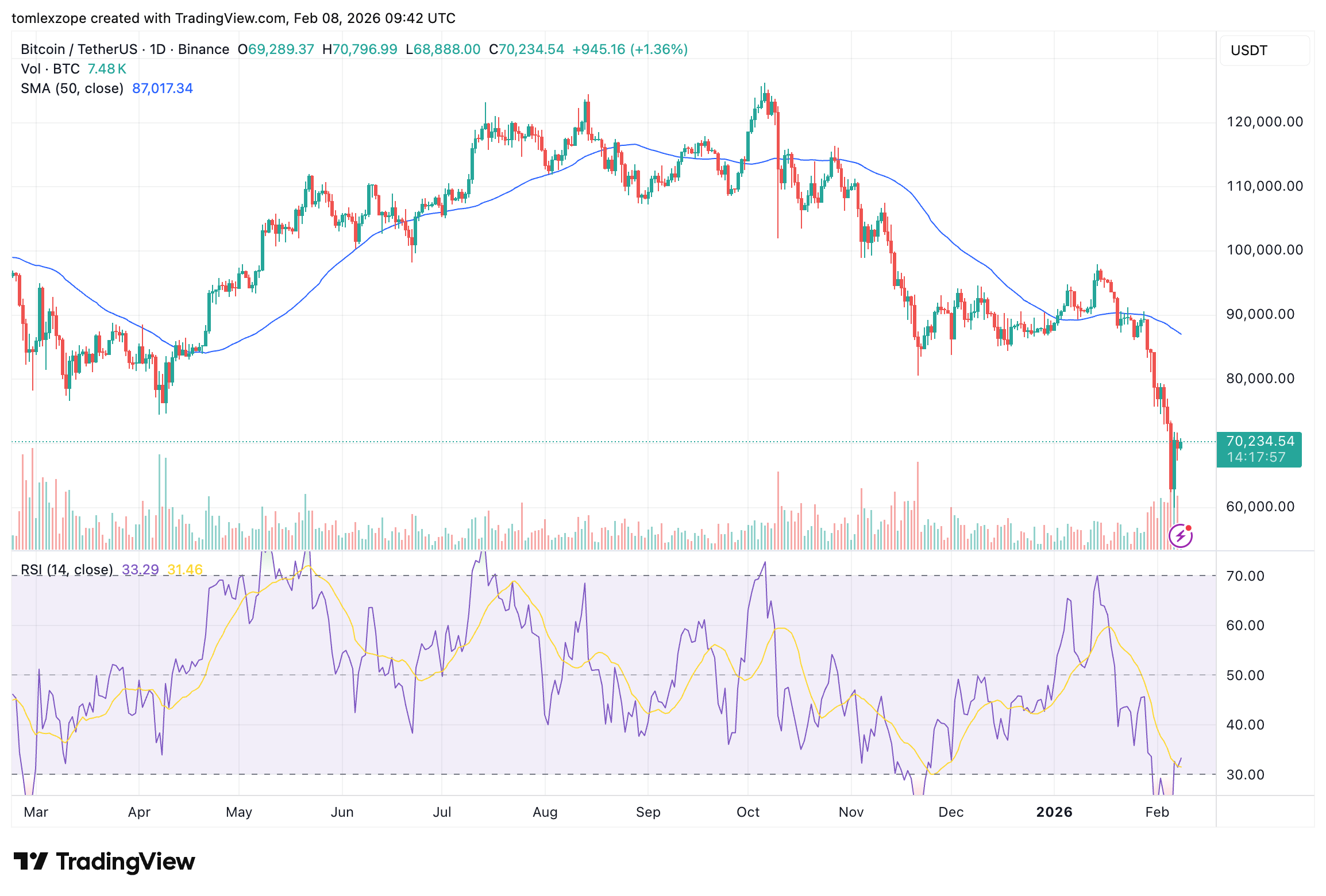

As of this writing, Bitcoin is price roughly $70,383, reflecting an over 2% bounce up to now 24 hours.

Associated Studying

Featured picture from iStock, chart from TradingView