Bitcoin hovered slightly below the $91,000 degree at this time, paring current good points after an explosive begin to the brand new yr that briefly pushed costs towards recent seven-day highs.

The bitcoin worth was buying and selling round $90,815, down roughly 1% over the previous 24 hours, in accordance with market knowledge. Each day buying and selling quantity stood close to $52 billion, whereas bitcoin’s complete market capitalization slipped to about $1.82 trillion, additionally down round 1% on the day.

The pullback leaves the bitcoin worth roughly 3% beneath its current seven-day excessive close to $94,700, after costs surged greater than 8% within the first days of 2026. That rally carried the bitcoin worth above $94,000 earlier this week, fueled by renewed ETF inflows, bullish choices positioning and a resurgence of the geopolitical hedge narrative.

Bitcoin’s circulating provide now stands at 19.97 million BTC, inching nearer to its mounted cap of 21 million cash.

The newest transfer marks a pause after bitcoin broke out of a multi-week consolidation vary that capped costs by way of a lot of December. The $91,000 degree, which beforehand acted as resistance, has now change into a key short-term help zone as merchants reassess momentum.

Market individuals say the retreat displays profit-taking fairly than a decisive shift in pattern, notably after final week’s speedy upside transfer.

From a technical perspective, a sustained break beneath $91,000 may expose deeper help close to $87,000, whereas a transfer again above $94,000 would reopen the trail towards resistance within the $98,000–$100,000 vary.

Bitcoin worth volatility looms forward of January 9

Past near-term technicals, merchants are more and more centered on macro catalysts — notably a U.S. Supreme Courtroom ruling scheduled for January 9 on the legality of President Donald Trump’s world tariffs.

Prediction markets counsel a excessive likelihood the courtroom will strike down the tariffs, a call that might drive the U.S. Treasury to refund as a lot as $133–$140 billion to importers. Such an consequence may inject volatility throughout equities, bonds and crypto markets concurrently.

Bitcoin, which has proven heightened sensitivity to macro and coverage shocks, may see sharp worth swings relying on how markets reprice fiscal danger and liquidity situations.

Regardless of near-term uncertainty, broader bullish alerts stay in place. Bitcoin ETFs just lately recorded their strongest day by day inflows since October, whereas choices markets proceed to point out heavy positioning for greater costs later within the yr.

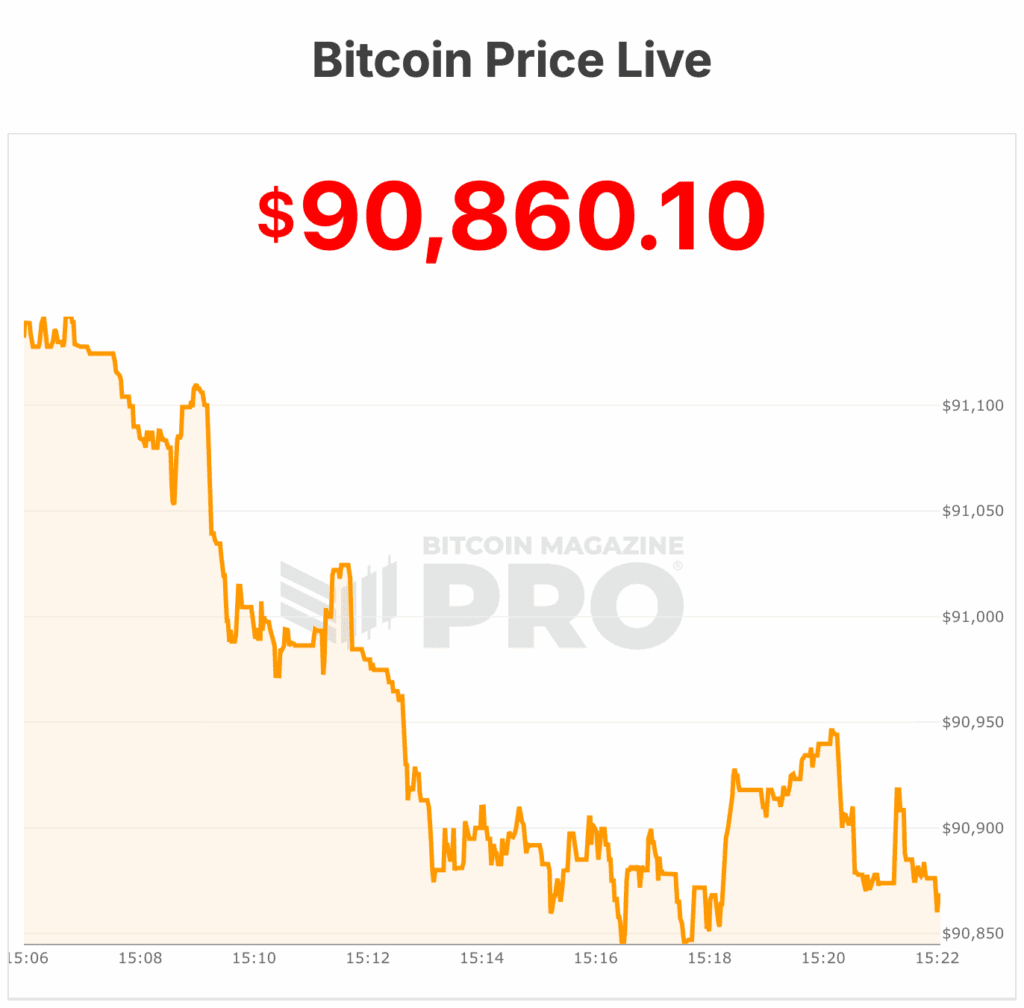

On the time of writing, the bitcoin worth is at $90,860.10.