Shares of Technique plunged at present, dipping greater than 8% in buying and selling as Bitcoin traded at new one-year lows and crypto threat property got here underneath renewed strain.

The decline pushed MSTR’s share worth to ranges not seen since late 2024, deepening a multi‑month downtrend that has left the inventory among the many worst performers on the Nasdaq this yr.

Bitcoin’s hunch — dipping beneath key technical thresholds over the weekend and early week — has reverberated by way of markets, hitting crypto‑linked equities particularly arduous.

Shares of main crypto platforms, like Robinhood and Circle additionally misplaced floor, highlighting the growing correlation between Bitcoin costs and associated shares.

With over 713,000 Bitcoins on its steadiness sheet, bought at a mean value close to $76,000 per coin, Technique is grappling with unrealized losses after Bitcoin’s latest slide beneath that stage.

Regardless of worth dips, Chairman Michael Saylor has made it clear that Technique received’t be promoting its Bitcoin — and in reality is doubling down on purchases even because the market dips, signaling his intent to maintain accumulating extra.

In his messaging, he’s principally mentioned he’s snug with holding and including even on weak spot, not cashing out when costs fall.

Technique purchased extra bitcoin final week

Earlier this week, Technique mentioned it bought 855 bitcoin for about $75.3 million, paying a mean worth of $87,974 per BTC, in line with a Monday submitting.

The acquisition got here simply days earlier than bitcoin fell beneath $75,000 over the weekend on some fast promoting, briefly pushing Technique’s treasury near $1 billion in unrealized losses.

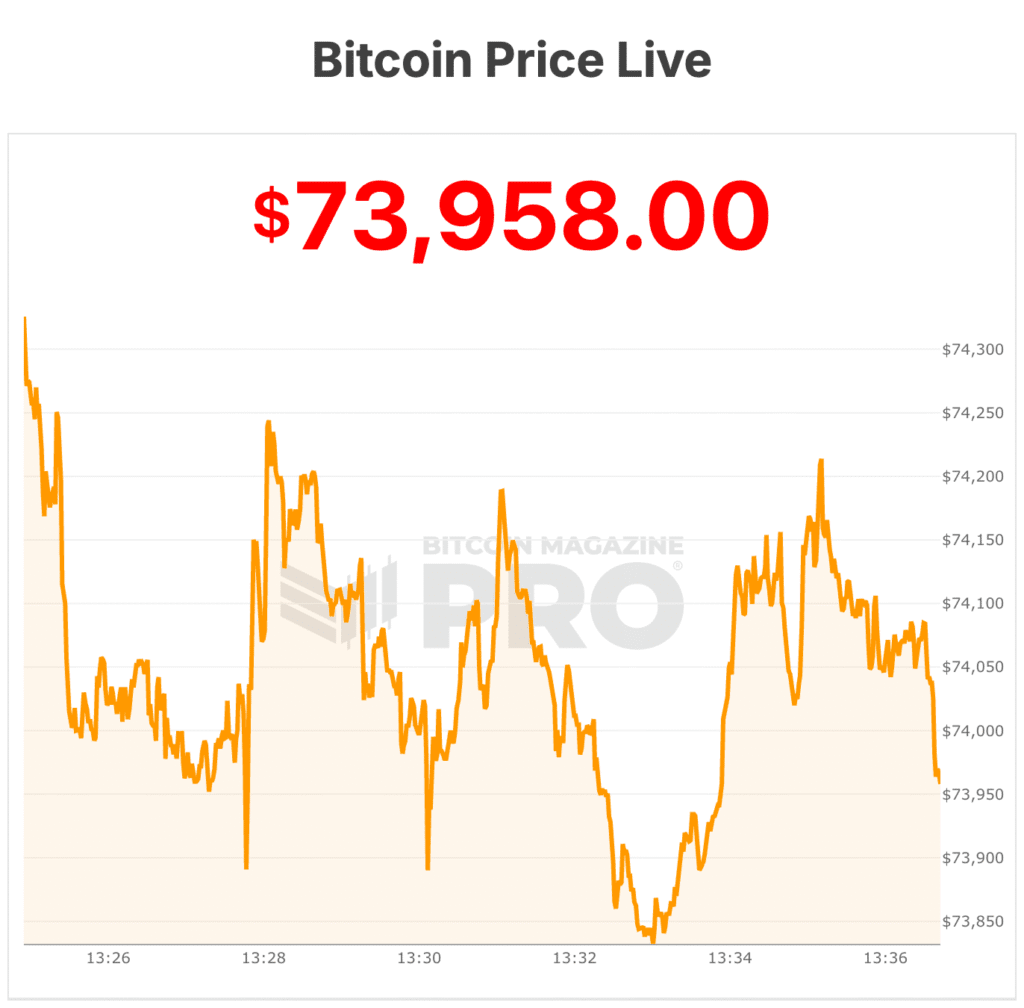

Now, the worth of bitcoin is beneath these ranges close to $74,000.

The corporate now holds 713,502 BTC, acquired for roughly $54.26 billion at a mean value of $76,052 per coin.

Final week’s buy was absolutely funded by way of the sale of frequent inventory, following Technique’s ongoing capital-raising strategy to finance bitcoin buys. The acquisition of 855 bitcoin was considerably smaller in comparison with prior firm purchases.

On the time of writing, bitcoin’s worth dropped beneath $74,000 at present, its lowest stage in a yr. The bitcoin worth has now retraced greater than 40% from its all‑time highs reached in late 2025.

Previous to at present, the one-year low for the bitcoin worth was $74,747. Technique shares began the day at $139.66, however are at the moment buying and selling at $128.87. The shares 52-week excessive was round $450 per share.