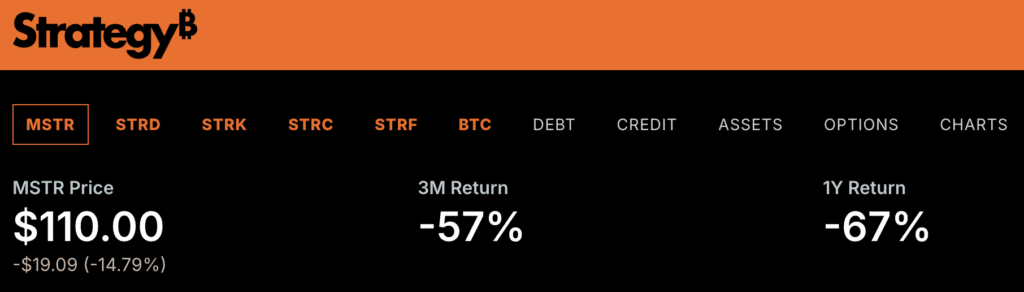

Shares of Technique dropped sharply Thursday, tumbling greater than 15 % in heavy buying and selling as markets reacted to deepening weak spot in Bitcoin and forward of the corporate’s quarterly earnings report scheduled after the market shut.

Analysts are pricing in a large post-earnings transfer for Technique, with choices markets implying a possible swing of roughly ±8.3% to eight.7% following the report.

The corporate’s This fall 2025 earnings name is ready for later at this time at 5 p.m. ET, with a livestream accessible on Bitcoin Journal’s YouTube channel.

It’s been a tough week for Technique, tumbling from the $150 vary to sub $110 per share.

The decline marked one of many largest single‑day strikes for Bitcoin‑linked fairness in latest months and mirrored intensifying issues amongst institutional and retail buyers.

The slide got here as Bitcoin’s worth plunged towards new year-long lows, extending a broader crypto downturn that has erased vital good points since late 2024.

Technique’s dip corresponds with Bitcoin’s worth crash

The Bitcoin promote‑off has imposed marked unrealized losses on Technique’s stability sheet, the place crypto holdings account for the overwhelming majority of the corporate’s property.

On the time of writing, Bitcoin is buying and selling close to $66,000.

Traders and merchants have been vocal on the web this week about heightened uncertainty surrounding Technique’s earnings name, provided that the corporate’s monetary outcomes will instantly replicate Bitcoin’s worth volatility below truthful worth accounting guidelines.

Market watchers famous that the truthful‑worth marking of the corporate’s holdings may translate swings in BTC costs into sizeable swings in reported earnings for the quarter ending December 31, 2025.

The strain in MSTR’s buying and selling comes after a collection of adverse strikes in BTC and associated property.

Bitcoin Journal reported earlier this week that firm shares had already sunk over 20 % in simply 5 buying and selling days as Bitcoin’s worth headed towards $72,000 and broader crypto markets confirmed sustained weak spot.

Now, bitcoin is combating for the $65,000 degree. Regardless of worth dips, Chairman Michael Saylor has made it clear that Technique received’t be promoting its Bitcoin — and actually is doubling down on purchases even because the market dips, signaling his intent to maintain accumulating extra.

In his messaging, he’s principally stated he’s snug with holding and including even on weak spot, not cashing out when costs fall.