Shares of Technique ($MSTR) plunged once more at this time as Bitcoin’s promote‑off deepened, reinforcing the tight correlation between the world’s largest company Bitcoin holder and the digital asset’s value motion.

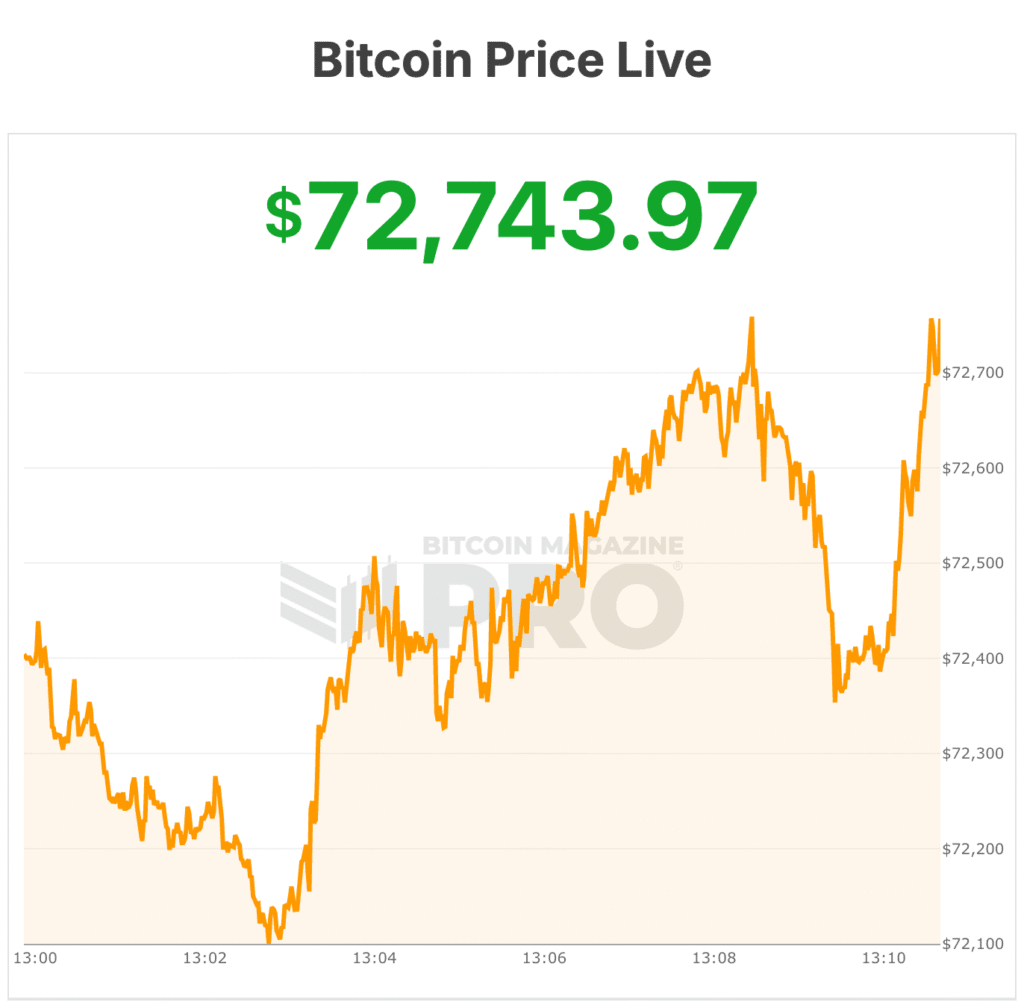

Bitcoin cratered towards $72,000, extending losses to ranges not seen since late 2024, whereas MSTR shares tumbled roughly 9% on the session, dipping to intraday lows close to $121.19.

At present ranges the inventory is down roughly 15% yr‑to‑date and a staggering 72% from its November 2024 peak.

The drop in Bitcoin — now hovering close to $72,000, far beneath the multi‑yr highs seen in 2025 — has rippled throughout the broader crypto advanced.

With sentiment souring and tactical merchants eyeing technical assist ranges close to the mid‑$60,000 vary, threat belongings have taken on a pronounced downbeat tone.

Commentary from market strategists has ranged from cautionary to outright bearish, with requires deeper retracements if demand fails to stabilize.

Analyst slashes $MSTR value goal by 60%

In a notable replace this week, Canaccord Genuity analyst Joseph Vafi, lengthy seen as one in every of MSTR’s most vocal supporters, dramatically slashed his value goal from $474 to $185 — a 61% discount — whereas sustaining a Purchase ranking on the inventory.

Based on Vafi’s revised outlook, the brand new goal nonetheless implies “vital upside” from present ranges if volatility subsides and Bitcoin finds a tradable backside.

Vafi’s retained bullish stance — regardless of the sharp goal lower — highlights a nuanced view amongst some Wall Avenue strategists: even amid brutal draw back, the inventory’s deep low cost to theoretical Bitcoin web‑asset worth may ultimately reprice upward.

Technique continues bitcoin buying

Earlier this week, Technique mentioned it bought 855 bitcoin for about $75.3 million, paying a median value of $87,974 per BTC, based on a Monday submitting.

The acquisition got here simply days earlier than bitcoin fell beneath $75,000 over the weekend on some fast promoting, briefly pushing Technique’s treasury near $1 billion in unrealized losses. Now, the value of bitcoin is beneath these ranges at $72,000.

The corporate now holds 713,502 BTC, acquired for roughly $54.26 billion at a median value of $76,052 per coin.

Final week’s buy was absolutely funded by the sale of widespread inventory, following Technique’s ongoing capital-raising strategy to finance bitcoin buys. The acquisition of 855 bitcoin was considerably smaller in comparison with prior firm purchases.

All eyes stay on MSTR’s upcoming fourth‑quarter 2025 earnings launch, scheduled for later this week, a report that might present extra coloration on its capital‑elevating cadence, BTC buy technique, and the evolving steadiness between leverage and asset protection.

On the time of writing, bitcoin’s value dropped to lows close to $72,000 at this time, its lowest degree in over a yr. The bitcoin value has now retraced greater than 40% from its all‑time highs reached in late 2025.