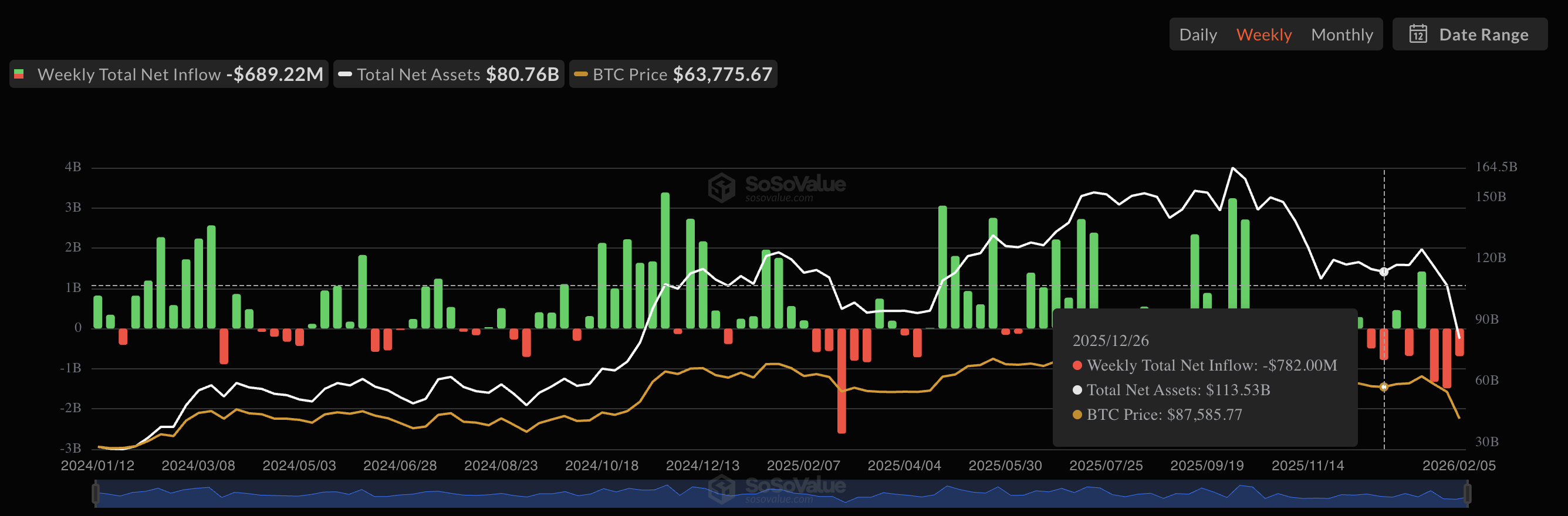

After a chaotic week for the cryptocurrency market, the US-based Bitcoin ETFs (exchange-traded funds) noticed important capital inflows on Friday, February 6. Because the flagship cryptocurrency and the remainder of the market suffered large declines, the BTC-linked exchange-traded merchandise additionally posted substantial withdrawals through the week.

With the bear market confirmed by the newest steep worth decline, it might be fascinating to see how the US Bitcoin ETFs would carry out throughout their first prolonged interval of downward worth motion. To provide perspective, the BTC exchange-traded funds have had 11 days of capital inflows to date in 2026.

US Bitcoin ETFs Submit $330M Web Inflows

In keeping with the newest market information, the US Bitcoin ETFs noticed a complete web influx of $330 million on Friday. This spherical of capital inflow comes after three days of heavy withdrawals from the BTC exchange-traded funds over the previous week.

Whereas the market information for Friday’s exercise stays incomplete, it comes as little shock that BlackRock’s iShares Bitcoin Belief (with the IBIT ticker) led this spherical of capital inflows. In keeping with SoSoValue’s information, the exchange-traded fund added $231.62 million in worth to shut the week.

Moreover, Ark & 21Shares’ (ARKB) adopted in second place, with a complete web influx of $43.25 million on the day. In the meantime, Bitwise’s Bitcoin ETF (BITB) and Grayscale’s Bitcoin Mini Belief (BTC) registered $28.7 million and $20.13 million in whole web inflows, respectively, on Friday.

Invesco Galaxy Bitcoin ETF (BTCO) was the one different Bitcoin ETF that registered exercise on the day, posting a complete web influx of $6.97 million. As inferred earlier, these figures are available stark distinction to the performances seen earlier within the week.

It’s price mentioning that this capital inflow seen by the Bitcoin ETFs coincided with the worth of Bitcoin reclaiming the $70,000 stage on Friday. In the meantime, it’s no coincidence that the Coinbase Premium, an indicator of demand from United States traders, flipped optimistic going into the weekend.

Supply: SoSoValue

In keeping with information from SoSoValue, this $330 million efficiency additionally introduced the weekly file to round $350 million in unfavorable outflows. Notably, the $561 million capital influx recorded on Monday, February 2, additionally performed a component within the closing weekly determine.

Bitcoin Value At A Look

After briefly reclaiming the $70,000 mark on Friday, the premier cryptocurrency has cooled off over the weekend. As of this writing, the worth of BTC stands at round $68,900, reflecting an over 1% decline prior to now 24 hours.

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.