U.S. Senate Democrats are reportedly set to reopen talks with representatives from the cryptocurrency business on Friday, in response to individuals aware of the plan chatting with CoinDesk.

All this comes lower than two days after a last-minute postponement of a key Senate Banking Committee listening to on sweeping digital asset laws.

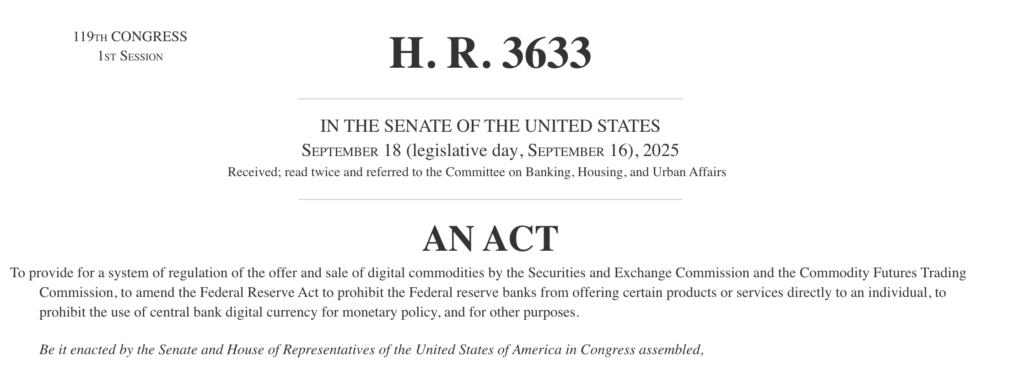

The decision follows Wednesday night time’s abrupt cancellation of the committee’s deliberate markup of the long-negotiated crypto market construction invoice, which had been anticipated to divide regulatory oversight of digital property between the Securities and Alternate Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC).

The delay got here after Coinbase, the biggest U.S.-based crypto trade, withdrew its assist for the draft laws, citing considerations over stablecoin rewards applications and what it considered as extreme authority granted to the SEC.

Coinbase CEO, Brian Armstrong, mentioned that banks are attempting to “kill their competitors” with the crypto market construction laws. “Crypto firms needs to be allowed to compete and supply loans similar to banks,” Armstrong mentioned.

Thursday marked a pause in public exercise after the cancellation, however lawmakers and business members say negotiations are removed from over.

Democrats from each the Senate Banking Committee and the Senate Agriculture Committee — which oversees the CFTC — are anticipated to hitch Friday’s name, together with representatives from crypto coverage advocacy teams in Washington, in response to reviews.

The Banking Committee had been scheduled to carry an all-day session Thursday to debate amendments and vote on whether or not to advance the invoice.

That plan unraveled late Wednesday after Coinbase CEO Brian Armstrong mentioned the corporate couldn’t assist the present model of the laws. Shortly thereafter, Senate Banking Committee Chair Tim Scott, R-S.C., postponed the listening to.

Lummis: Senate is nearer than ever

Regardless of the setback, a number of lawmakers concerned within the negotiations mentioned discussions will proceed. In a publish on X, Sen. Cynthia Lummis, R-Wyo., a number one crypto advocate within the Senate, mentioned lawmakers have been “nearer than ever” to reaching settlement.

“Everybody continues to be on the negotiating desk, and I sit up for partnering with [Chairman Scott] to ship a bipartisan invoice the business — and America — may be happy with,” Lummis wrote Thursday.

Sen. Invoice Hagerty, R-Tenn., echoed that optimism, saying he remained “assured” that lawmakers might attain a consensus “in brief order.”

“I’m absolutely dedicated to persevering with this vital work with my colleagues on market construction and sit up for passing laws that ensures this revolutionary expertise prospers in the USA for many years to come back,” Hagerty mentioned.

Trade response to Coinbase’s withdrawal has been blended. Whereas Armstrong’s feedback intensified scrutiny of the invoice, different crypto executives and advocacy teams urged lawmakers to maintain pushing ahead.

Kraken co-CEO Arjun Sethi mentioned abandoning negotiations now would worsen regulatory uncertainty for U.S. crypto companies. “Strolling away now wouldn’t protect the established order in follow,” Sethi mentioned in a publish on X. “It could lock in uncertainty whereas the remainder of the world strikes ahead.”

A significant level of competition in latest negotiations has been whether or not stablecoin issuers needs to be permitted to supply rewards or yield applications — a difficulty that has drawn pushback from financial institution lobbyists and a few Democrats involved about shopper safety and competitors with conventional deposits.

Whereas the Banking Committee’s markup has been postponed, the Senate Agriculture Committee continues to be anticipated to carry a listening to on the laws on January 27, after beforehand pushing again its personal earlier session. Finally, each committees’ work would must be merged earlier than the invoice might advance to the complete Senate.

Some analysts see the delay as a strategic pause, with Benchmark’s Mark Palmer saying it might assist lawmakers construct broader bipartisan assist and finally strengthen what he referred to as a probably historic overhaul of U.S. monetary regulation.

Others are extra uncertain: TD Cowen warned that bridging Democratic calls for and Coinbase’s objections could also be tough, particularly since some disputed provisions have been already concessions to Democrats, whereas election-year timing and the Senate’s 60-vote threshold add additional hurdles.