The present Bitcoin value is stabilizing close to $89,000 because the U.S. Federal Reserve saved rates of interest regular at a spread of three.5% to three.75%

Abstract

- Bitcoin is holding channel low and worth space low assist.

- Reclaiming the purpose of management alerts enhancing short-term construction.

- Rising open curiosity helps the likelihood of a reduction rally.

Bitcoin (BTC) value is exhibiting early indicators of stabilization after a corrective section, with value motion responding positively from a key technical assist zone.

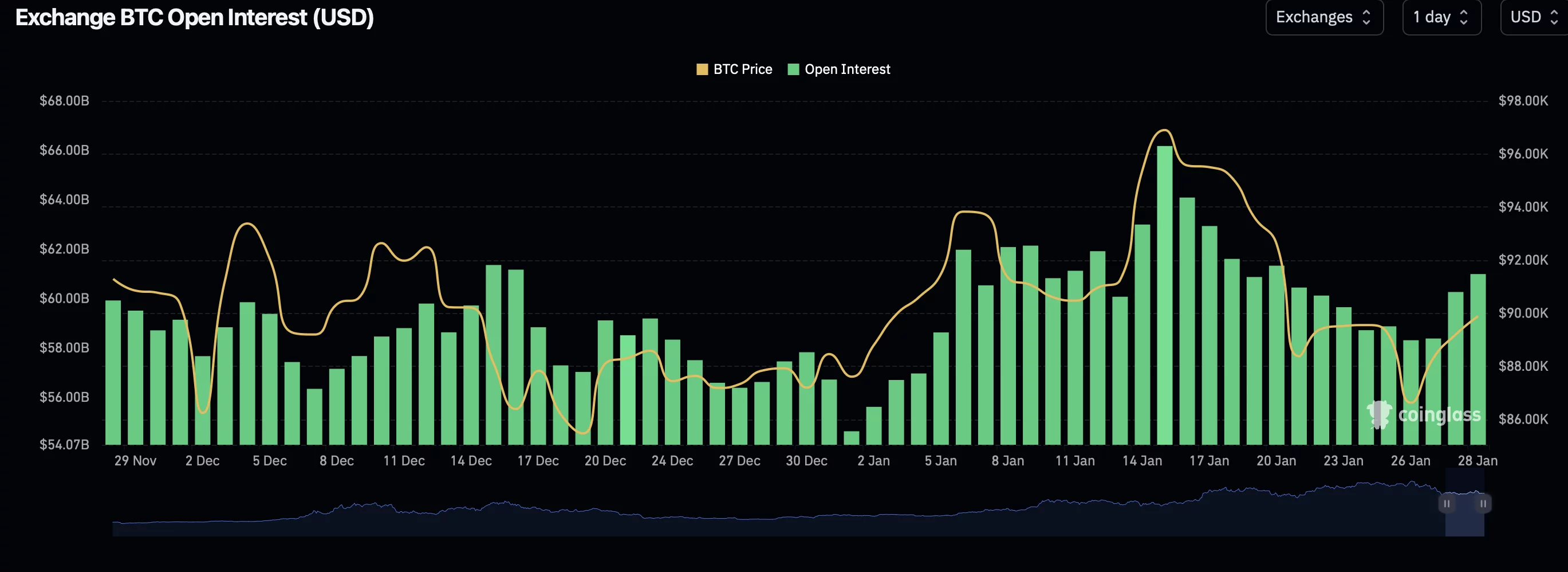

As Bitcoin trades close to the channel low, market conduct means that promoting strain could also be easing. This shift is being strengthened by a notable improve in open curiosity, indicating rising participation within the derivatives market.

Whereas affirmation remains to be required, the mixture of technical assist and rising positioning factors to the potential of a short-term reduction rally if present circumstances maintain.

Fed Price

When the Federal Reserve retains rates of interest regular, it alerts steady borrowing prices and may make money and bonds much less engaging, generally weakening the U.S. greenback.

Bitcoin usually strikes inversely to the greenback, so a softer or stagnant greenback can increase demand for crypto in its place retailer of worth.

Regular charges additionally recommend the Fed isn’t aggressively tightening to battle inflation, encouraging traders to tackle extra danger, which advantages higher-risk property like Bitcoin.

Bitcoin value key technical factors

- Channel low and worth space low holding as assist

- Level of management reclaimed, signaling enhancing construction

- Rising open curiosity helps the bullish reduction thesis

Bitcoin’s latest bounce originated from the channel low, which aligns carefully with the worth space low, making it a technically dense area.

This confluence usually attracts patrons on the lookout for discounted entries inside a broader vary. The preliminary response from this zone has been constructive, suggesting that demand is starting to soak up sell-side strain.

Importantly, this bounce was not instantly rejected. As an alternative, value adopted by simply sufficient to reclaim a key degree that always defines the vary’s management.

Reclaim of the purpose of management alerts power

One of many extra encouraging developments is Bitcoin’s reclaim of the purpose of management (POC). The POC represents the value degree the place the best quantity has traded not too long ago and sometimes acts as a dividing line between bullish and bearish management.

Holding above the POC shifts short-term bias in favor of patrons. So long as Bitcoin maintains acceptance above this degree, the likelihood will increase that the latest transfer is greater than a easy dead-cat bounce and as an alternative a growing rotation greater inside the channel.

Alongside enhancing value construction, open curiosity has been rising, including an necessary layer of affirmation to the setup. Rising open curiosity throughout consolidation close to assist means that merchants are actively opening new positions relatively than merely closing previous ones.

This conduct sometimes signifies conviction, significantly when it happens at technically necessary ranges. On this context, the rise in open curiosity implies that derivatives merchants are positioning for a continuation of upper relatively than a right away breakdown.

Nevertheless, open curiosity alone isn’t inherently bullish or bearish. Its significance is determined by whether or not the value holds assist. If Bitcoin have been to lose the reclaimed ranges, rising open curiosity may as an alternative amplify draw back. For now, although, positioning aligns with the reduction rally narrative.

Worth space excessive turns into the subsequent take a look at

If Bitcoin continues to carry above the POC, consideration shifts to the worth space excessive, which now acts as quick resistance. Acceptance above this degree would affirm that the value is transitioning again into greater worth territory, strengthening the case for a transfer towards the channel excessive resistance.

This step-by-step reclaim course of is essential. Aid rallies usually fail when the value can not transfer past the higher boundary of worth, leading to renewed consolidation or rejection. A clear reclaim, backed by sustained open curiosity and quantity, would materially enhance upside possibilities.

Market construction remains to be cautious however enhancing

From a broader market construction perspective, Bitcoin remains to be recovering from a bearish section. Whereas the quick draw back momentum has slowed, a full pattern reversal has not but been confirmed. As an alternative, the present setup favors a reduction rally inside a bigger vary relatively than an outright bullish breakout.

That mentioned, the advance in construction, from holding channel assist to reclaiming the POC, marks a significant shift in comparison with latest weak spot.

Bitcoin value motion: What to anticipate

Bitcoin is at a pivotal short-term inflection level. So long as the value stays above the purpose of management and channel low assist, the likelihood favors a continued reduction rally towards the worth space excessive and doubtlessly the channel excessive resistance. Rising open curiosity helps this situation by signaling lively positioning at assist.

Nevertheless, failure to carry these reclaimed ranges would weaken the bullish case and reopen draw back danger. Within the quick time period, value acceptance above worth will decide whether or not this reduction transfer develops right into a sustained rotation greater.