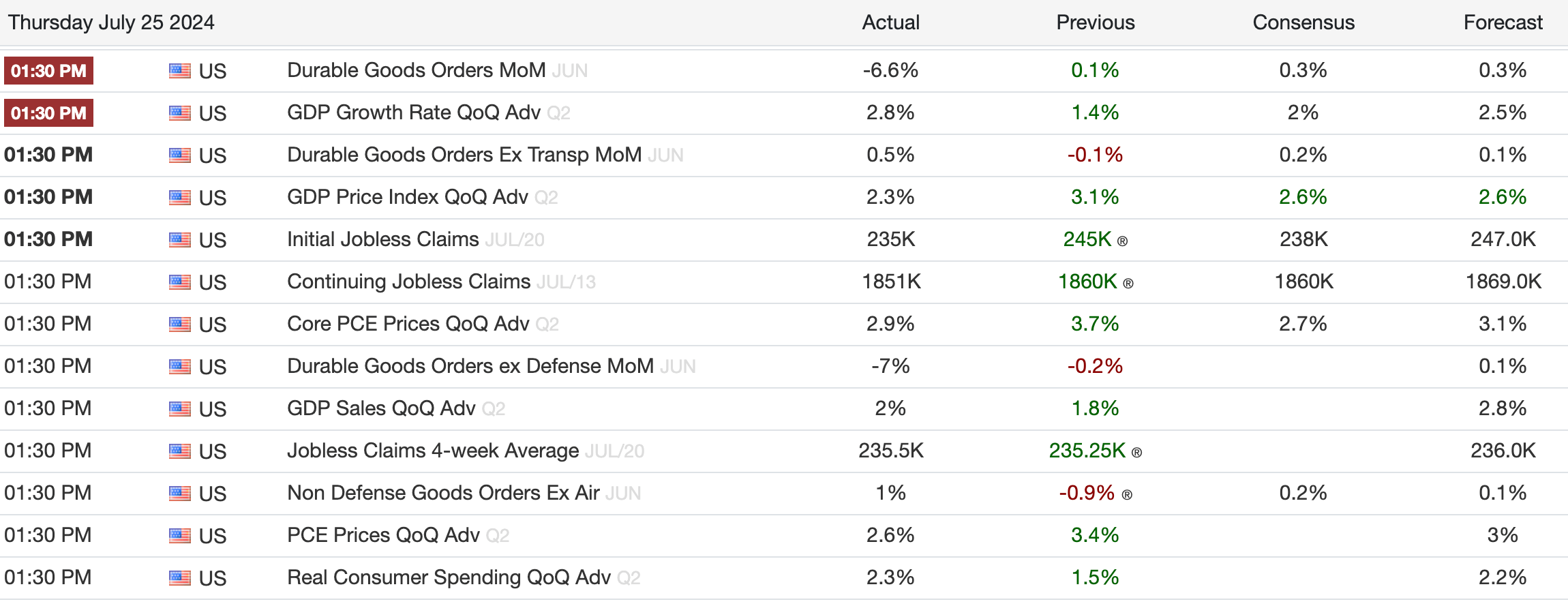

Bitcoin maintained stability at round $64,000 after the current financial knowledge confirmed that the US GDP Development Fee for Q2 elevated by 2.8% QoQ, surpassing the earlier quarter’s progress of 1.4% and the consensus forecast of two%.

This stronger-than-expected financial progress alerts a sturdy restoration, doubtlessly influencing investor sentiment positively towards property like Bitcoin. Nonetheless, Bitcoin has since began to say no to round $63,500, and as of press time, it’s simply 16% under its all-time excessive.

The GDP Value Index for Q2 superior by 2.3%, under 3.1% from the earlier quarter, but aligned carefully with forecasts, lacking by 0.3%. This moderation in inflationary strain might contribute to the Federal Reserve’s much less aggressive financial coverage stance, an element that crypto traders carefully monitor because of its potential influence on liquidity and market situations.

Sturdy Items Orders for June introduced a blended image, with a notable decline of 6.6% MoM, contrasting sharply with the slight enhance of 0.1% in Could and consensus of 0.2%. Nonetheless, orders excluding transportation noticed a modest rise of 0.5%, indicating some underlying energy in different sectors. These figures replicate ongoing financial uncertainties, which can play into Bitcoin’s enchantment as a hedge in opposition to conventional market volatility.

Bitcoin’s stability amidst these financial indicators emphasizes its function as a resilient asset in fluctuating financial knowledge and investor sentiment.