RippleX, the developer-focused arm of Ripple,used a Jan. 6 X thread to refresh a set of “FAST FACTS” about XRP, framing the asset much less as a speculative ticker and extra as market infrastructure, arriving as spot ETF momentum and early institutional treasury narratives start to kind across the token.

“XRP is a digital asset of alternative for real-world utility – from stablecoin settlement to real-world property, to institutional funds,” RippleX wrote. “With new momentum round XRP ETFs and institutional treasuries forming, listed here are some up to date FAST FACTS about XRP.”

What Is XRP?

The thread’s opening factors stick with the positioning Ripple has leaned on for years: XRP as a liquidity and settlement rail between monetary programs somewhat than an app-layer wager.

RippleX described it as “a practical digital asset designed for settlement and liquidity, specializing in transferring worth between monetary programs,” including that, “performing as a impartial bridge, it helps transfer worth between funds, stablecoins, tokenized monetary property, and collateral throughout the worldwide economic system.”

RippleX additionally reiterated provide constraints and management narratives that often resurface in institutional due diligence. “XRP was created on the launch of XRPL in 2012 and its provide is completely capped at 100B – no further XRP can ever be minted and no single entity (together with Ripple) controls or can change the entire provide,” the publish stated.

Different “quick info” have been extra about market posture than mechanics, together with the declare that XRP is “one of many few digital property with clear regulatory standing within the US” and that it stays a top-three asset by market capitalization.

RippleX devoted a number of entries to XRPL’s decentralization metrics and operational historical past, emphasizing that the ledger runs independently of Ripple the corporate.

“XRPL is a public, decentralized blockchain with 116+ unbiased validators and 910+ public nodes – it operates unbiased of Ripple as an entity,” RippleX wrote. “XRP performs a core position on the community as its native settlement and liquidity asset.”

On consensus and execution, RippleX stated XRPL makes use of “Proof-of-Affiliation (PoA),” describing a mannequin with “no mining, no staking, no block rewards,” and “transaction finality in 3–5 seconds.” It additionally pointed to network-scale utilization stats since inception: “4B+ transactions,” “100M+ ledgers,” “6.4M+ wallets,” and “$1T+ in worth” settled.

Actual-World Property And Stablecoins

A notable portion of the thread centered on RWAs and stablecoins,two classes the place issuers and liquidity relationships matter greater than uncooked TPS.

RippleX stated XRPL is “now one of many high 10 blockchains for RWA exercise,” itemizing issuers and initiatives “corresponding to Ondo Finance, OpenEden, Archax/abrdn, Guggenheim Treasury Providers, Mercado Bitcoin, VERT, and the Dubai Land Division” as constructing or launching property on XRPL.

On stablecoins, RippleX cited a “rising stablecoin ecosystem” together with “RLUSD, USDC, XSGD, AUDD, BBRL/USBD, and EURCV,” including that “XRP usually serves as a liquidity pair,” facilitating change between stablecoins and different property on the community.

RippleX’s closing “quick info” aimed instantly at regulated entry and institutional steadiness sheets. It claimed XRP “now has its first institutional treasury” by way of Evernorth, which “has secured greater than $1B in commitments,” describing this as a shift “from a traded asset to a regulated, balance-sheet asset for establishments.”

It additionally stated XRP is “now supported by a number of spot ETFs,” naming Bitwise (XRP), Canary Capital (XRPC), Franklin Templeton (XRPZ), and Grayscale (GXRP) as issuers—positioning ETFs as a bridge into “regulated, mainstream funding merchandise.”

Lastly, RippleX pointed to wrapped XRP as an interoperability lever, saying it extends XRP’s utility to the “XRPL EVM Sidechain” and to ecosystems together with “Ethereum, Solana, Optimism, and HyperEVM.”

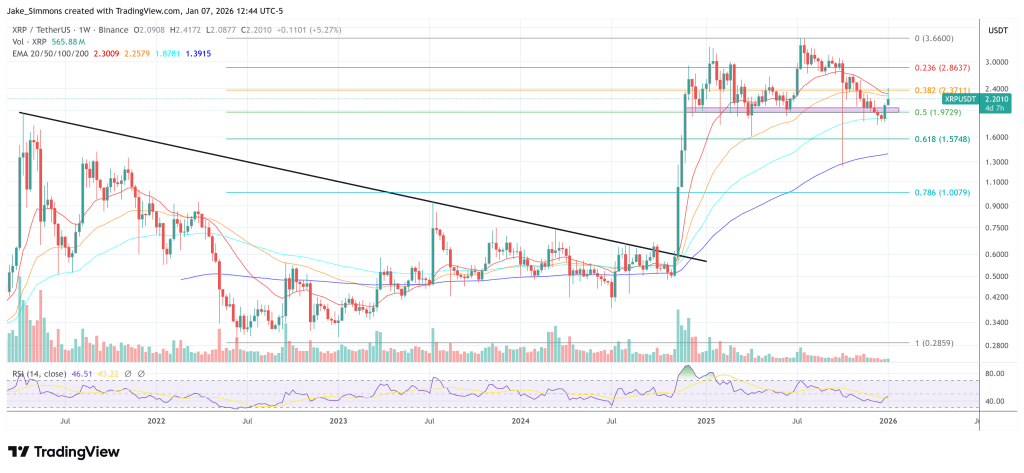

At press time, XRP traded at $2.20.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.