Bitcoin pushed above the $92,000 stage late-Sunday as a authorized escalation round Federal Reserve Chair Jerome Powell turned public. The catalyst was Powell’s resolution to publicly deal with Division of Justice subpoenas and a legal probe he characterised as political strain tied to the administration’s charge preferences.

In a video launched Sunday night, Powell instantly addressed US President Donald Trump: “The specter of legal prices is a consequence of the Fed setting charges primarily based on our greatest evaluation of what is going to serve the general public, quite than following the preferences of the President.”

BREAKING: Fed Chair Powell responds after Federal prosecutors open a legal investigation into him:

“The specter of legal prices is a consequence of the Fed setting charges primarily based on our greatest evaluation of what is going to serve the general public, quite than following the preferences of… pic.twitter.com/y1dRdoQ1fm

— The Kobeissi Letter (@KobeissiLetter) January 12, 2026

Bitcoin Neighborhood Reacts To The Information

The Bitcoin and broader crypto market responded instantly with an honest push increased, whereas “metals [were] blasting to new highs,” as analyst Will Clemente wrote by way of X.

Associated Studying

The timing issues for crypto merchants: the Fed is heading into its January 28 assembly with the market more and more primed for a pause in cuts, amplifying sensitivity to any notion that financial coverage is being pulled into partisan battle.

For Bitcoin-native observers, the episode learn like a real-time stress take a look at of institutional belief: one which flatters Bitcoin’s pitch. Clemente added by way of X: “This surroundings is actually what Bitcoin was created for. The President is coming after the Fed chair. Metals are ripping as sovereigns diversify reserves. Shares & threat belongings at document highs. Geopolitical threat rising.”

Alex Thorn, head of firmwide analysis at Galaxy, put the distinction in financial regimes entrance and heart, arguing that Bitcoin’s “credibly impartial, predictable, clear, and censorship resistant financial coverage seems to be fairly good right here,” after flagging Powell’s view that the subpoenas are “pretexts” for administrative meddling in financial coverage.

Associated Studying

Others used the second to widen the indictment past any single character. Bitwise advisor Jeff Park argued that “independence alone can’t be a advantage when the establishment at its core is incompetent,” including that “the age of Bitcoin is drawing nearer.” Walker, a outstanding pro-Bitcoin voice, framed it as a structural downside: “The issue isn’t President Trump or Jerome Powell. The issue is a centralized cabal of unelected banker-bureaucrats set the value of cash and print it out of skinny air.”

Notably, the bullish reflex wasn’t rooted in sympathy for Powell. Attempt CEO Matt Cole wrote he had “zero sympathy” for the Fed chair and accused the central financial institution of “gaslight[ing] the American folks” on independence, concluding: “Bitcoin is much more underpriced than we realized…”

Bitcoin’s transfer via $92,000 places that narrative onto a value chart, however the identical political-legal suggestions loop that fuels the “impartial cash” thesis can even intensify volatility. “For the primary time ever, Fed Chair Powell is combating again: Over the past 12 months, Fed Chair Powell has remained silent amid President Trump’s criticisms,” The Kobeissi Letter wrote by way of X, including: “Right now, that modified. […] Trump vs Powell will end in much more volatility.”

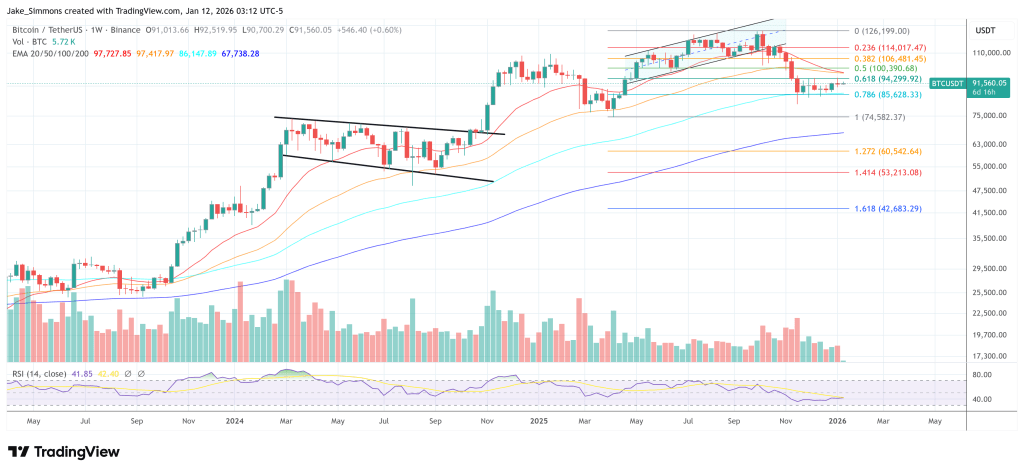

At press time, Bitcoin traded at $91,560.

Featured picture created with DALL.E, chart from TradingView.com