The bitcoin value slid to $69,000 in Asian buying and selling Thursday as a deepening selloff in international markets spilled into crypto markets. The world’s largest cryptocurrency fell as a lot as 9% over the previous 24 hours, touching lows at $69,031 earlier than trimming losses.

Bitcoin value has now worn out all beneficial properties since its earlier $69,000 all-time excessive in 2021. BTC is now down almost 30% over the previous 12 months and about 45% under its October peak, in line with Bitcoin Journal Professional knowledge.

The transfer got here alongside sharp declines in Asian equities. MSCI’s Asia know-how index fell for a fifth time in six classes, whereas South Korea’s Kospi dropped about 4% as main AI-linked names confronted renewed strain.

Buyers have grown uneasy concerning the sturdiness of the unreal intelligence funding growth that lifted tech shares by 2025, with issues constructing round stretched valuations, slowing earnings momentum, and the chance that company AI spending might crest earlier than anticipated.

Bitcoin value sell-off

The danger-off tone unfold into different markets, with silver plunging as a lot as 17% and gold falling greater than 3%, signaling broad deleveraging throughout speculative and commodity-linked trades.

Bitcoin value’s decline additionally mirrored fading institutional demand. U.S.-listed spot bitcoin ETFs recorded internet outflows of roughly $545 million on Wednesday, marking a second consecutive day of withdrawals.

BlackRock’s IBIT led the promoting with about $373 million in internet outflows.

CryptoQuant analysis highlighted the reversal in ETF-driven demand. At this level in 2025, spot ETFs had bought about 46,000 bitcoin on a internet foundation.

In early 2026, they’ve as an alternative turn into internet sellers, lowering holdings by roughly 10,600 BTC year-to-date, creating a requirement hole of about 56,000 BTC versus final 12 months.

The decline leaves the bitcoin value down about 20% year-to-date and roughly 45% from its October peak close to $126,000. Market veterans have warned that the sample of consecutive decrease highs and decrease lows resembles sustained distribution somewhat than remoted retail panic.

Technique’s ($MSTR) losses and bitcoin mining problem

Consideration now turns to Technique, the most important company holder of bitcoin, forward of its fourth-quarter earnings report Thursday. The corporate holds about 713,502 BTC, and traders are awaiting any modifications in its balance-sheet posture.

Technique shares have collapsed greater than 70% from their 2025 excessive, lately buying and selling close to $120, ranges final seen in September 2024. The decline has weighed on public pension funds with publicity to the inventory, with reported paper losses within the a whole bunch of hundreds of thousands.

Regardless of value dips, Chairman Michael Saylor has made it clear that Technique gained’t be promoting its Bitcoin — and in reality is doubling down on purchases even because the market dips, signaling his intent to maintain accumulating extra.

Earlier this week, Technique mentioned it bought 855 bitcoin for about $75.3 million, paying a bitcoin value of $87,974 per BTC, in line with a Monday submitting.

Stress has additionally emerged within the mining sector. Bitcoin’s value close to $71,000 sits under estimates of all-in manufacturing prices close to $87,000, compressing margins.

CryptoQuant knowledge reveals community hashrate has fallen about 12% from October highs, whereas every day mining income briefly dropped to $28 million. A problem adjustment anticipated on Feb. 8 might lower mining problem by roughly 14%, providing aid to operators nonetheless on-line.

U.S. authorities can’t ‘bail out’ bitcoin

Yesterday, Treasury Secretary Scott Bessent informed the Home Monetary Companies Committee that the U.S. authorities has no authority to “bail out” bitcoin or direct banks to purchase BTC.

Rep. Brad Sherman pressed him on whether or not regulators might intervene like they did in the course of the 2008 monetary disaster, however Bessent rejected the thought outright.

He mentioned that the federal government’s solely bitcoin value publicity comes from legislation enforcement seizures, not taxpayer-funded investments.

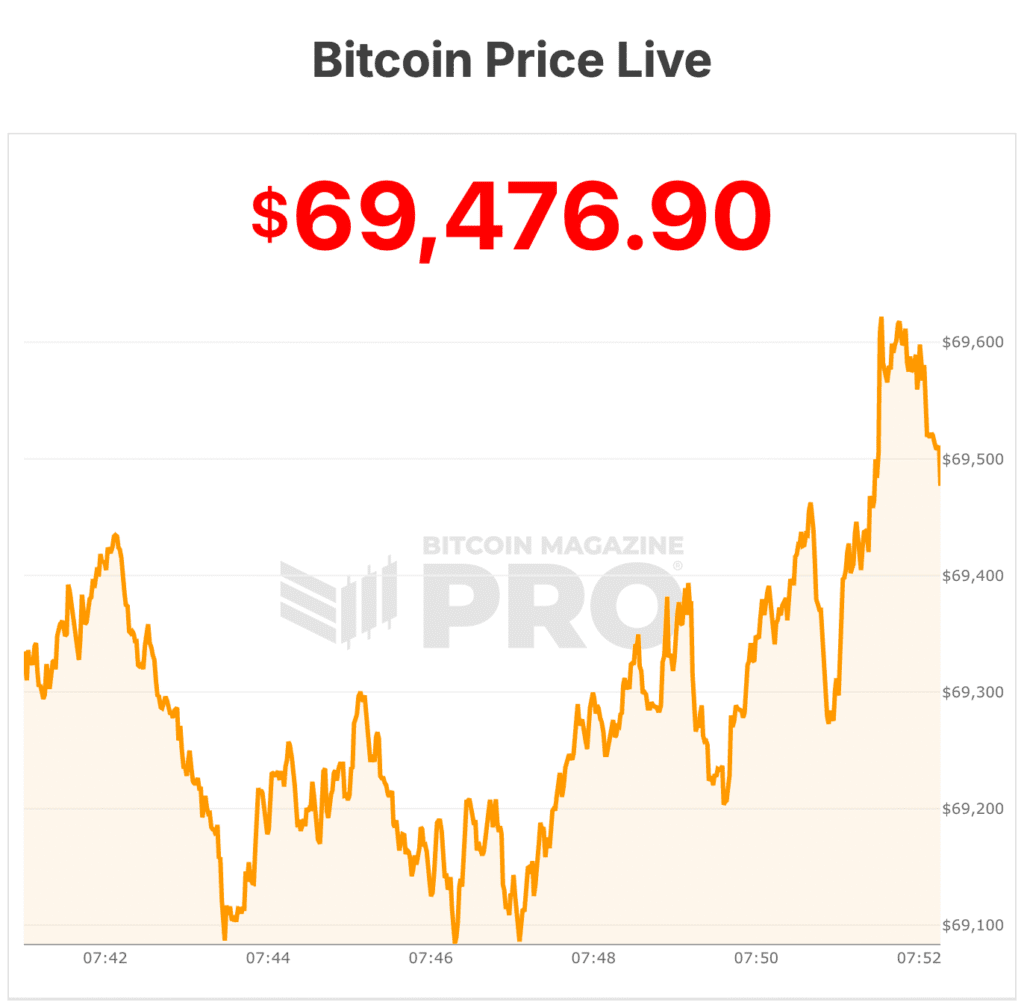

Per BM Professional knowledge, Bitcoin value fell 9% over the previous 24 hours to $69,402 on $101 billion in buying and selling quantity, pulling its market cap right down to $1.39 trillion because it trades close to its seven-day low with 19.98 million BTC in circulation.