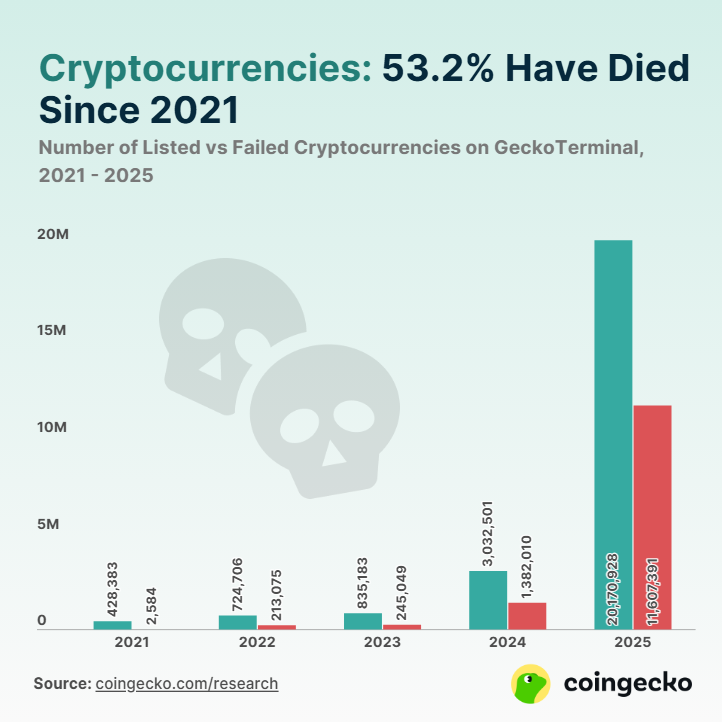

Memecoins had been hammered final 12 months, and the fallout was big. In keeping with CoinGecko analysis, about 11.6 million tokens stopped buying and selling or turned inactive in 2025. That quantity dwarfs earlier years and has left buyers and market watchers sorting via losses and damaged initiatives.

Memecoin Failures Spike After Main Promote-Off

Primarily based on reviews from CoinGecko, roughly 7.7 million token failures occurred within the fourth quarter of 2025. That quarter accounted for many of the whole, pushed by a pointy market transfer on October 10, 2025, when reviews present greater than $19 billion in crypto liquidations occurred in a single day.

Small tokens with little liquidity had been hit the toughest. A lot of these lists of useless tokens had been dominated by memecoins and low-effort initiatives that not often had energetic growth or actual buying and selling depth.

A Flood Of New Tokens Met Weak Demand

Launch instruments made it simple to create tokens, and that contributed to the issue. Stories be aware that platforms which simplified token creation led to a surge in new, cheaply issued cash. When market situations turned, a lot of these cash had no patrons left.

In distinction, mainstream tokens with deeper swimming pools of buying and selling and clearer use instances had been extra prone to survive the shock. CoinGecko in contrast the size: round 1.3 million tokens failed in all of 2024, displaying how dramatic final 12 months’s collapse was.

What This Means For Merchants And Exchanges

Buying and selling exercise fell for numerous small tokens. Quantity dried up quick for poorly backed initiatives, and worth swings turned extra excessive. Some exchanges and knowledge websites needed to replace lists and delist tokens that not met minimal exercise guidelines. The memecoin sector’s share of speculative buying and selling fell sharply as threat urge for food pale and merchants moved into property with extra liquidity.

Picture: Altorise

Regulatory And Market Watchers React

Requires higher oversight of token listings grew louder. Some market analysts stated exchanges ought to tighten itemizing requirements and that clearer labels for experimental tokens might assist retail patrons keep away from traps. Others warned that stricter guidelines would possibly sluggish innovation. For now, updates from analysis platforms are getting used to map which tokens vanished and why they failed.

Market Sentiment Stays Fragile

Traders are selecting via the wreckage, in search of classes. A variety of small initiatives had been deserted by groups, and an extended record of inactive tokens now serves as a warning to merchants chasing hype. Primarily based on CoinGecko’s knowledge, the size of failures in 2025 is unparalleled in recent times, and it alerts that, with out patrons and liquidity, newly minted cash can disappear shortly.

Featured picture from Phantom, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.