Experiences say an on-chain analytics account referred to as Rand flagged a brand new milestone: crypto funds have recorded three straight months of outflows for the primary time on report.

Associated Studying

That streak stands out as a result of it breaks the sample of sporadic withdrawals and inflows that marked earlier market cycles. Many buyers are watching carefully.

Outflows Attain A Historic Turning Level

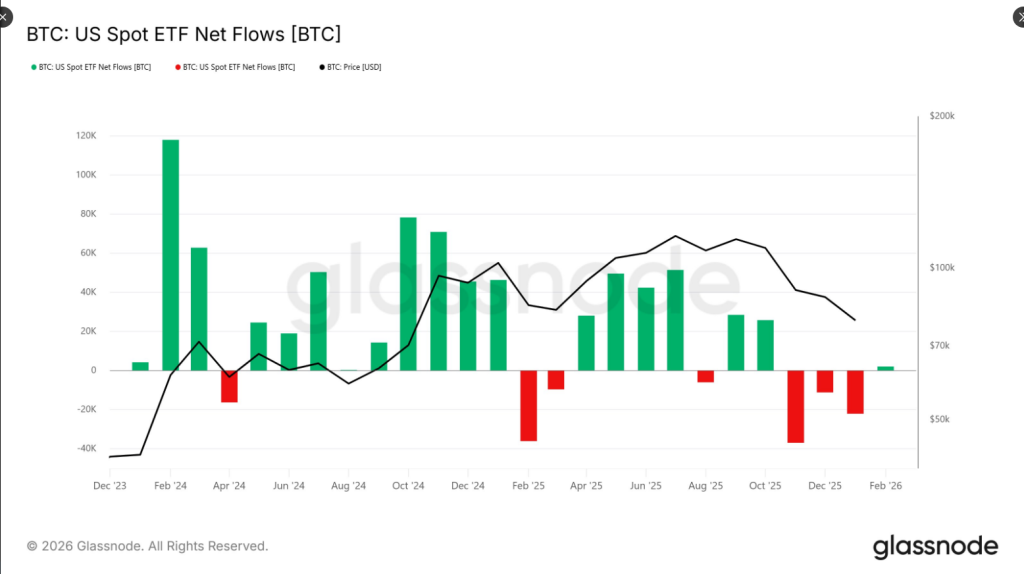

Based on market watchers, the run of withdrawals covers each retail and institutional flows. Spot Bitcoin exchange-traded funds (ETFs) within the US have been a significant focus, with inflows that had been as soon as monumental now trimming down.

Among the earlier features that piled into ETFs have been partially reversed, leaving holders with paper losses that many see as painful proper now.

US spot #Bitcoin ETF’s recorded 3 months of web outflows in a row.

The primary time in historical past that there was 3 consecutive months of outflows. pic.twitter.com/WusDpXuSSm

— Rand (@cryptorand) February 3, 2026

ETF Traders Holding Their Floor

Experiences say a number of distinguished analysts have identified that, whereas the current bleed seems to be alarming, ETF holders haven’t fled.

James Seyffart famous that holders stay largely in place regardless of steep paper losses.

Jim Bianco weighed in too, suggesting the common ETF stake is underwater by a significant margin but nonetheless being held.

This isn’t a full-scale selloff; it’s a gradual retreat for now. Giant sums entered the market through the peak months and people inflows dwarf the current outflows when measured over the longer run.

Sentiment has shifted, however conviction has not collapsed.

What The Numbers Present

Over 30 days, spot Bitcoin’s value slid by a large quantity, and that drop helped push ETF positions into the crimson. Experiences present some holders face losses across the low 40%, whereas shorter home windows present steeper swings.

The mathematics is easy: large features got here quick, and a few of that revenue has been given again. On the similar time, web positions stay sizable and a fair proportion of the capital that flowed in earlier remains to be parked in ETFs.

Lengthy Time period Positive aspects Versus Quick Time period Ache

Based on different market commentators, the larger image nonetheless favors those that saved religion by the rally years. Since 2022, Bitcoin’s cumulative rise outpaced a number of conventional shops of worth, say analysts monitoring long-term efficiency.

That report is raised as a counterpoint to the present outflow story. Some buyers see the present weak stretch as a pause; others see it as a warning.

Associated Studying

What Comes Subsequent

The three-month outflow run is a sobering marker. It alerts warning has unfold past a handful of merchants and reached merchandise that many thought would easy volatility.

Cash can return simply as rapidly because it left, or the gradual drip might proceed. For now, experiences and the info each present a market in a uncommon place: bruised, however not emptied.

Featured picture from Unsplash, chart from TradingView