Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.

Topping Binance DappBay charts for days and promoted by Aster earlier than the vacation, how does SIA remodel “good cash” into public infrastructure utilizing composable brokers?

Abstract

- SIA breaks down elite buying and selling methods into reusable on-chain brokers, enabling abnormal customers to seize alternatives beforehand accessible solely to professionals.

- Via Good Copy Buying and selling and deep integration with Aster, SIA automates trades, reduces friction, and drives thousands and thousands in on-chain buying and selling quantity.

- SIA’s multi-layer system, together with transaction, agent, and knowledge layers, goals to create a decentralized AI infrastructure for steady market monitoring, technique execution, and agent collaboration.

Why is AI agent dialogue resurging in early 2026?

An unavoidable {industry} variable is the commercialization progress of general-purpose AI brokers validated by main tech giants. Meta’s multi-billion-dollar acquisition of Manus by late 2025 may mark a watershed second, signaling that AI’s core worth is poised to shift from “content material era” to “process execution and completion” in 2026.

However shifting focus again to web3, the challenges grow to be extra concrete, and even brutal: If AI fails to instantly decrease the barrier for on-chain operations,cut back consumer hopping between DApps, or make transactions extra controllable, then irrespective of how sizzling the hype cycle will get, AI will battle to interrupt free from its uninteresting “hype cycle.”

Curiously, proper across the flip of the 12 months, on-chain knowledge captured a distinctly totally different trajectory from typical AI tasks:

- Binance DappBay’s new DApp every day energetic consumer rankings have been dominated for consecutive days by the brand new challenge “SIA” (SIANEXX), which opened up a big hole in scale in comparison with the second-place contender;

- Concurrently, Aster’s official Twitter account closely promoted SIA’s “Good Copy Buying and selling” characteristic on Christmas Day, enabling customers to execute one-click copy trades instantly from SIA on Aster. Subsequently, on-chain buying and selling quantity for this module quickly surged to thousands and thousands of {dollars}.

In a cycle the place AI × Web3 tasks exhibit excessive homogeneity, why has SIA managed to fireplace the primary shot of 2026? What’s the underlying logic behind this explosive development?

I. Can ‘good cash’ be encapsulated as an API?

At first of the brand new 12 months, most blockchain gamers collectively witnessed Vida’s “tremendous good cash” maneuver—amid BROCCOLI714’s irregular volatility, Vida exactly captured an especially transient window of alternative, securing thousands and thousands in earnings.

Such extraordinary circumstances are now not uncommon. Arbitrage alternatives emerge virtually every day on the blockchain. But for abnormal customers, these alternatives are sometimes blocked by two formidable obstacles:

- Info asymmetry resulting in “invisibility”: By the point you catch wind of a sizzling subject via social media, skilled addresses have already positioned themselves.

- Execution friction inflicting “incapacity to maintain up”: Authorizations, slippage changes, transaction confirmations. Conventional UI interactions really feel clunky and inefficient towards the backdrop of quickly shifting volatility.

Finally, the blockchain isn’t missing in alternatives or high-probability addresses. What’s lacking is the power for abnormal customers to persistently seize, replicate, and execute these alternatives.

For many, failure doesn’t stem from misjudgment however from the execution course of itself: paths are too lengthy, steps too quite a few, feelings fluctuate relentlessly, finally letting alternatives slip away amid cumbersome operations.

That is exactly why CZ publicly declared that “AI buying and selling can be a large frontier.” Objectively talking, whereas the narrative of Crypto × AI has cycled via numerous iterations over the previous two years (computing energy, AI chains, brokers, infrastructure, and so on.), one actuality stays unchanged: the operational complexity of web3 has not considerably decreased with the appearance of AI.

From this attitude, AI agent explorations within the web2 world like Doubao Cellular and Manus provide worthwhile classes. For web3, AI merchandise that actually retain customers sooner or later mustn’t merely be “higher at answering questions,” however fairly extremely built-in “service kinds.”

Particularly on the on-chain operational degree. Think about this: what if AI didn’t simply help with evaluation, however progressively broke down and encapsulated extra buying and selling selections, handing them off to brokers for steady execution? Finally attaining round the clock market monitoring, sign detection, and energetic participation in trades. What would unfold?

That is exactly the query SIA, talked about on the outset, seeks to handle. As a cohesive staff comprising seasoned Wall Road merchants and high AI consultants, its self-positioning is crystal clear: it aspires not merely to be a “smarter AI evaluation instrument,” however to grow to be an AI Agent infrastructure and software platform for web3. Crucially, it pioneers AI deployment within the high-frequency, execution-intensive buying and selling area, a situation with plain demand.

Thus, “making buying and selling easy for all” is SIA’s core proposition. Its elementary logic could be summarized in a single sentence: Decompose buying and selling experience and methods, beforehand held by a choose few, into composable brokers and empower abnormal customers with them.

When AI actually begins “monitoring the market” and takes over parts of on-chain execution across the clock, the crypto market enters a brand new part.

II. When AI begins ‘on-chain monitoring’: SIA’s 24×7 on-chain dealer community

To be honest, “AI buying and selling” or “automated buying and selling” isn’t a brand new idea in web3, and leveraging pure language processing (NLP) to exchange cumbersome operations has lengthy been a sizzling route within the discipline.

Nevertheless, SIA’s core differentiation lies in its method: fairly than forcing customers to adapt to complicated specialised instruments, it has constructed a composable clever community via AI Brokers. Briefly, in comparison with tasks nonetheless caught within the whitepaper part, SIA has achieved deep implementation in each commerce execution and modular Agent creation.

Its product matrix outlines a transparent development: from assisted data filtering (web3- unique GPT), to automated technique era (Agent Technique Manufacturing unit), to totally delegated execution (Good Copy Buying and selling).

1. Web3-exclusive chat agent: From fundamental Q&A to ‘deep funding help’

Essentially distinct from the ever present “ChatGPT-clone” tasks flooding the market, SIA’s Chat Agent features extra like a “crypto-version of Jarvis” with quantitative experience, or, extra precisely, an on-chain analytical frontend grounded in quantitative evaluation.

It goes past merely reporting token costs. Its true aggressive edge lies in integrating hundreds {of professional} buying and selling technique fashions on the backend. This allows the Agent to immediately entry on-chain knowledge, technicalindicators, and capital movement paths, producing actionable analytical insights and delivering extremely granular funding suggestions to customers.

For example, when customers inquire a few particular token, it delivers not imprecise development assessments however a complete breakdown based mostly on real-time technical evaluation (e.g., MA, RSI, MACD), on-chain good cash conduct, and liquidity construction. This contains the most recent closing value, a abstract of latest value actions, skilled technical indicator evaluation (MA/RSI/MACD), and value development projections.

This “skilled technique library + pure language interplay” mannequin primarily condenses analytical capabilities historically reserved for elite merchants right into a toolkit accessible and comprehensible by abnormal customers. This empowers common buyers to grow to be quasi-professional merchants geared up with expert-level insights.

2. Barrier-free agent technique manufacturing facility: Democratizing buying and selling capabilities

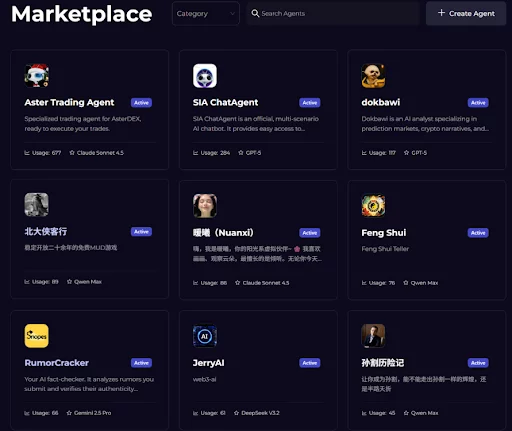

That is essentially the most energetic and geek-centric characteristic within the SIA group.

Below this structure, buying and selling methods are now not non-public belongings however fairly Agent items that may be created, fine-tuned, and reused. This signifies a shift from “privatization” to “democratization” in buying and selling methods.

Inside SIA’s Technique Manufacturing unit structure, particular person customers want no programming or quantitative background. Merely enter a pure language immediate to generate a customized Agent inside one minute, leveraging over ten giant language fashions. The present Market already hosts lots of of user-created Brokers, starting from useful instruments and market monitoring/prediction modules to experimental and entertainment-oriented functions, together with hardcore video games just like the AI-engine recreation of “The Legend of the Condor Heroes.”

This range itself indicators the early phases of a wholesome agent ecosystem.

SIA’s long-term imaginative and prescient is obvious: to empower everybody with customized brokers that match their fashion and autonomously execute duties. Because the system evolves, these brokers will regularly remodel into customers’ “on-chain buying and selling digital avatars.” Even when customers are offline, their agent will constantly scan for buying and selling alternatives aligned with their logic 24/7.

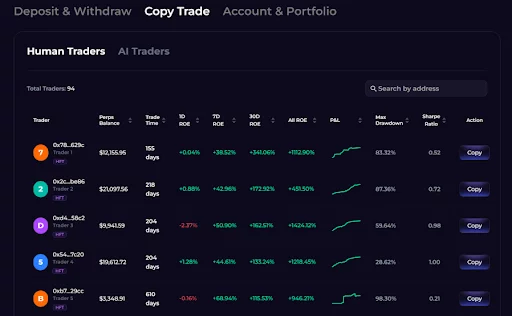

3. Nanny-level execution: Good copy buying and selling × deep integration with the Aster ecosystem

After all, what actually propels SIA’s fast knowledge development within the quick time period is its execution layer design.

As an official deep companion of Aster, SIA has streamlined the complicated on-chain order copying course of into an especially simplified workflow. Customers want solely deposit funds and click on “Copy.” The AI Agent then constantly synchronizes indicators and executes trades on the DEX.

This streamlined interplay has pushed astonishing conversion charges. As talked about earlier, following Aster’s pre-holiday promotion, buying and selling quantity surpassed thousands and thousands of {dollars} inside days. This not solely retained Degen customers but in addition captured vital consideration from conventional monetary establishments.

Notably, SIA has averted the revenue-sharing mechanisms frequent in conventional copy buying and selling. As an alternative, it prioritizes returning incentives to customers and the ecosystem itself, the platform fees no income share, and customers concurrently qualify for twin airdrop rewards from each SIA and Aster.

Total, SIA’s product logic doesn’t instantly generate buying and selling methods. As an alternative, it abstracts a lot of on-chain addresses with traditionally excessive win charges into pluggable, reusable execution items. When AI Brokers start actively “monitoring the market” and assume partial execution obligations on a 24/7 foundation, a brand new type of participation emerges within the crypto market—the on-chain dealer community.

III. Past buying and selling instruments: The way to construct web3’s AI working system?

If devoted Chat Brokers, good order copying, and Agent factories signify SIA’s vanguard for capturing market consideration, the general structure outlined in its roadmap factors towards a longer-term goal: constructing an AI working system (AI OS) for Web3.

In SIA’s imaginative and prescient, a mature and sustainable AI Agent ecosystem should tackle at the least three foundational questions: The place does knowledge come from? How are intents executed? How does worth flow into throughout the system?

Addressing these questions, SIA is progressively constructing a multi-layered system comprising a transaction layer, knowledge layer, and Agent community.

Step one is the web3 good transaction layer, which is at the moment SIA’s most instantly implementable and user-perceivable tier.

At this layer, SIA doesn’t try to invent new buying and selling markets. As an alternative, it makes use of AI Brokers as a central hub to combine operational paths beforehand scattered throughout totally different chains and buying and selling venues. Customers now not want to grasp “which chain, which protocol, or which path to take.” They merely specific their transaction intent, and the system handles the decomposition and execution.

From a product perspective, this represents a repackaging of the transaction expertise. Structurally, it additionally serves because the foundational layer underpinning all subsequent Agent collaboration and routing capabilities.

The second step is the web3 Tremendous AI Agent, an idea particularly launched above the transaction layer.

This Agent transcends single-function limitations, aiming to embody your complete core behavioral chain of web3 customers: market evaluation, technique formulation, conversational order placement, portfolio administration, good cash monitoring, and even fast scanning of meme-driven market tendencies.

Extra importantly, SIA doesn’t deal with buying and selling capabilities as a closed module. Constructing upon the Tremendous Agent basis, customers can additional assemble bespoke buying and selling brokers tailor-made to their threat preferences and funding kinds. This allows the system to constantly execute predetermined logic 24/7, that means buying and selling now not depends on consumer on-line standing however positive aspects traits of continuity and automation.

The third layer is the web3-exclusive AI knowledge layer, because the ceiling of any AI finally relies on knowledge high quality.

Not like general-purpose giant fashions, SIA doesn’t accept public corpora. As an alternative, it builds a devoted knowledge basis for web3: on one hand, consolidating industry-level data constructions via vector databases (RAG); on the opposite, dynamically absorbing on-chain fluctuations, protocol updates, and market sentiment shifts in real-time by way of the dynamic knowledge layer (MCP).

The purpose isn’t to make it higher at chatting, however to regularly evolve the Agent right into a vertical area knowledgeable that actually understands web3’s operational logic, not only a generic question-answer mannequin.

Lastly, the Agent collaboration community represents SIA’s most visionary part. Below this idea, Brokers will now not function in isolation however could be paid to collaborate and carry out duties collectively.

For instance, theoretically, an Agent tasked with “monitoring public sentiment” may routinely request one other Agent specializing in “executing transactions” to position an order upon detecting a sign. Every invocation and collaboration could be recorded, priced, and settled, fostering productiveness synergy amongst Brokers.

This mechanism elevates Brokers past mere instruments, endowing them with productive significance, Brokers start collaborating, and code begins instantly producing worth.

After all, whereas SIA demonstrates distinctive PMF (Product-Market Match), it should additionally confront the shared challenges of the AI + web3 area. This isn’t solely SIA’s problem however a query each challenge making an attempt to combine AI into the crypto world should tackle:

- For example, when tens of hundreds of customers concurrently observe the identical batch of good cash addresses by way of SIA, may transaction congestion immediately erode revenue margins?

- Or, after the TGE (Token Era Occasion), how will SIA steadiness incentives with promoting stress? Whereas its Rewards Hub at the moment demonstrates robust group stickiness, the long run hinges on whether or not it will probably construct a real deflationary loop via developer name charges and protocol income repurchases.

Total, “making buying and selling easy for all” represents SIA’s directional response.

But fragmented knowledge, complicated operational paths, and disjointed execution environments stay persistent challenges for web3. SIA’s method isn’t to supply grand narrative options, however to deconstruct these structural issues into systematic engineering duties that merchandise can regularly deal with, a path requiring persistent refinement and incremental progress.

Closing ideas

Frankly talking, AI buying and selling cryptocurrency will not be a brand new story.

The actually novel variable lies in whether or not anybody will start deconstructing “good cash” into pay-as-you-go, composable, and reusable on-chain primitives and transaction networks, enabling abnormal customers to take part with minimal operational overhead.

Trying again on the historical past of the web, engines like google modified the world not by creating data, however by considerably decreasing the obstacles to accessing and using data via “linking data.” Standing within the context of web3 in 2026, an equally crucial query is rising: Is it potential to systematically decrease the obstacles to interacting with and executing crypto belongings by linking AI?

In spite of everything, solely when customers now not must repeatedly decipher addresses, authorizations, and protocol particulars, and customers can merely instruct AI with ‘execute the technique in my fashion’, can the explosive development of scaled web3 × AI transactions actually materialize.

May brokers grow to be the brand new ‘Lego of liquidity’? Is SIA positioned at this pivotal second? 2026—we’ll see.

Disclosure: This content material is supplied by a 3rd get together. Neither crypto.information nor the writer of this text endorses any product talked about on this web page. Customers ought to conduct their very own analysis earlier than taking any motion associated to the corporate.