Bitcoin’s unusually subdued choices pricing and weak month-to-date exercise are establishing what ProCap CIO and Bitwise adviser Jeff Park calls a harmful asymmetry: upside momentum is unlikely with out volatility, and the longer BTC stays “quiet,” the extra violent the eventual transfer might be.

In a put up through X on Jan.27, Park described the present tape as “nonetheless a dealer’s market,” arguing that low implied volatility and skinny participation are a poor basis for a clear grind increased. “It is rather unlikely for Bitcoin to seek out momentum to the upside with out experiencing considerably increased volatility,” he wrote.

“The truth that we’re at ~38 IV mixed with horrible quantity MTD provides me pause (decrease than ANY month of 2025, and particularly unhealthy for January generally) when you may see what the metals complicated is doing. You actually can’t think about a worse arrange for disappointment.”

What Occurred In Silver And Why It May Repeat For Bitcoin

Park’s reference level is a silver market that has gone from sturdy to disorderly. Silver costs have surged above $117 per ounce on Monday, with studies pointing to a speculative bid layered on prime of tight bodily circumstances and heavy retail participation through bars, cash, and bodily backed ETFs.

Associated Studying

The transfer additionally featured a pointy single-day soar. On Jan. 26, the most-active silver futures contract rose 14%, the most important one-day acquire since 1985. That worth motion coincided with a staggering surge in buying and selling and choices exercise throughout silver automobiles.

Bloomberg ETF analyst Eric Balchunas highlighted the dimensions: “WHOA: The quantity within the SLV is $32b.. that 15x its avg and by far essentially the most quantity of any safety on the planet. For context, SPY is $24b, NVDA and TSLA $16b. Can’t keep in mind the final time one thing so comparatively small took over like this. Recreation Cease possibly.”

WHOA: The quantity within the $SLV is $32b.. that 15x its avg and by far essentially the most quantity of any safety on the planet. For context, $SPY is $24b, $NVDA and $TSLA $16b. Can’t keep in mind the final time one thing so comparatively small took over like this. Recreation Cease possibly. pic.twitter.com/s6lVajUq4J

— Eric Balchunas (@EricBalchunas) January 26, 2026

He later added that SLV “ended up buying and selling $40b value of shares [on Monday],” including: “To place that into perspective, that’s greater than it traded in all of Q1 final 12 months. Jan + Feb +Mar = $35b. Choices quantity additionally in stratosphere. It’s already performed $1.5b in pre-market, which is 3x greater than every other ETF, 5x greater than Tesla, Nvidia. Once more, jogs my memory of Recreation Cease in its how is that this even possible-ness.”

“Paper” Publicity As An Accelerant

A standard crypto chorus is that “artificial” or “paper” bitcoin suppresses spot worth. Park argued the alternative dynamic is usually underappreciated and he used silver as an instance how leverage and market construction can flip into the catalyst.

Associated Studying

“Individuals usually blame incorrectly that ‘artificial/paper’ bitcoin is the reason for worth suppression,” Park wrote. “I’ve lengthy argued it’s fairly the alternative, which you’ll see the way it manifests in silver below- Silver didn’t have a 6-sigma occasion as a result of the spot market was so vibrant.”

In his telling, silver’s melt-up wasn’t pushed by orderly spot demand; it was pushed by the “shenanigans” inside financialized publicity. “Silver’s record-setting meltup comes from all of the shenanigans behind ‘paper silver’ the place margin guidelines, leveraged devices and automobiles, and liquidity and maturity transformation mismatches create super stress on breaking factors the place no bodily provide might be launched quick sufficient to counter the speed of paper provide,” he mentioned.

“For Park, the takeaway is directional however not calendar-specific. “To root for Bitcoin is to root for its volatility,” he wrote. “Anybody who tells you in any other case doesn’t perceive the basics of the commodities market … It is probably not at present or but tomorrow, however ultimately Bitcoin goes to tear many faces off. Volatility or bust.”

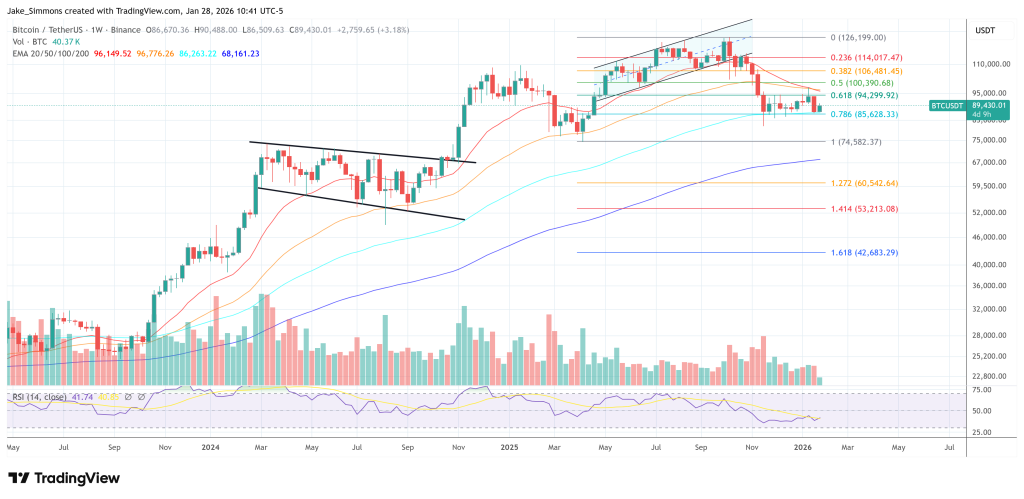

At press time, BTC traded at $89,430.

Featured picture created with DALL.E, chart from TradingView.com