The Senate Banking Committee postponed its deliberate markup of the Digital Asset Market CLARITY Act, capping what had been anticipated to be a pivotal week for U.S. crypto coverage with an anticlimactic halt amid rising business opposition and unresolved political disputes, in keeping with reporting from Crypto in America.

The choice got here after tensions escalated all through the week as crypto corporations and commerce teams voiced frustration over late-stage amendments to the 278-page market construction invoice.

Critics argued the adjustments tilted the laws additional in favor of banks and conventional finance, significantly by tightening restrictions round stablecoin rewards and tokenization.

Compounding the uncertainty, Democrats on the committee continued to press for stronger ethics provisions that might bar senior authorities officers — together with the president — from personally cashing in on crypto ventures. These provisions have repeatedly stalled in negotiations with the White Home, contributing to the deadlock.

The speedy catalyst for the CLARITY Act postponement arrived round 4:00 p.m. Jan. 14, when Coinbase CEO Brian Armstrong introduced that the change was withdrawing its help for the invoice. Coinbase had been one of the vital influential business backers of a complete market construction framework, investing closely in lobbying efforts on Capitol Hill.

“We admire all of the laborious work by members of the Senate to achieve a bipartisan final result, however this model could be materially worse than the present established order,” Armstrong wrote in a submit on X. “We’d reasonably haven’t any invoice than a foul invoice.”

In a follow-up submit, Armstrong stated he remained optimistic that lawmakers might nonetheless attain a suitable compromise and pledged that Coinbase would proceed partaking with policymakers on the CLARITY Act.

The withdrawal was a significant setback. The lack of help from certainly one of crypto’s most distinguished coverage voices risked signaling to undecided senators that the invoice lacked enough business consensus, elevating the probability the committee would delay or abandon the markup altogether.

Whereas the markup was in the end postponed, Coinbase’s resolution didn’t set off a whole business retreat. A number of main companies and advocacy teams — together with a16z, Circle, Paradigm, Kraken, Ripple, Coin Middle, and the Digital Chamber — publicly reaffirmed their help for transferring ahead with a markup.

“It’s simple to stroll away when a course of will get troublesome,” Kraken co-CEO Arjun Sethi stated in a submit on X. “What is tough and what truly issues is continuous to indicate up, working by way of disagreements, and constructing consensus in a system designed to require it.”

In a quick assertion asserting the postponement, Senate Banking Committee Chairman Tim Scott (R-SC) stated that “everybody stays on the desk working in good religion,” however he didn’t supply a brand new date for the markup or specify which points would must be resolved earlier than it may very well be rescheduled.

The Senate is out of session subsequent week for the Martin Luther King Jr. Day recess and is about to return the next week.

The Senate Agriculture Committee, which shares jurisdiction over components of the invoice — significantly spot market oversight and the Commodity Futures Buying and selling Fee’s function — is predicted to carry its personal markup on the CLARITY Act later this month after suspending an earlier session.

It stays unclear whether or not Banking’s delay will have an effect on Agriculture’s timeline.

What’s the CLARITY Act?

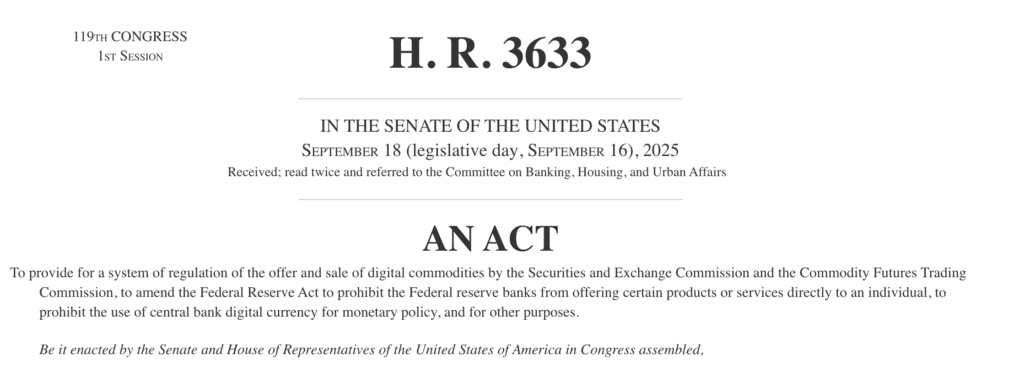

The CLARITY Act, which makes use of Home-passed H.R. 3633 as its base textual content, is designed to determine a complete federal framework for digital asset markets.

The laws seeks to divide oversight between the Securities and Trade Fee and the CFTC, set requirements for cost stablecoins, make clear guidelines for decentralized finance, and defend software program builders who don’t management buyer funds.

Supporters, primarily Republicans, argue the invoice would change regulatory uncertainty with clear guidelines, strengthen anti-fraud and illicit finance authorities, and convey crypto exercise again onshore. Committee truth sheets describe it because the “strongest illicit finance framework Congress has ever thought-about” for digital property.

Critics, nonetheless, contend the invoice weakens investor protections and dangers creating new loopholes.

Former SEC Chief Accountant Lynn Turner warned earlier this week that the CLARITY Act draft lacks Sarbanes – Oxley–stage safeguards, similar to necessary audited monetary statements, inner management certifications, and sturdy Public Firm Accounting Oversight Board oversight — deficiencies he stated might allow one other FTX-style collapse.

Stablecoin rewards have emerged as one of the vital contentious points within the CLARITY Act. Banking teams argue that yield-bearing stablecoins might siphon deposits from conventional banks, whereas crypto companies counter that broad bans on rewards would stifle innovation and push customers towards offshore platforms.