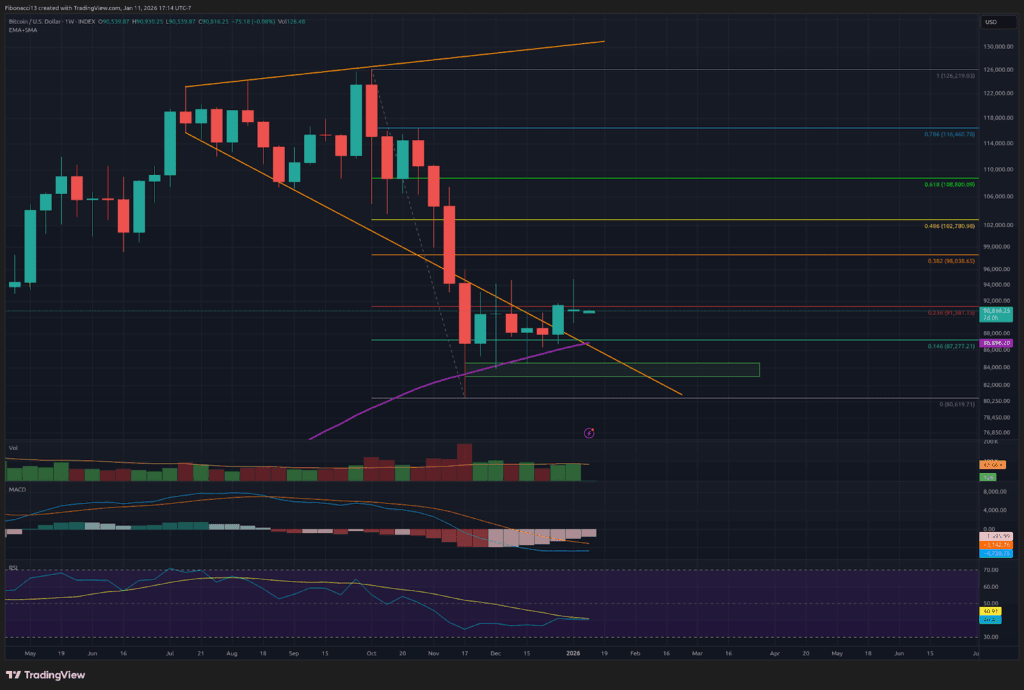

Bitcoin Value Weekly Outlook

Bitcoin consumers made a pleasant push to $94,000 resistance once more final week, however the value promptly offered off once more from this degree to shut the week out at $90,891. Sunday’s shut gave us a doji candle, indicating indecision and a possible reversal again within the bears’ favor. The bulls are as soon as once more wanting torpid as they lack the follow-through essential to overtake resistance. Bears are within the driver’s seat heading into this week. Search for them to attempt to push the worth down by means of the $87,000 assist degree to make one other try at breaking $84,000 assist.

Key Assist and Resistance Ranges Now

The bulls are on the lookout for assist on the $87,000 degree to carry if bears handle to maintain the push decrease going right here. $84,000 nonetheless sits as robust assist under right here, however will weaken with any additional strain. If the bears can handle to interrupt this assist, the worth is certain to speed up right down to the low $70,000 space, with an in depth under $68,000 required to lose this assist degree. Under this zone, bulls will look to realize some type of power off the 0.618 Fibonacci retracement at $58,000.

Bears will look to defend the $91,400 degree as resistance over the brief time period right here. The resistance at $94,000 has accomplished its job to this point, however it will likely be beneath heavy strain if bulls can muster the power to get the worth again up there. Above $94,000, there’s a resistance zone that stretches from $98,000 as much as $103,500. Above right here, we have now one other resistance zone from $106,000 as much as $109,000 on the 0.618 Fibonacci retracement from the drop from the highest right down to $80,000.

Outlook For This Week

Wounded bulls want some assist to hold on to momentum this week. Search for the bears to push the worth right down to $87,000 early within the week and presumably under it. Bulls will attempt to cease the worth from closing any days under $87,000. If the bears handle a each day shut under right here, $84,000 assist will probably be beneath heavy menace, and the bulls will want consumers to step as much as the plate with some massive quantity to carry this assist degree as soon as once more.

Market temper: Bearish – After a weekly taking pictures star doji candle shut, the bulls’ momentum has light. The bears have tilted management barely of their favor to start out this week.

The subsequent few weeks

Value motion could stay uneven and confined inside a variety over the subsequent few weeks. Bulls have to see an in depth above $94,000 to interrupt above this vary and search for upward momentum, whereas bears have to see an in depth under $84,000 to attempt to break down under this main assist degree. Between $94,000 and $84,000 is now a impartial zone, the place bulls and bears could battle forwards and backwards. Neither aspect is poised to take agency management of the worth motion till both of those boundaries is damaged.

Bulls/Bullish: Patrons or traders anticipating the worth to go larger.

Bears/Bearish: Sellers or traders anticipating the worth to go decrease.

Assist or assist degree: A degree at which the worth ought to maintain for the asset, not less than initially. The extra touches on assist, the weaker it will get and the extra possible it’s to fail to carry the worth.

Resistance or resistance degree: Reverse of assist. The extent that’s more likely to reject the worth, not less than initially. The extra touches at resistance, the weaker it will get and the extra possible it’s to fail to carry again the worth.

Capturing Star Candle: A candlestick that happens after an uptrend, marked by an extended wick upwards above the candle physique and a smaller wick (or no wick) to the draw back. The lengthy wick up signifies robust promoting close to the highs. This candle can typically point out the tip of an uptrend.

Doji Candle: A candlestick that closes at practically the identical value at which it opened. This candle signifies indecision, and may sign a reversal in value motion if it happens after an uptrend or downtrend.

Fibonacci Retracements and Extensions: Ratios primarily based on what is called the golden ratio, a common ratio pertaining to progress and decay cycles in nature. The golden ratio is predicated on the constants Phi (1.618) and phi (0.618).