Ethereum is exhibiting indicators of energy on two crucial fronts on the identical time. On-chain exercise has climbed to file ranges, reflecting heavier actual utilization throughout the community, whereas long-term technical construction is leaning in the direction of upside continuation.

Collectively, these alerts recommend that Ethereum’s present section could also be extra than simply sideways motion, as underlying information factors to sustained demand and constructive value habits.

Associated Studying

Ethereum Every day Transactions Attain New Excessive

Ethereum’s value motion is popping bullish with a gradual enhance in latest days. Notably, on-chain information reveals that this enhance is on high of regular on-chain exercise in latest days.

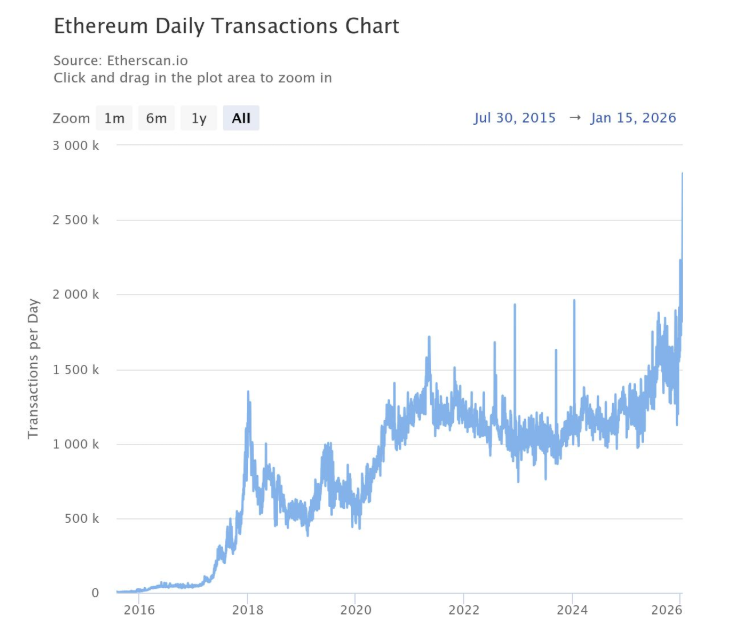

Knowledge from Ethereum’s on-chain exercise reveals that each day transactions lately climbed to roughly 2.8 million, setting a brand new all-time excessive for the community. Apparently, this determine stands out not simply as a file, however as a result of it’s roughly 64% larger than the each day transaction ranges noticed through the peak of the 2021 bull market.

The chart information from Sentora illustrates a development exhibiting Ethereum’s transaction depend rising steadily over time and spiking up in early 2026.

Evaluating the transaction exercise to 2021 provides extra context contemplating the extreme quantity of exercise that the Ethereum community was witnessing on the time. Again then, Ethereum was on the heart of an altcoin season and NFT increase, all of which contributed to a spike in transaction exercise and a push to new value highs.

The truth that Ethereum is now processing considerably extra transactions per day in comparison with 2021 reveals that its community utilization has grown above speculative habits. The regular climb in transaction exercise reveals the sheer quantity of utilization throughout decentralized finance and stablecoin settlement, amongst many others.

Ethereum Every day Transactions Chart. Supply: @SentoraHQ On X

Ethereum Reaccumulation Inside A Macro Uptrend

Technical evaluation of Ethereum’s market capitalization on the three-week candlestick timeframe reveals the cryptocurrency remains to be buying and selling in a zone of stability. Notably, technical evaluation finished by crypto analyst Egrag Crypto means that Ethereum is in reaccumulation inside a macro uptrend.

A have a look at the 3-week timeframe reveals that ETH’s market cap is holding above the 21 EMA, respecting the rising macro trendline, printing larger highs & larger lows, and compressing beneath historic resistance. That’s constructive habits, not weak spot.

Historical past reveals that intervals the place Ethereum’s market cap held above the 21 EMA on this timeframe have led to enlargement phases, whereas sustained strikes under it have marked bear market circumstances.

Associated Studying

At current, the construction signifies the EMA help is being defended. From a probabilistic standpoint, the present setup leans towards continuation reasonably than breakdown. A transfer by way of the overhead resistance band would doubtless verify an enlargement section and permit Ethereum to go on a 70% to 75% bullish continuation.

Market Cap ETH. Supply: @egragcrypto On X

However, a bearish end result will turn out to be potential if the value motion loses the 21 EMA on the three-week chart. This might validate a deeper 25% to 30% correction towards the decrease trendline, however this situation carries a decrease chance.

Featured picture from Unsplash, chart from TradingView