Bitcoin merchants are as soon as once more anchoring to FX, after intervention rumors round USD/JPY revived a well-known tug-of-war: short-term shock threat from a strengthening yen versus the longer-horizon bid that usually follows a softer greenback and simpler international liquidity.

The spark over the weekend was a viral X thread (2.9 million views) from Bull Idea (@BullTheoryio), which framed reported “charge checks” by the Federal Reserve Financial institution of New York as a prelude to coordinated motion. “The New York Fed has already completed charge checks, which is the precise step taken earlier than actual forex intervention,” the account wrote. “Which means the US is making ready to promote {dollars} and purchase yen. That is uncommon. And traditionally, when this occurs, international markets surge.”

Bitcoin In The Crosshairs

Bull Idea pointed to the macro backdrop in Japan, years of yen weak point, Japanese bond yields at multi-decade highs, and a still-hawkish Financial institution of Japan, because the stress cooker forcing officers towards extra aggressive signaling. Within the thread’s telling, the important thing variable is coordination: Japan appearing alone “doesn’t work,” whereas joint US-Japan motion “does,” citing 1998 and the Plaza Accord period as historic reference factors.

A Bloomberg report cited by the account described the yen’s sharp bounce on hypothesis that Japanese authorities may very well be making ready intervention to arrest the forex’s slide, after merchants reported the New York Fed had performed charge checks with main banks. The story stated the yen rallied as a lot as roughly 1.6% to round 155.90 per greenback, marking its strongest degree since December in that session.

THE FED IS PREPARING TO SELL U.S. DOLLARS AND BUY JAPANESE YEN FOR THE FIRST TIME THIS CENTURY.

The New York Fed has already completed charge checks, which is the precise step taken earlier than actual forex intervention. Which means the U.S. is making ready to promote {dollars} and purchase yen.

This… pic.twitter.com/7xFReOFoDo

— Bull Idea (@BullTheoryio) January 25, 2026

The battle within the replies was much less about whether or not markets moved and extra about what a “charge verify” truly indicators.

Daniel Kostecki (@Dan_Kostecki) dismissed the viral framing outright, arguing the mechanism is usually misinterpret. “The Japanese requested the NY Fed to behave as their agent within the American market,” Kostecki wrote. “NY Fed staff then began calling banks in New York to carry out the ‘charge verify’—strictly on the Japanese’s request. If officers from Tokyo had referred to as New York banks, merchants may need ignored it as a ‘native Japanese drawback.’ However when the Fed calls, banks deal with it as a sign {that a} joint intervention (USA + Japan) may be coming.”

That distinction issues for crypto as a result of the thread’s “bull case” leans closely on the concept that promoting {dollars} to purchase yen mechanically weakens the greenback and expands liquidity, circumstances many macro-focused crypto merchants affiliate with risk-asset upside.

Ted (@TedPillows) echoed the liquidity-first interpretation whereas flagging the trail dependency. “The Fed is making ready for a potential yen intervention,” he wrote, earlier than laying out the causal chain: {dollars} bought, yen purchased, greenback weaker, liquidity greater, threat property helped, then warning that “a strengthening yen might first trigger the same crash like in August 2024.” After that, he added, markets might stabilize and rally.

Michael A. Gayed (@leadlagreport), Portfolio Supervisor of The Free Markets ETF, supplied a special rationale for why Washington would care, suggesting the Fed is appearing to stop a state of affairs the place Japan would want to promote US Treasuries to boost {dollars} to intervene—“It’s not that Japan will panic. It’s the Fed that can panic,” he wrote.

Bull Idea’s most concrete crypto declare was that the setup accommodates each a near-term lure and a medium-term tailwind. The account argued there are “lots of of billions of {dollars} tied into the yen carry commerce,” which means abrupt yen power can power deleveraging within the very property, shares and crypto, funded with low-cost yen borrowing.

For instance, the account pointed to August 2024, claiming a small BoJ charge hike pushed the yen greater and “Bitcoin crashed from $64K to $49K in six days,” with crypto shedding “$600B in worth.” Bull Idea framed that episode because the template for the “catch” in 2026: yen power may be poisonous within the first act, even when sustained greenback weak point finally improves the liquidity backdrop for Bitcoin.

LondonCryptoClub (@LDNCryptoClub) leaned into that lagged-liquidity framing, arguing {that a} weaker greenback tends to filter into threat property with a delay, whereas additionally introducing a further US liquidity variable. “Continued and accelerated breakdown of the greenback will likely be good for Bitcoin and broad threat over the following few months,” the account wrote, including that the greenback “tends to behave with a 3 months lag” exterior of “knee jerk reactions.” It additionally warned {that a} potential US authorities shutdown and subsequent Treasury Normal Account rebuild might offset a number of the optimistic liquidity impulse.

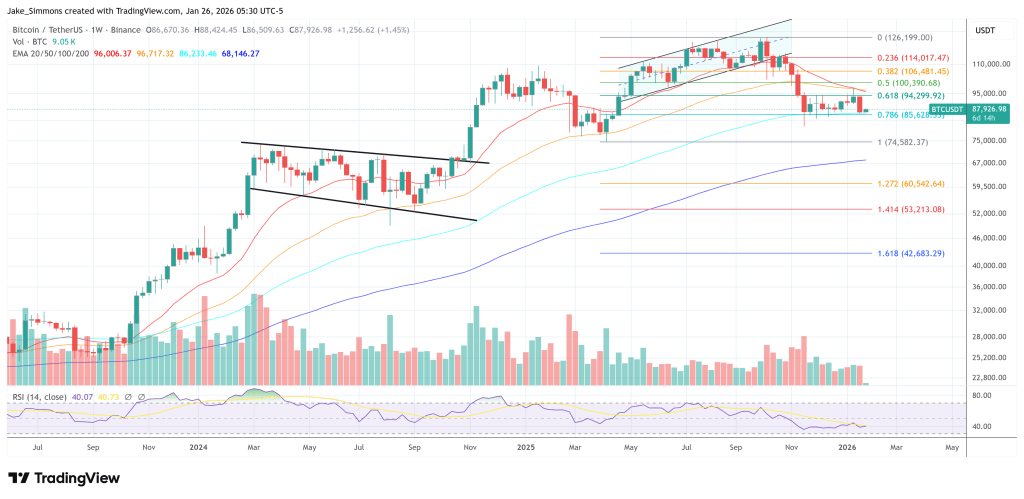

At press time, Bitcoin traded at $87,926.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.