Galaxy Digital is warning that the Bitcoin selloff will not be completed, arguing that on-chain knowledge, weakening technical ranges, and a skinny catalyst calendar go away BTC susceptible to a deeper retracement towards the high-$50,000s over the approaching weeks or months.

In a shopper observe dated Feb. 1, 2026, Galaxy researcher Alex Thorn framed final week’s drawdown as greater than a quick shakeout. Bitcoin fell 15% from Monday, Jan. 28 by Saturday, Jan. 31, with the transfer accelerating into the weekend. Saturday alone noticed a ten% slide that, in keeping with the observe, triggered one of many largest liquidation occasions on report, wiping out greater than $2 billion in lengthy positions throughout futures venues.

Why The Subsequent Weeks, Months Look Bearish For Bitcoin

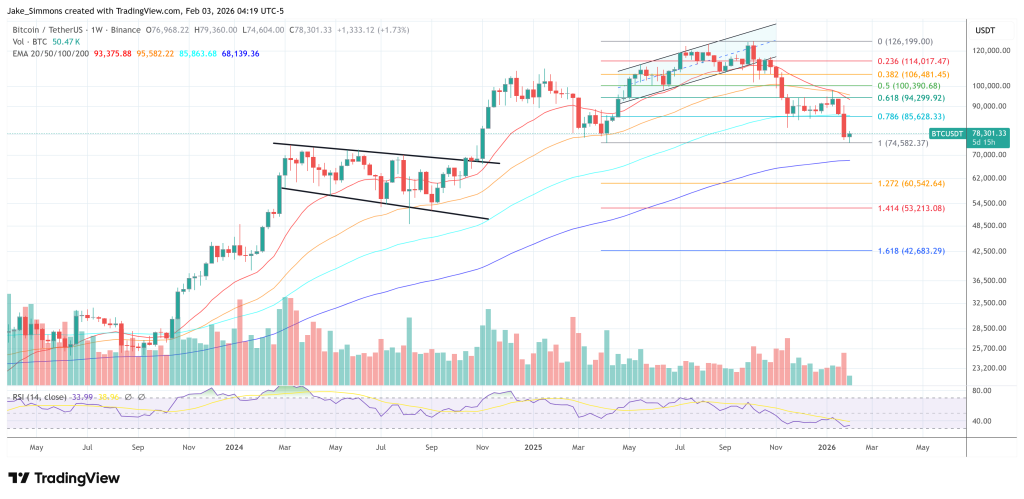

The selloff pushed BTC as little as $75,644 on Coinbase and briefly drove the spot value under a number of extensively watched investor price bases. Thorn famous that BTC dipped as a lot as 10% beneath the common price foundation of US spot ETFs, estimated round $84,000 primarily based on the costs at which creations occurred, earlier than recovering some floor. At one level, BTC additionally pierced Technique’s common price foundation of $76,037, and almost revisited the 1-year low of $74,420 set in the course of the April 2025 “Tariff Tantrum.”

On the time of writing, Thorn pegged Bitcoin at roughly 38% under its Oct. 6, 2025 all-time excessive of $126,296. Traditionally, he argued, that magnitude issues: except 2017, the asset has not usually stopped at a 40% drawdown from peak with out extending towards 50% inside three months. A 50% decline from the October excessive would suggest a transfer towards roughly $63,000.

Thorn’s central roadmap was outlined by two long-term reference factors which have repeatedly acted as “gravity” in prior cycles after key helps failed. Bitcoin misplaced its 50-week shifting common in November 2025, and the observe argued that, in earlier bull markets, shedding that degree usually preceded a deeper imply reversion to the 200-week shifting common which at present sits across the $58,000 value mark.

In the meantime, realized value, an on-chain proxy for the common price foundation of cash primarily based on their final motion, is round $56,000. Each metrics rise over time if BTC trades above them.

The observe pointed to ETF positioning as an extra stress take a look at. US spot Bitcoin ETFs, launched in January 2024, had amassed $54 billion in internet inflows as of the week ending Jan. 30, 2026, down from a peak of $62.2 billion in early October 2025. Thorn highlighted that the prior two weeks have been the second- and third-worst for ETF flows, with mixed outflows of $2.8 billion, whilst ETF holders largely remained in place by the broader drawdown.

On-chain distribution knowledge additionally recommended to Galaxy that the $82,000–$70,000 area may very well be frivolously defended, growing the chances of a downward probe. Thorn described a noticeable possession “hole” in that band, and argued that value usually seeks out zones the place demand has beforehand been established, notably after sharp deleveraging occasions.

Thorn additionally flagged a deteriorating narrative backdrop. “Catalysts stay arduous to search out. Narratives are working towards Bitcoin. There’s little proof of serious accumulation,” he wrote, including that BTC’s latest failure to trace gold and silver amid macro uncertainty has undercut the “debasement hedge” framing.

Even so, the observe stopped in need of calling a clear break into the $50,000s inevitable. Thorn emphasised that long-term holder profit-taking, described as exceptionally heavy in 2024 and 2025, has begun to abate, a situation that has traditionally coincided with late-stage selloffs.

For merchants, Galaxy’s framing units up a tactical query: whether or not the present ETF price foundation space close to $84,000 can maintain as a near-term anchor, or whether or not the provision hole under turns right into a vacuum that pulls BTC towards the $70,000 deal with. If that offers method, the extra consequential take a look at is whether or not realized value and the 200-week shifting common within the excessive $50,000s once more perform because the type of cycle-defined ground Galaxy believes long-term buyers have traditionally handled as an entry zone.

At press time, Bitcoin traded at $78,301.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.